A data-driven deep dive into founder salary and equity, from Pre Seed to Series A

Welcome to the first edition of the Start-Up Founder Compensation Survey – powered by Graphy.

At Seedcamp, this question comes up time and time again and we struggled to find any reliable data. As a consequence, the purpose of this survey is to provide a clear set of results, based on peer data, absent of bias, for free. A starting point for founders to construct a compelling case to empower their position, especially for those from diverse backgrounds, not an investor-led set of guidelines. More #powertothefounder

I would like to extend thanks and congratulations to Graphy, a Seedcamp company, for the awesome charts and their recent launch!

I would also like to thank the other funds who contributed their data outside of the Seedcamp Nation to help provide insight, namely Anthemis, Notion Capital, and BackedVC (if anyone else’s companies contributed please let me know and I’ll add you here!)

Please read!

We collected a number of variables from the companies that submitted the survey including: Annual Salary; Equity % Held; Company Revenue; Last Round Type; Last Round Size; Number of Co-Founders; Number of Employees; Years in Operation; Geographical Location (HQ); Office Status (Office, Hybrid, Remote)

Please find the forex rates used at the time of generating the charts here.

We have spent countless hours digesting all this data and comparing and contrasting these variables together on hundreds of charts. The conclusion was that only a few variables showed any reliable impact on founder salary or equity. These variables were:

- Last Round Type (Pre Seed, Seed, Series A)

- Geographical Location

- Number of Co-Founders

Fascinatingly, traditional indicators associated with company and consequent founder success, such as revenue, number of employees, etc. had zero correlation to the amount of salary or equity that founders held. We will present this data following the main results if you wish to explore for your own interest, but it raises a huge question as to what KPIs founders should be working towards as an indicator for their success, to leverage during compensation reviews with investors and their Board in the early stages of company building.

How is early-stage compensation currently considered by VCs?

I had a chat with our Partner, Tom Wilson, to discuss how we look at assessing a founder’s compensation.

There is no one size fits all, other than initial factors such as round size, Tom said that most founders know that they are going to sacrifice short term earnings (salary) in order to allocate capital to different company assets that enable growth, such as hiring, technology, infrastructure, etc. However, it is important that the founder’s personal circumstances come into play.

It is rare that we will get involved unless there are extreme outliers, such as not paying anything or too little, or overpaying, creating unsustainable conditions for the founder or company alike. However, we prefer to massively incentivise early-stage founders to hold equity, as that’s where the long-term gain comes from and ultimately where founders will see the most value when wanting to build and scale a start-up, but also earning above their breadline so that they’re comfortable and able to live. It is important that investors help to “create the best environment for excellence to thrive”, not overpaid so that equity is undervalued, but not so stressed by personal liquidity problems that short-term decision making can be skewed. It is clear to see that when you can remove any negative emotions held on these external factors, it massively increases an individual’s personal performance and the consequential likelihood of success towards the overall mission objective.

Results

The below charts are interactive, please hover your mouse over the charts to highlight specifics.

The biggest trend and indicator of founder compensation came down to the funding round. Based on this data, as you go through fundraising rounds, expect your salary to increase and your equity to go down.

Between funding rounds, you can expect to see a salary increase of circa (to the whole number):

- Pre-Seed – Seed: 28%

- Seed – Series A: 35%

Equity decrease of circa (to the whole number):

- Pre-Seed – Seed: 9%

- Seed – Series A: 9%

Geography

Looking at the geographical data, the country holding the most founder compensation is the US followed by the UK however the majority of the data came from these two areas. So, we broke down the data into continent buckets to provide a better comparison:

Clearly, North America leads the way on salary, however, it is clear to see that equity across ecosystems is relatively level.

Number of Co-Founders

This is quite an interesting one, as per the salary chart, the solo founder holds great earning power, apart from at Seed, which, other than that outlier, behaves as expected with increasing founder numbers.

Equity is more logical, with the solo founder holding the highest amount of equity at Pre-Seed and Seed, then balancing out at Series A. However, it is important to note that only one founder from each company filled out this survey in 99% of the cases, so this is only indicative of one founders compensation, not the entire founding team.

Interesting discoveries

As mentioned in the introduction, for those interested in looking at some more of the data, I was surprised to see that some of these variables had no seeming impact on salary or a huge spread in the data across the set.

Revenue

The chart above shows the average salary by company revenue. Whilst there is an evident slope towards the upper limit at the end of the chart, the variance between this is huge and if the outlier spike at £186.99k salary and £10.42m ARR was absent, that slope would be even more gradual.

So, very interestingly, from the data we have and the variables measured, between Pre-Seed and Series A, the proportionate increase of salary when prepared to increase in revenue is low, not taking into account other cash incentives such as bonus or dividend payments.

Interesting insight showing that as per the above chart looking at general revenue, when you break revenue down by continent, European and UK ecosystems seem to follow a general pattern of revenue and salary increasing together, but no consistency in the US.

Based on the above chart, the trend would indicate that the more revenue your company earns, the more equity you lose!

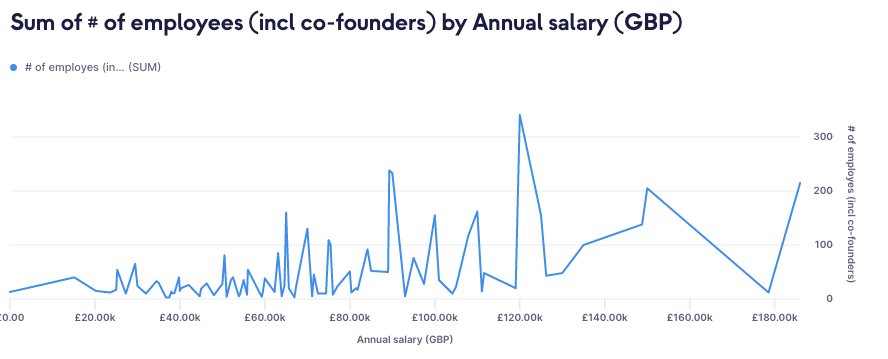

Number of Employees

The number of employees by annual salary also presents a steady slope increase and an interesting spread of data. The lowest number of employees is 3 and the greatest is 341, with the same range on salary as mentioned above.

As you can see from the spread, whilst there is a general increase, it doesn’t appear to be reliable for founders as a variable to assign salary.

Office Status

I was really looking forward to seeing how office status impacted compensation, if at all. Interesting to see that none of the Series A companies surveyed are purely office-based, perhaps indicative of launching during the pandemic. But if we look at the above, other than equity at Seed, it appears that being purely office-based doesn’t pay off!

Wrap Up

Thank you all so much for taking the time to read through the findings of the survey, I hope it is truly useful to founders when wanting to have informed and powerful conversations about their compensation.

I would love to hear your thoughts and comments on the findings and if there are any other variables you would like us to consider when looking at the next survey.

You can reach me at alexlewis@seedcamp.com