Each Seedcamp vintage tells a unique story about the tailwinds and themes behind our investment decisions. We think that venture is about seeing the present for what it is and committing to founders on missions to solve deeply painful problems. The most exciting solutions are unorthodox and start on the very edge of markets before gravitating to the centre. We invested in Revolut long before mobile banking reached the masses, in Grover when the circular economy was in its infancy and Synthesia when no one had heard of generative AI. In our second installment celebrating the Seedcamp Nation’s milestones, we wanted to share some of the threads that weave together our investments in no-brainer products, inefficient markets and extraordinary entrepreneurs.

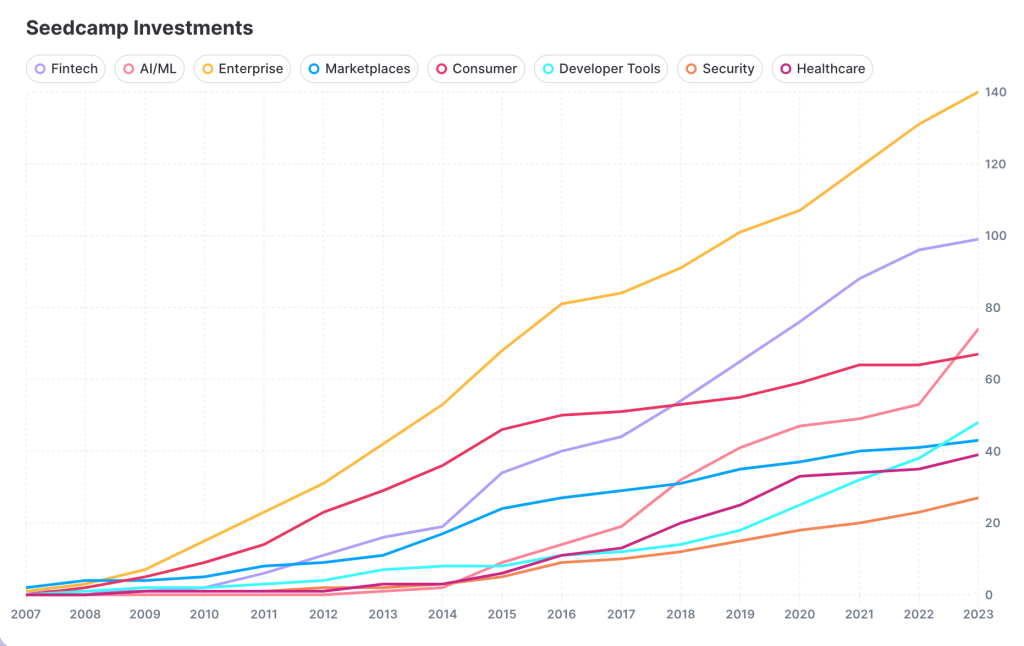

Timing matters and we make it our business to understand fast-moving currents before they reach escape velocity. For example, we lent into fintech in 2015 as open- and neo-banking came to market and our AI commitments accelerated around key breakthroughs– TensorFlow in 2014, Transformers in 2017, and GPT-4 in 2022. As different forces emerge, our theses evolve, resulting in distinctive waves of investment tracing back to 2007.

The total companies invested exceed the number of Seedcamp Investments, as some companies are in more than 1 sector (max 2). Made with Graphy

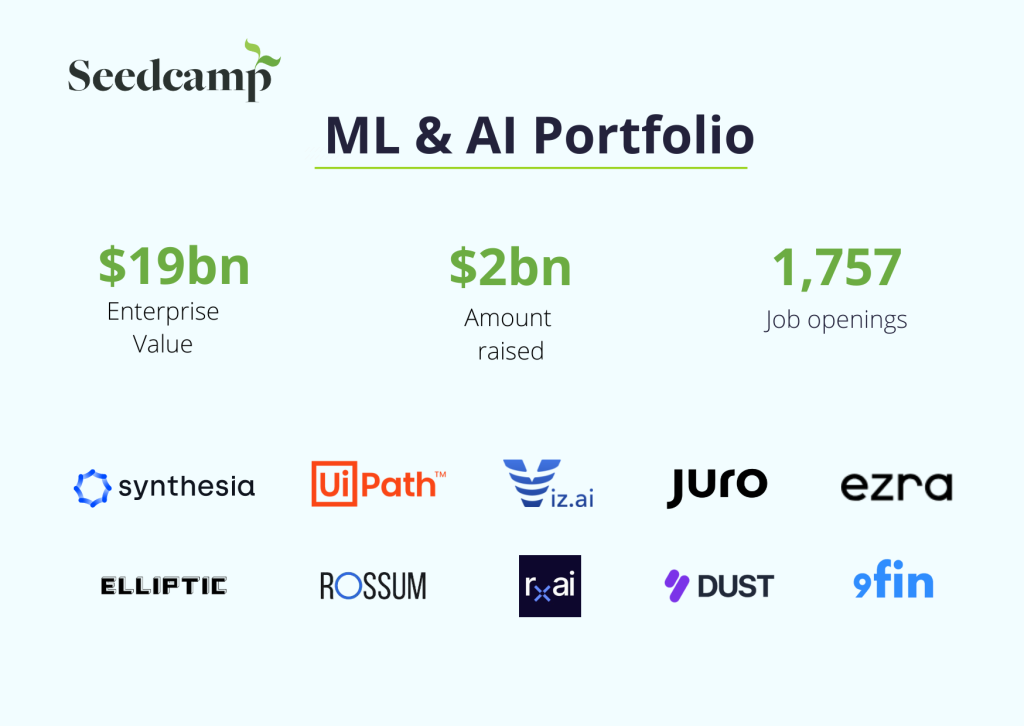

Machine learning first caught our attention in 2012 when we backed Charlie Finance and then Elliptic. Since then, we have invested across the infrastructure and application levels, watched UiPath (NYSE: PATH) go public and recently cheered on Synthesia to unicorn status in one of Europe’s rare growth rounds of 2023. It’s a sector we have studied for over a decade and we can’t wait to see commitments in the enterprise stack like Juro and Rossum continue their upward trajectory, while pattern detection technology like Viz and 9fin drive discoveries across healthcare and finance. Of course, we couldn’t not mention that as GPT-3, -3.5 and -4 have blossomed, we have been thinking about what LLMs will mean and how they will be used in the enterprise. We have made investments like Dust and AskUI to drive business processes, but also can’t wait to see what this technology means for biology, medicine and chemistry. Many components of the machine learning stack like devops, guardrails and security are just getting started and we look forward to supporting the leading minds.

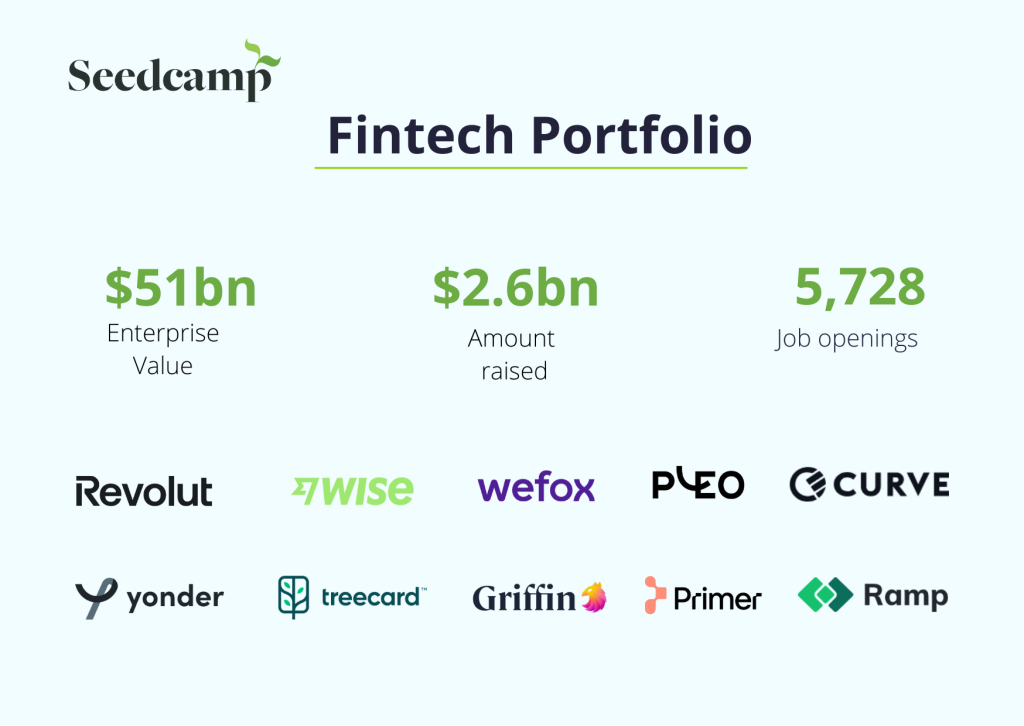

Around the same time as the first wave of machine learning startups emerged in Europe, financial technology began to catch our eye. We came with a prepared mind in 2011, when we invested in Taavet and Kristo’s mission at Wise (LSE: WISE) out of Fund II. In Fund III we were among the earliest supporters of unicorns Pleo, WeFox and Revolut, which recently announced revenue expectations of $2bn for 2023. Meanwhile, other members of the Seedcamp fintech portfolio are in the earlier years of their journey. On the consumer side, Yonder and Treecard are revolutionizing credit and impact at a rate of knots, while Griffin, Weavr and Primer break new ground in the worlds of embedded finance and payments. Financial digitalisation is still in its first innings and while fintech accounts for less than 10% of global transaction volume, we look forward to supporting the next wave of technology that fixes the broken worlds of banking, real-estate, payments, procurement and much more.

In spaces that are a little earlier – like open-source – we think we are where fintech was in 2016

Of course not all themes align neatly to sectors. For example, Adobe’s Flash Player accelerated the development of multimedia applications across all industries and the platform shift to mobile gave rise to innovation from gaming to the Internet of Things. In our emerging portfolio, open-source business models stand out as a fundamental shift in go-to-market philosophy, away from the ultimate buyer in the finance department, and towards the developer. Two rapidly growing businesses that have struck a chord with programmers are Appwrite, which raised its Series A from Tiger Global for its backend in-a-box and Meilisearch, which raised an A round from Felicis for its embedded search engine API. While some open-source commitments look like conventional developer tools for optimizing the process of code writing, deployment and release, others look more like Saas that is simply developer-first. Baserow is a no-code database built in Django and Nust, Rerun is an SDK for visualizing multimodal data, and Medusa is a platform for building rich performant commerce applications. As more and more open-source companies transition their fanbase to paid and supported services, we are excited to see these businesses flourish.

_________________________________________________________________________________________

For any startup looking to build something truly awesome, Seedcamp is the place to start.

Taavet Hinrikus, Co-founder of Wise

Each year, new ideas emerge around fresh ways to build and sell software products. It has been a privilege to partner with businesses on various journeys, from on-prem to the cloud, from desktop to mobile, from centralised to decentralised, and more. Today, new tools are enabling everyone to be a developer, application UX is increasingly voice-first and infrastructure is enabling data to be ingested, transformed, loaded, streamed and analyzed with incredible efficiency. We can’t wait for what’s to come and in episode 3, we look ahead to the next decade.

If you missed Part I, read it here: Seedcamp Turns 17. The Seedcamp Nation and the European Tech Ecosystem, Then and Now (1/3)

Also read Seedcamp Turns 17 | The Next Decade (3/3).

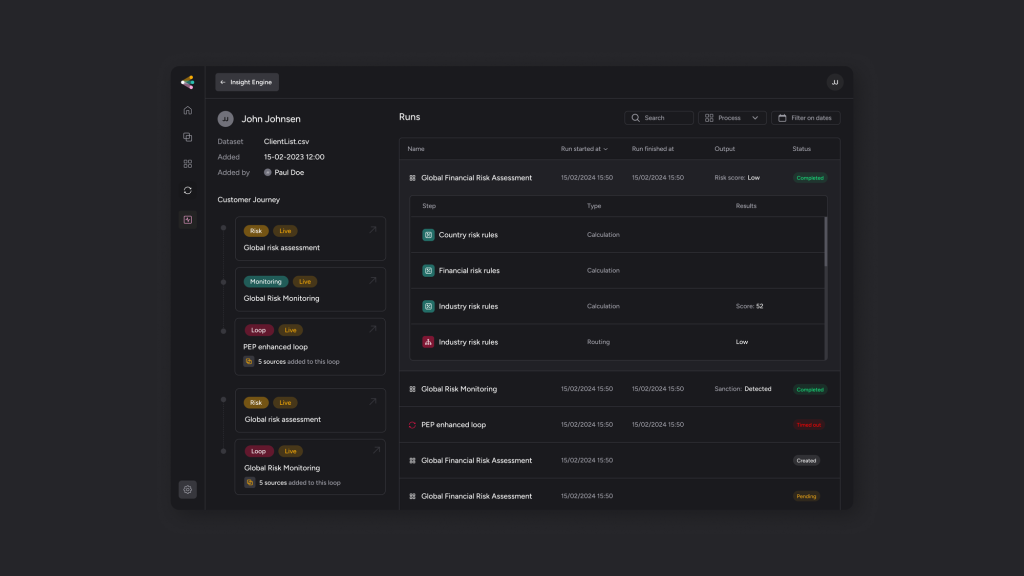

From our own experience investing in many startups building in financial services, we know only too well that ongoing due diligence (ODD) tends to be a manual and inefficient process, even more so for companies that must adhere to rules and laws across different markets. Fortunately, some new approaches and solutions go beyond seeing ongoing due diligence as a mere cost center. They enable compliance professionals to use ODD for regulatory purposes and also to scale their businesses into commercial success.

This is why we are excited to back spektr‘s mission to change ongoing due diligence processes in the financial sector. The Copenhagen-based fintech is founded by a team of experienced serial entrepreneurs, including CEO Mikkel Skarnager, Ciprian Florescu, Jérémy Joly, and Jan-Erik Wagner. We are especially delighted to be working with Mikkel and Cip again, having backed their first startup HelloFlow in 2021 (sold to Canadian company Trulioo in 2022). They’ve assembled a dream team that spent years building simple, easy-to-use, solutions to complex problems at HelloFlow and subsequently Truiloo. We firmly believe they have the ideal combination of skills and experience to build a market-defining company with spektr.

Spektr’s customizable, no-code platform offers financial companies an automated solution for client monitoring and risk control while completely automating all parts of the ongoing due diligence cycle. Recognizing the exponential growth of the compliance field globally, spektr aims to simplify risk-based monitoring with an automation-focused platform that does not require specialised IT skills for the user.

Spektr’s four main solutions provide the ability to:

These solutions help customers:

Co-founder and CEO Mikkel Skarnager highlights:

“With the spektr platform, we can make ongoing due diligence an efficient function with commercial value for companies rather than being a costly expense. When looking at the explosion in the number of employees and expenses, I am convinced that there is great potential in making compliance a better business.

“We’re off to an incredible start, thanks to both the platform and the generous support from our investors. This journey brings back memories of our success with HelloFlow, but this time, we’re aiming for something even bigger and long-lasting.”

On why we invested, our Partner Tom Wilson comments:

“We’re delighted to have the opportunity to back Mikkel and Ciprian as they go again with spektr. The HelloFlow journey gave us a taste of the market-leading products they can build and we’re excited to see where they can take spektr, building on that experience.”

We are excited to participate in spektr’s € 5 million round, alongside our friends at Northzone and PreSeed Ventures.

For more information, visit spektr.com.

Seedcamp has always been about people and the magic that happens when you bring the right people together. 2024 will be our 17th year in the service of Europe’s most exceptional entrepreneurs. We think it’s a perfect time to reflect on how our network, from the Seedcamp Expert Collective to the Talent Network, drives an unfair advantage for Europe’s most impactful software companies.

Many things have changed about technology in Europe since we started out in 2007. European startups now receive over 20% of global funding, up from 8% in 2003, and can stay private for much longer in an ecosystem flush with global capital looking for private opportunities.

At Seedcamp, we are dedicated to keeping the main thing the main thing and doubling down on what we have always done best. As our portfolio enterprise value eclipses $100 billion in enterprise value and our total number of investments reaches 500, we continue to commit to the best founders in Europe and Israel at the earliest stage, drive an unfair advantage through the power of our network and support them to multi-billion dollar outcomes.

Seedcamp works as its own microeconomy, also known as the Seedcamp Nation. Our purpose is to build the best platform in the world for founders to connect with the talent, expertise and capital they need to grow their businesses. Over the years we have seen the depth of this network drive hiring – 59 portfolio alumni now work in C-Suite, VP and ‘Head of’ roles at other portfolio companies – and foster founder-to-founder serendipity as portfolio companies become each others’ design partners and early customers. Some companies get on so well that they join forces. For example, UiPath (NYSE:PATH) acquired Re:Infer in 2022.

Supporting founders is our number one priority, and the team are 24/7 confidantes, cheerleaders and occasionally providers of a friendly boot. But we don’t always know the right answer, and we also act as conduits to world-leading functional and sectoral leaders in our network. The Seedcamp Expert Collective (SxC) is home to highly skilled operators who have taken businesses from $0m to $100m ARR from our own portfolio, like UiPath, Revolut, Pleo and Wise, and other category-defining businesses like Stripe, Cloudflare, Uber, Deliveroo and NextDoor. Founders work with our experts ad-hoc on issues from pricing strategy to product-led-growth to culture building, and in many cases, connect on an ongoing basis as the company evolves. Similarly, our Talent Network of hundreds of vetted candidates across sectors, functions and seniority levels is often a handy shortcut for companies looking for A players at the start of their journey.

From founder meet-ups across Europe, to New York get-togethers for teams who move to the US, events and spending time together in person has been part of Seedcamp’s DNA. While Skeedcamp, Founder Summits and roundtables remain core to our success, other elements have evolved as the needs of founders have changed. In 2007 we were an accelerator, which revolved around Demo Days and Investment Forums. Today, our products are designed not only to support a business at its inception, but to add value around the clock on the journey from early-stage company, to product-market fit, to punchy follow-on fundraises.

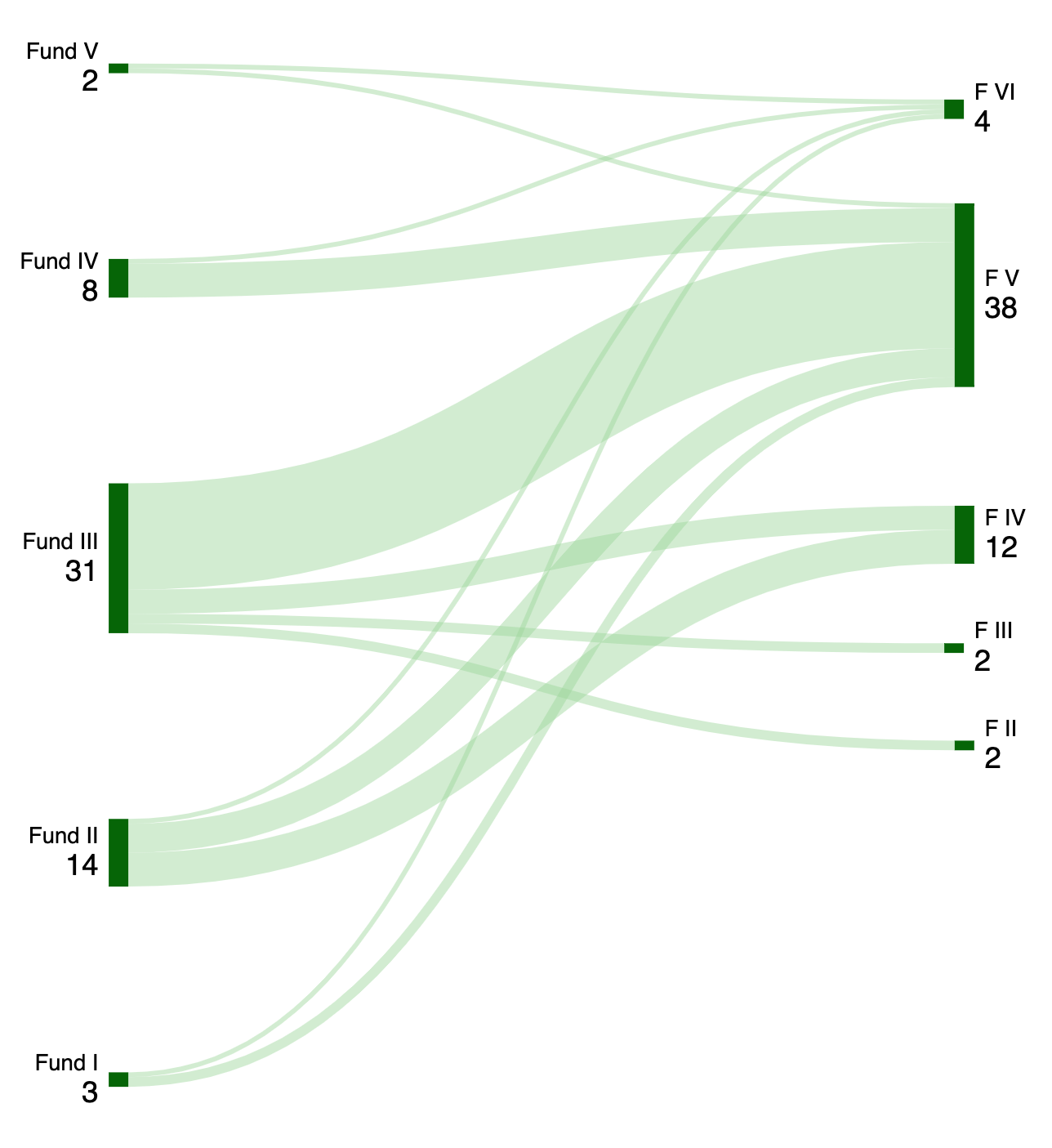

We know how to bring together the right mix of people and the conversations that start at our events often result in a partnership sales agreement, LinkedIn marketing collaboration or even a Seedcamp micro-community. For example, Seedcamp founders with an open source go-to-market strategy share a channel for tips on documentation, Discord engagement, remote culture-setting and lots more. Equally, founders from different spheres might share connections in the form of investor references or buyer introductions. While it doesn’t make sense for all businesses to work together, the network effects of the Seedcamp Nation are compounding dramatically as we deploy Fund VI.

The Seedcamp Nation fosters relationships that span companies and decades and when we talk about network, it’s about more than the volume or prestige of people that we know. It’s the depth and quality of those partnerships, highlighted by some of the founding teams we have backed on multiple journeys. To name a few, we are excited to be part of Stan and Gabriel’s new journey with Dust after their first business, Totems, was acquired by Stripe, to invest in Emi and Ezra after Brainient exited to Teads.tv and partner with Gary and Jamie as founders of Fluidstack and subsequently, Treecard. As Europe’s Seed Fund, we have been a central component of the European flywheel – in fintech alone, we have committed to 8 new businesses founded by the growing mafias of Revolut, Wise and WeFox.

Similarly, when founders move onto different pastures after their founding journey, we are always pleased to continue working together as they become our LPs, co-investors and members of the Expert Collective. And when our members of the Seedcamp Nation choose to move on and do brilliant things on both sides of the cap table, we love to continue working with them as Partners at funds like Point Nine, Tiny or Kima and founders of start-ups like Outverse and Ben.

_________________________________________________________________________________________

We believe that 2024 is the most exciting time there has ever been to invest in European technology. Entrepreneurship is top of the list for the brightest minds and startup failure is a chevron worn with pride in a way that hasn’t always been true. Experienced management teams have emerged from the previous decade’s success and are driving scaleups to new levels of ambition. We can’t wait to support the next decade of exceptional founders. In the meantime, stay tuned for episode 2 where we look back at some of the themes that shape our portfolio.

Safety is paramount in the drug discovery and development process. However, despite recent technological strides, unforeseen toxicity continues to be one of the most significant and costly drivers of failure in drug discovery campaigns.

This is why we are excited to back Sable Bio, a London-based tech bio startup on a mission to change how biotech and pharma companies evaluate drug target safety for effective decision-making. The company is developing a unique AI-enhanced platform designed to offer pharmaceutical companies predictive safety insights, mitigating the risk of clinical trial failures.

Founded in 2023 by Alex de Giorgio, PhD and Josh Almond-Thynne, PhD – a team of AI-driven drug discovery experts who in their previous roles at BenevolentAI produced a series of innovations with company-wide and external adoption – Sable aims to provide scientists with richer specialist data, initially concentrating on toxicology.

To deliver predictive safety insights at key drug development decision points, Sable Bio’s platform extracts proprietary signals from structured and unstructured data sources. Leveraging large language models (LLMs), causal inference, and deep biological data knowledge to build predictive and interpretable indicators validated against real-world benchmarks, the platform enables scientists to explore results holistically with transparent explanations.

Josh Almond-Thynne, co-founder of Sable Bio highlights:

“We are really excited, this investment will help Sable Bio redefine drug safety assessment and change the ways actionable biomedical insights are generated. Working with leading investors Episode1 and Seedcamp is enabling us to build an exceptional team and a platform to accelerate safer drug development for patients in need”

On why we invested our Partner Tom Willson comments:

“Taking drugs to market from discovery to development and beyond takes far too long and toxicity is a major factor adding delays or causing such processes to fail entirely. Sable is perfectly positioned to solve this problem by providing access to the right data at the right time to those who need it, leveraging LLMs to surface data that would have previously been impossible to cover fully. Alex and Josh as co-founders have the ideal blend of scientific excellence, specific domain experience and entrepreneurially drive to be building Sable and we’re delighted to have the opportunity to partner with them.”

We are excited to participate in Sable Bio’s oversubscribed £1.5 million pre-seed funding round, led by Episode1 Ventures. With the new funding, the founders plan to build out a stellar team of scientists and engineers to enable the refinement and enhancement of their core technological infrastructure, providing a solid and expansive foundation for their data capabilities.

The company is currently seeking to establish partnerships with biotech, pharma, and healthtech companies, as well as academic collaborations.

For more information, visit sablebio.com.

Copyright © 2019 Seedcamp

Website design × Point Studio