Over the past 17 years, we have witnessed the rapid development of new technologies and the swift creation of new markets. We have also learned that founders possess profound insights into their fields, often staying ahead of market trends. These insights, gleaned from our conversations with both new and established founders, significantly shape our investment strategies at Seedcamp.

Throughout the year, we engage in internal investment discussions about emerging technologies and cutting-edge research that have the potential to disrupt markets driven by strong tailwinds and/or rapid changes in market dynamics.

In this context, we rely on our founder relationships to guide us toward new and promising areas of investment exploration. While we approach these opportunities with a prepared mind, we recognise that our insights are no match for the expertise of the teams we support.

In this post, influenced by the trends and opportunities shared with us by founders and close angel friends, we present some of the investment team’s thoughts on sectors where there is a critical need for new solutions for both consumer and enterprise buyers.

We hope this list inspires prospective founders and angel investors with a glimpse of what excites us most in 2024. While we have some ideas about how incumbents in the areas highlighted might be disrupted, please note that this is not an exhaustive list of ideas or how companies might enter them.

This year we’re excited to explore industrial energy needs

THE BIG IDEAS

Reengineered manufacturing

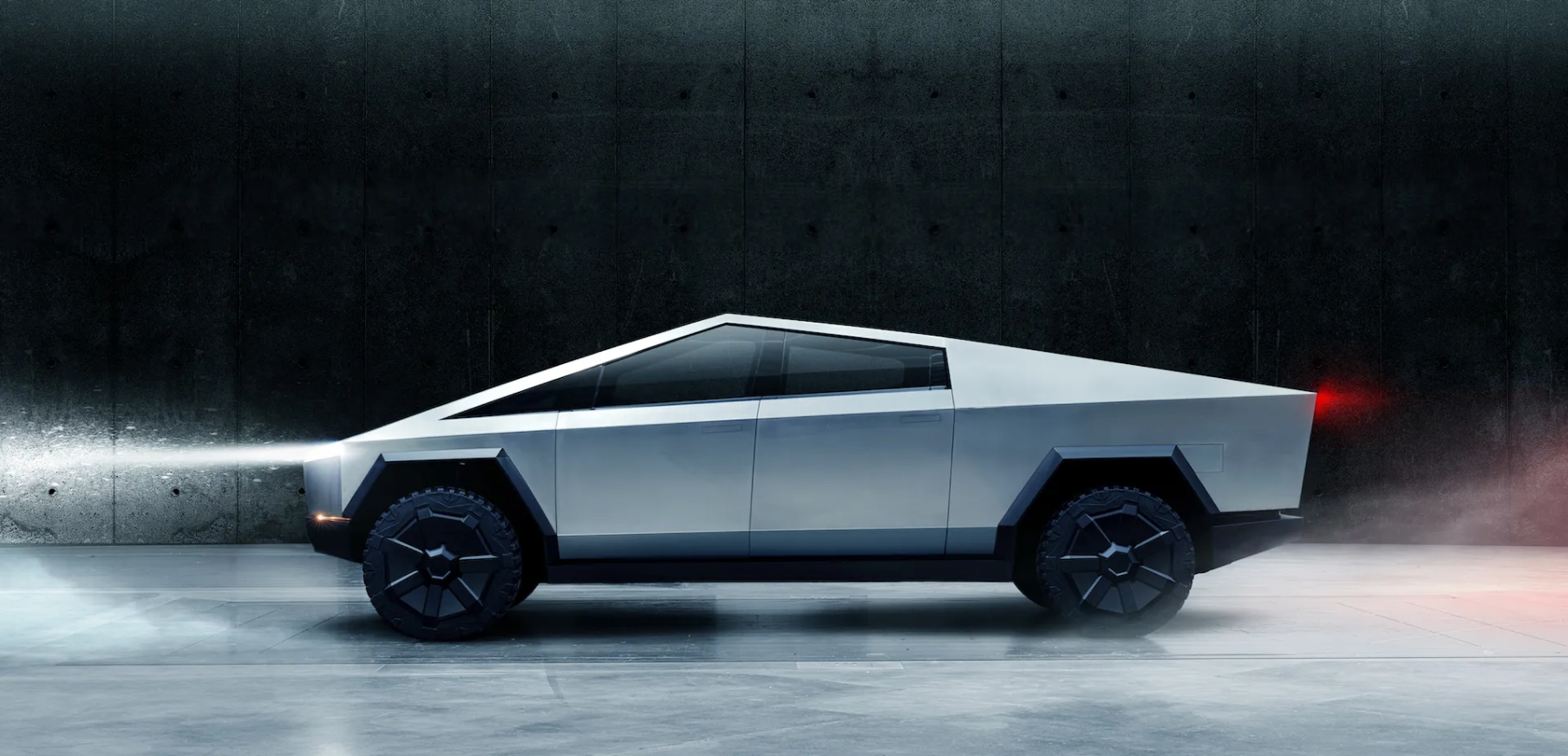

In 2023, 91% of manufacturers re-optimised (some version of re-shoring) part of their production, up from just 7% in 2012. Coupled with an increasing workforce shortage and a generation of founders who cut their teeth at best-in-class, tech-enabled manufacturing companies like Tesla and Northvolt, we believe the next 12 months will be a very exciting time for manufacturing technology. We are especially excited about technology that removes data siloes, unearths operational insights, and enables digital twins that provide a holistic view of real world processes. Connecting IoT devices, forecasting productivity with better time-series modelling and simply improving centralised ledgers for factories are just some of what excites us.

Whilst some companies are tweaking existing factory processes, other models flip manufacturing on its head completely. Hadrian-esque software-orchestrated manufacturers can not only build a propriety operating system but also develop a fully connected factory from the bottom-up. We see a ton of potential for SMBs and multi-site manufacturers to deploy software and bring immense efficiency to their operations.

Manufacturing founders cut their teeth at pioneers like Tesla and Northvolt

Transforming legacy industries

AI has dislodged long-standing inertia within traditional industries to adopt digital solutions. Leaders across shipping, agriculture, and heavy machinery are increasingly eager to collaborate with startups that can improve their productivity, reduce human error, and give their businesses a competitive edge. We’re excited to back founders who are helping these sectors automate repetitive tasks, on the field and in the back-office, and harness data for better decision-making. We’re especially looking forward to meeting with founders who are democratising this data and these insights for a wide range of employees, from the C-Suite and middle management to the individual contributor.

As we see rising safety and security provisions taking effect, our attention is not only turning to profitability-boosting but also to risk-mitigating solutions in the traditional economy. Whether through more streamlined audit processes in the shipping sector or improved workplace safety via off-the-shelf cameras on an oil rig, there is a pressing demand for technology to bridge the gap between the real and digital economy.

There is a pressing demand for technology to bridge the gap between the real and digital economy

Data Infrastructure

We think that it’s day one for the infrastructure that supports burgeoning enterprise data requirements. 90% of the world’s data was generated in the last three years and enterprises n better methods to ingest, transform, stream and analyse it. For example, streaming architecture is still nascent and there is limited consensus on how Flink, Kafka, Trino and Spark should be used in the enterprise and by whom; 75% of the Nasdaq use Kafka to stream only a fraction of their data.

Similarly, as ETL, ELT and reverse ETL have emerged, analysts have scrambled to store the freshly formatted data. However, databases and warehousing technologies are only just starting to move away from a model of one-size-fits-all. Hybrid transaction/analytical processing (HTAP) databases to run analytical and transactional processes, wide-columnDBs to load and search entire columns and navigationalDBs to store a physical location are in their first iterations. Each of these markets in themselves are enormous and deserve more than Postgres extensions to hack together solutions.

Databases continue to be an excellent enterprise insertion point because customers build applications on top of products they love (see Oracle). We can’t wait to see what the next generation of tooling will bring, especially as incumbents evolve from what started as customer-centric products to slow-innovating platforms and eventually to extractive pricing and contract lock-ins.

Europe is experiencing a shortage of 2m healthcare professionals and in the UK alone 470K adults are waiting for care

Easing pressure on our healthcare systems

Healthcare systems across Europe and the US are under immense strain. Europe is experiencing a shortage of 2m healthcare professionals and in the UK alone 470K adults are waiting for care. This pressure is propelling AI into board-level hospital conversations at an unprecedented pace and 75% of health system executives believe generative AI has reached a turning point in its ability to reshape the industry. We are already seeing a high level of trust in co-pilot use cases, targeting administrative workflows (e.g. billing, clinical documentation, patient engagement). Clinical professionals are also starting to adopt tools that support in-flight procedures, although at a slightly slower rate. Computer vision to support procedure safety and accuracy or precision robotics to enhance the efficiency of operations are just two of the emerging areas we are most excited about.

Pioneering advances in pharma and bio

We think that the next 10 years could witness astonishing change in how software can enhance the workflows, outputs, precision and personalisation of pharmaceutical and biological processes. Above all, we’ve been longtime believers in technology that sits at different intersections of the pharmaceutical lifecycle, from drug positioning to clinical trial development and approval. The time and cost to bring new drugs to market are still growing at a steep rate and we are excited about the role of software that can improve contract research, contract development and manufacturing to shortcut the sticking points on the ~10 year approval time horizon.

We think that this really is biology’s century; several foundation models for molecular discovery have emerged in Europe alone and data is increasingly shared across corporate and jurisdictional boundaries to encourage progress and collaboration. The Human Genome Project is just one example of what can be achieved and we are excited to see how research and development will weave in artificial intelligence but also quantum hardware to run compute-heavy simulations and nanotechnology to build with precision that was once impossible. Where once a data scientist would interact with software a few steps removed from operations at the lab bench, we are excited about the future of software built for scientists.