Each Seedcamp vintage tells a unique story about the tailwinds and themes behind our investment decisions. We think that venture is about seeing the present for what it is and committing to founders on missions to solve deeply painful problems. The most exciting solutions are unorthodox and start on the very edge of markets before gravitating to the centre. We invested in Revolut long before mobile banking reached the masses, in Grover when the circular economy was in its infancy and Synthesia when no one had heard of generative AI. In our second installment celebrating the Seedcamp Nation’s milestones, we wanted to share some of the threads that weave together our investments in no-brainer products, inefficient markets and extraordinary entrepreneurs.

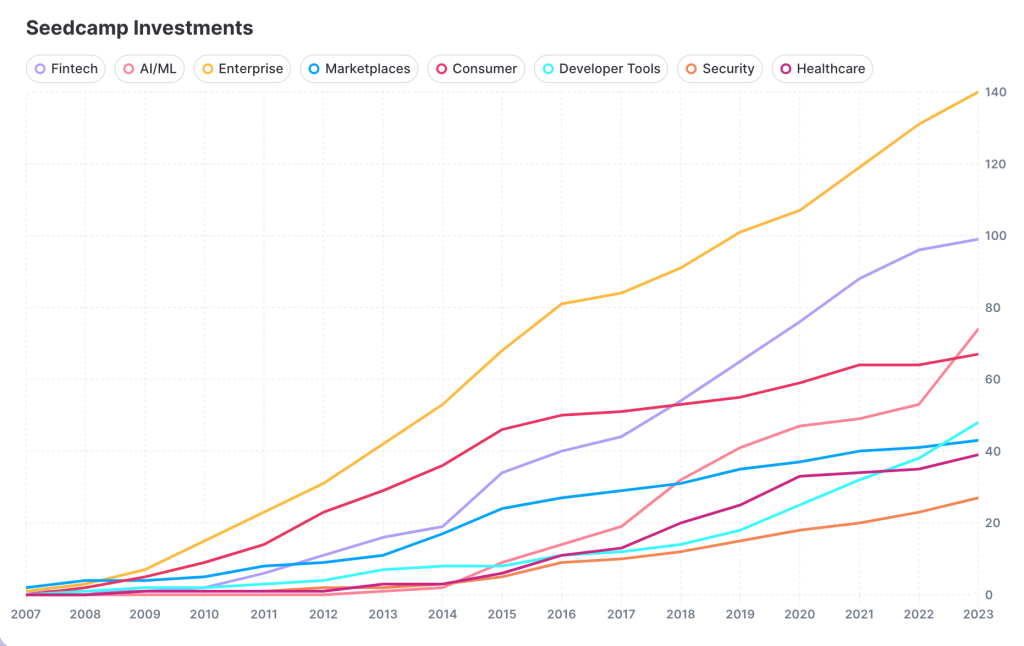

Timing matters and we make it our business to understand fast-moving currents before they reach escape velocity. For example, we lent into fintech in 2015 as open- and neo-banking came to market and our AI commitments accelerated around key breakthroughs– TensorFlow in 2014, Transformers in 2017, and GPT-4 in 2022. As different forces emerge, our theses evolve, resulting in distinctive waves of investment tracing back to 2007.

The total companies invested exceed the number of Seedcamp Investments, as some companies are in more than 1 sector (max 2). Made with Graphy

In the early 2010s, we made big bets on machine learning and fintech

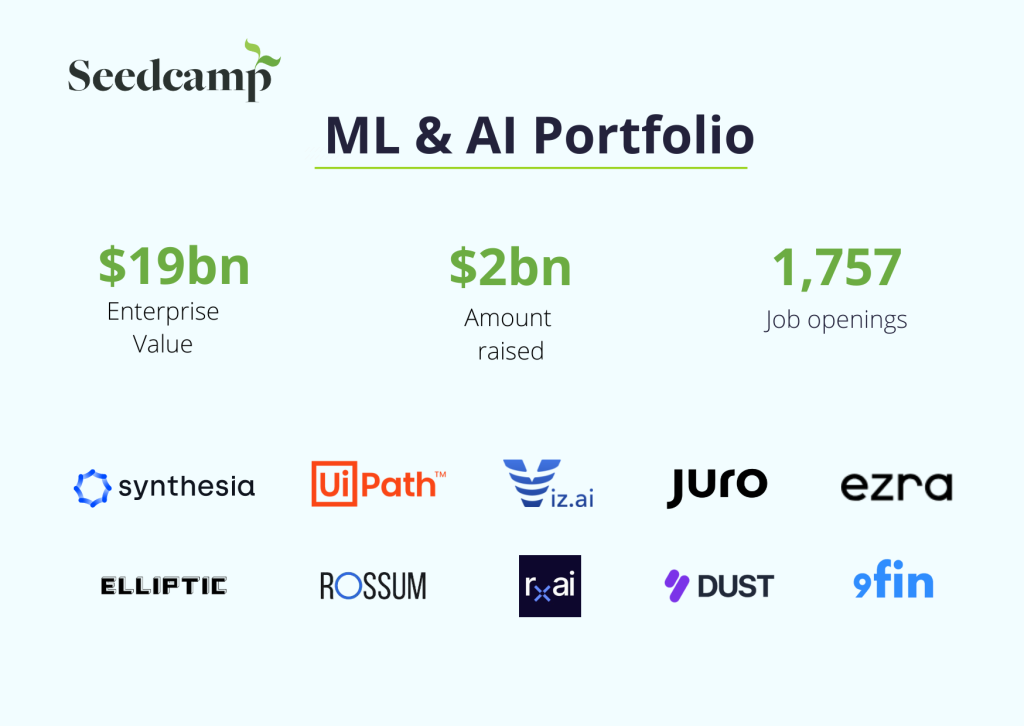

Machine learning first caught our attention in 2012 when we backed Charlie Finance and then Elliptic. Since then, we have invested across the infrastructure and application levels, watched UiPath (NYSE: PATH) go public and recently cheered on Synthesia to unicorn status in one of Europe’s rare growth rounds of 2023. It’s a sector we have studied for over a decade and we can’t wait to see commitments in the enterprise stack like Juro and Rossum continue their upward trajectory, while pattern detection technology like Viz and 9fin drive discoveries across healthcare and finance. Of course, we couldn’t not mention that as GPT-3, -3.5 and -4 have blossomed, we have been thinking about what LLMs will mean and how they will be used in the enterprise. We have made investments like Dust and AskUI to drive business processes, but also can’t wait to see what this technology means for biology, medicine and chemistry. Many components of the machine learning stack like devops, guardrails and security are just getting started and we look forward to supporting the leading minds.

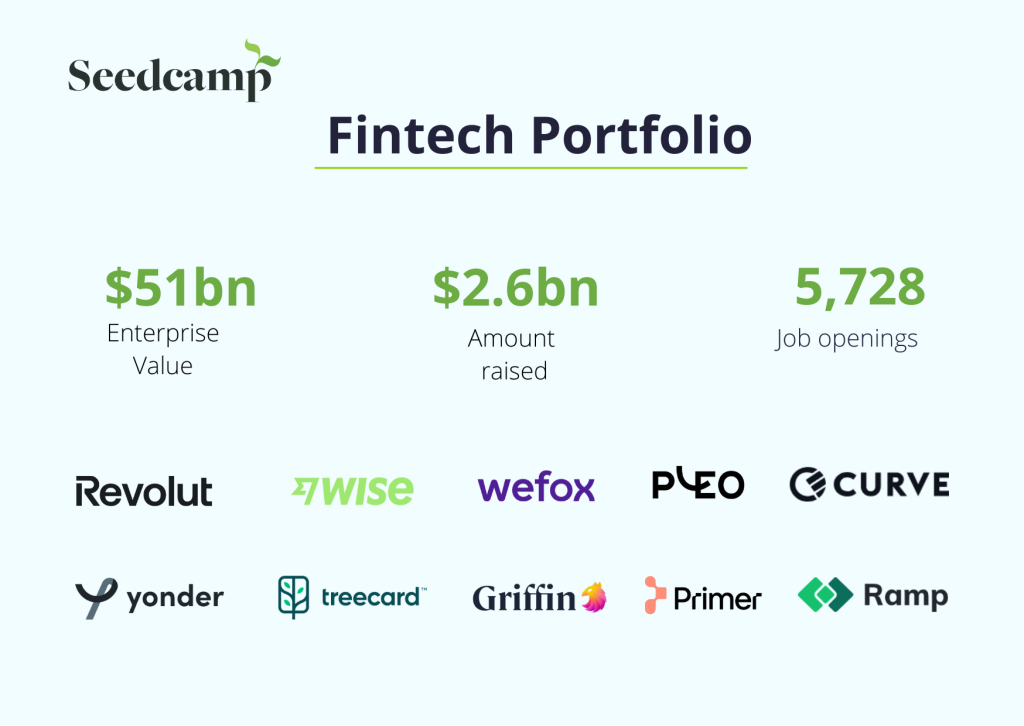

Around the same time as the first wave of machine learning startups emerged in Europe, financial technology began to catch our eye. We came with a prepared mind in 2011, when we invested in Taavet and Kristo’s mission at Wise (LSE: WISE) out of Fund II. In Fund III we were among the earliest supporters of unicorns Pleo, WeFox and Revolut, which recently announced revenue expectations of $2bn for 2023. Meanwhile, other members of the Seedcamp fintech portfolio are in the earlier years of their journey. On the consumer side, Yonder and Treecard are revolutionizing credit and impact at a rate of knots, while Griffin, Weavr and Primer break new ground in the worlds of embedded finance and payments. Financial digitalisation is still in its first innings and while fintech accounts for less than 10% of global transaction volume, we look forward to supporting the next wave of technology that fixes the broken worlds of banking, real-estate, payments, procurement and much more.

In spaces that are a little earlier – like open-source – we think we are where fintech was in 2016

Of course not all themes align neatly to sectors. For example, Adobe’s Flash Player accelerated the development of multimedia applications across all industries and the platform shift to mobile gave rise to innovation from gaming to the Internet of Things. In our emerging portfolio, open-source business models stand out as a fundamental shift in go-to-market philosophy, away from the ultimate buyer in the finance department, and towards the developer. Two rapidly growing businesses that have struck a chord with programmers are Appwrite, which raised its Series A from Tiger Global for its backend in-a-box and Meilisearch, which raised an A round from Felicis for its embedded search engine API. While some open-source commitments look like conventional developer tools for optimizing the process of code writing, deployment and release, others look more like Saas that is simply developer-first. Baserow is a no-code database built in Django and Nust, Rerun is an SDK for visualizing multimodal data, and Medusa is a platform for building rich performant commerce applications. As more and more open-source companies transition their fanbase to paid and supported services, we are excited to see these businesses flourish.

_________________________________________________________________________________________

For any startup looking to build something truly awesome, Seedcamp is the place to start.

Taavet Hinrikus, Co-founder of Wise

Each year, new ideas emerge around fresh ways to build and sell software products. It has been a privilege to partner with businesses on various journeys, from on-prem to the cloud, from desktop to mobile, from centralised to decentralised, and more. Today, new tools are enabling everyone to be a developer, application UX is increasingly voice-first and infrastructure is enabling data to be ingested, transformed, loaded, streamed and analyzed with incredible efficiency. We can’t wait for what’s to come and in episode 3, we look ahead to the next decade.

If you missed Part I, read it here: Seedcamp Turns 17. The Seedcamp Nation and the European Tech Ecosystem, Then and Now (1/3)

Also read Seedcamp Turns 17 | The Next Decade (3/3).