Tom Wilson investigates why there isn’t more VC money flowing into LegalTech startups and the untapped potential for the sector.

We recently hosted a legal tech roundtable together with our friends at Draper Esprit to discuss some of the big topics related to the sector. It was a lively discussion between founders, investors and industry experts and it got me thinking to the size of the market opportunity in legal tech and why more VC money hasn’t been invested in the space. This was also a topic that came up a lot at the recent excellent Legal Geek conference in London so I thought I’d dive in to take a bit more of a look.

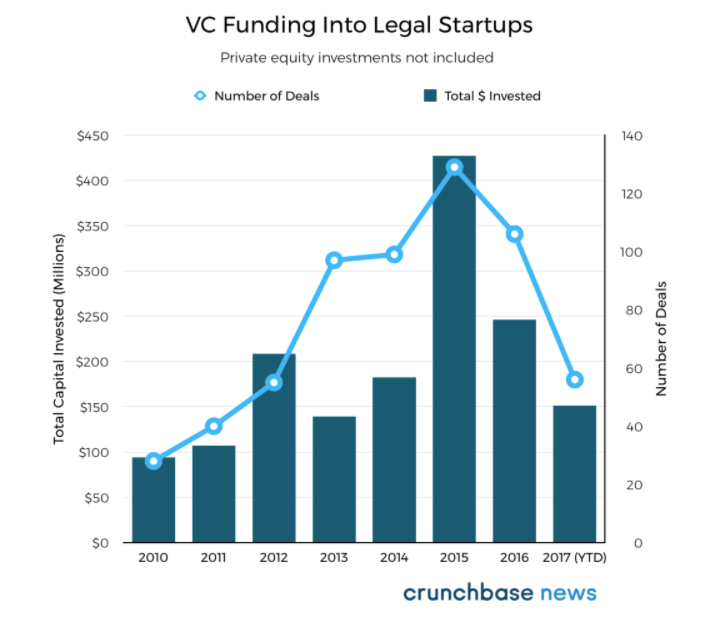

Big numbers are often thrown around regarding the size of the legal tech market. I’ve seen pitch decks with numbers ranging from over £26bn for the UK market to $400bn for the US. However, as indicated by the chart above, investment in the legal tech sector isn’t anything to write home about. Total VC funding globally for 2016 was less than $250m, which given the size of the global VC market is not a huge number. 2017 seems to be tracking at a similar rate and the spike for 2015 was largely driven by two large financings (Relativity and Avvo).

To add to this, the recent legal tech report produced by Legal Geek and Thomson Reuters (Movers and Shakers: UK Lawtech Start-ups, 2017) had the amount invested into UK Seed stage startups (those who had raised <$5m) for 2017 (to June) at a mere £6.7m.

This poses the question, why isn’t more VC funding flowing into Legal Tech? I wanted to unpack 3 of the headline reasons I often hear and explain why I remain very bullish on the potential for the sector.

- “The market isn’t actually that big”

Whilst the headline numbers are impressive (£26bn, $400bn etc.), when you actually look at the market size for some of the legal tech solutions the addressable market could be seen as much smaller. For example, ML contract review is an exciting space that many legal tech startups are focussed on (Beagle, Luminance, Kira to name some of the more established players). However, on the face of it, the universe of potential purchasers of such solutions is a lot smaller than the large market numbers would suggest. Such startups that sell into law firms (to note, not all are focused on this segment) are only likely to find appetite amongst the larger more technologically savvy firms who, whilst significant, represent a smaller sub-set of the overall market.

Whilst the market size concern is valid and I’m not a fan of startups solely pitching the massive headline numbers. I believe it’s short sighted to see this as a substantial issue. There’s no doubt that the legal services market is becoming more sophisticated and technology adopted at the more tech forward law firms will filter down to the smaller firms (or arguably such smaller firms will cease to exist). We just have to look at the adoption of tech solutions across the larger firms and even the steps by certain large firms to set up accelerators (MDR Labs), investment arms (Next Law Labs), work spaces (Fuse) etc. as evidence of an increased appetite.

Also, law firms themselves are only one aspect of the market. Selling into the in-house legal, business or compliance teams is another lucrative market segment (Juro, Legit and Libryo are some examples from our portfolio of startups addressing such respective segments). Such in-house teams are often more astute purchasers of software and as such a potentially better route to market.

Additionally, one could argue, there is an untapped latent legal market that could present an even larger market opportunity. For example, we’ve only began to scratch the surface of democratising access on a B2C level to legal services (e.g. Willing, Farewill, DoNotPay, CrowdJustice, Absolute Barrister). p.s. I’d love to meet founders building Legal Tech companies focusing on the B2C space – I think there’s some big opportunities here!

2. “The incentives aren’t aligned”

Law is an odd industry where many law firms (not all) still bill clients by the hour. Therefore tech solutions that make them more efficient may not be positively received and hard for legal tech startups to sell in.

Whilst this has traditionally been an issue, I think the market is finally turning on this point. For one, a large proportion of the consumers of legal services are themselves sophisticated users and purchasers of software across different business areas (Accounting, CRM etc.). Therefore, there is an expectation that their legal service providers utilise tech solutions to provide the best service. Clients / consumers expect more transparency around how much they are paying and startups are helping provide more transparency here (Apperio, SeedLegals and Lexoo are some taking advantage of this trend). Furthermore, the emergence of startups such as Atrium is further evidence that startups are seeing the move away from the billable hour as an opportunity to provide tech to leverage efficiency gains across the market.

We’re also seeing law firms look to tech solutions as a way to differentiate versus competitive firms. Adopting the latest advancements in technology ahead of their competitors such as smart contract technology (Clause are a startup in our portfolio doing some exciting stuff in this space) or ML contract review (see companies listed above) is an additional way for firms to stand out in a crowded market.

To add to this, as per above, law firms is only one potential customer segment and for other segments (e.g. in-house etc.) the incentives to keep legal cost and time spent down are very much aligned.

3. “The sales cycle is too long”

Lawyers and law firms are notoriously tough to sell to. Law firms are usually structured as partnerships requiring multiple sign offs to get to a sale. Add this to the inherent risk averse nature of the industry and you have a bit of a perfect storm.

I think this one is potentially here to stay for a while but there are signs things are improving. Larger law firms are putting tech on the exec team (partnership board) agenda and we’re even seeing CTOs start to be appointed. All promising signs. Furthermore, looking outside of law firms and more towards in house teams or non-legal businesses and the sales cycle point begins to fall away.

Whether selling in-house, private practice (law firms) or otherwise, the key thing for startups to do is to try to identify the key decision makers to expedite the process. As the spotlight on legal tech increases this should help raise awareness of its potential and reduce the sales cycle.

The future of the funding landscape

I firmly believe there are huge opportunities for startups in the legal tech space. It feels like the sector is at a real tipping point and I see the emergence of major startup success stories as an inevitability. I think we’re going to see more VC funding looking to back the standout startups scaling up. I’m excited about seeing what talented founders build to tackle some of the biggest problems and take advantage of such massive opportunities.