We are delighted to continue our support for Steven, Huss, and the incredible 9fin team, as they build the leading AI-powered analytics platform for debt capital markets.

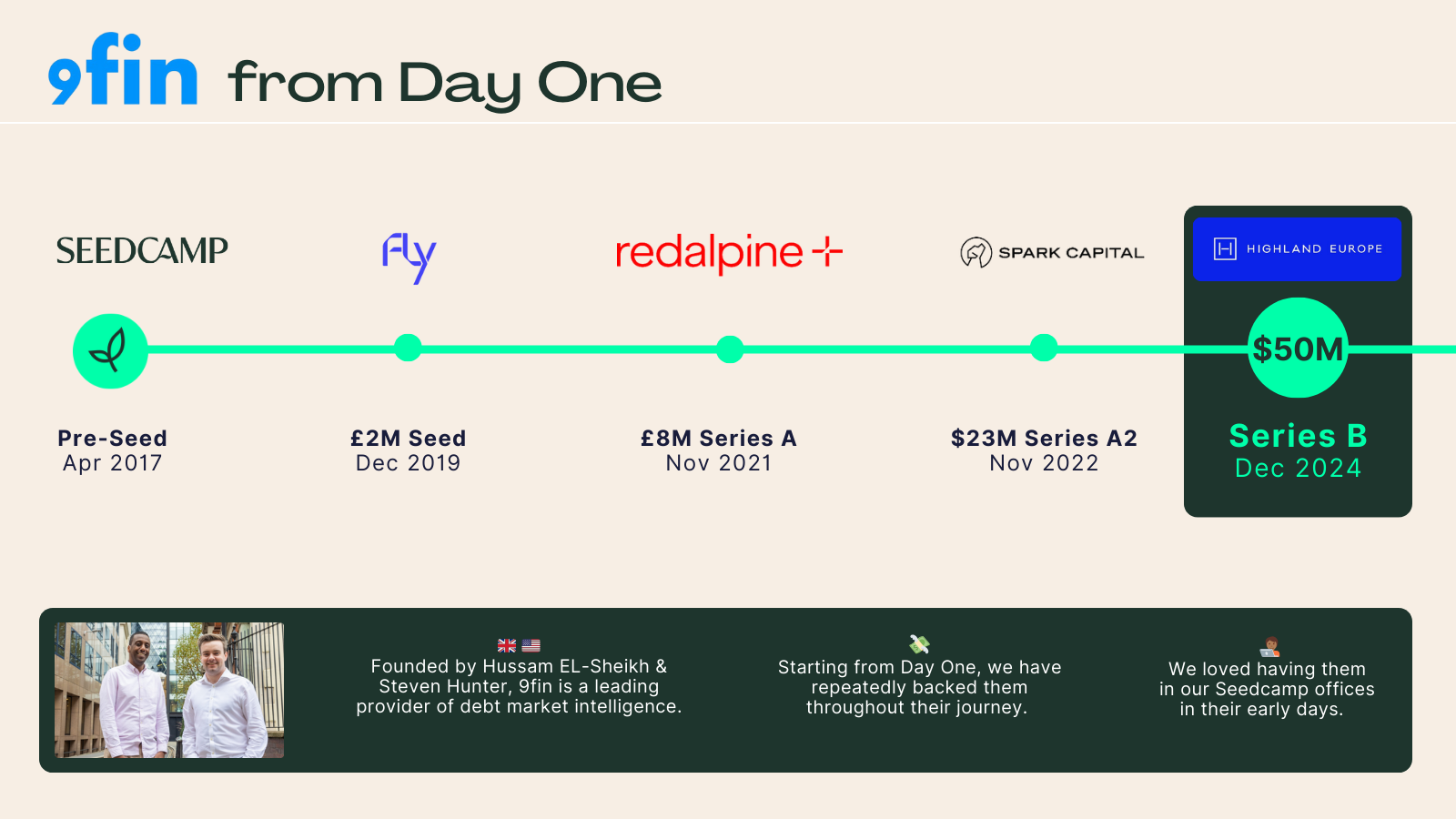

We first partnered with Steven and Huss in 2017, when we wrote their pre-seed cheque on St Patrick’s Day. We were impressed by the determination of this duo of uni friends who had just quit their jobs in finance to tackle their frustration with the lack of data on debt issuers and loved having them as one of the companies who worked out of our Seedcamp offices.

Fast forward to 2024, 9fin secured a $50 million Series B led by Highland Europe, with our participation alongside Spark Capital, Redalpine, 500 Startups and Ilavska Vuillermoz Capital.

Steven Hunter, 9fin’s Co-founder and CEO, comments:

“Credit markets are the biggest overlooked asset class in the world and yet they still rely on information sources straight out of the 1980s – opaque, slow and messy. We started 9fin to give professionals in the market a data edge, with smarter, faster intelligence.”

Our Partner Sia Houchangnia, highlights:

“At Seedcamp, we are so proud to have supported the team from day one and are thrilled to continue backing them as they seize this opportunity and build the future of debt capital markets technology.”

The new funding will accelerate the team expansion into the US and to further enhance the platform’s AI capabilities.

9fin supports 170+ clients, including asset managers with a combined AUM of over $17 trillion, counting all 10 of the top 10 investment banks as its customers.

Find out more about 9fin on their blog and in the Financial Times.