While email marketing is one of the most effective channels for achieving high conversion rates, its effectiveness has plateaued in the past 15 years due to a lack of innovation.

We believe that meaningful personalisation is the future of large-scale communication. This is why we are excited to back Singulate, a generative AI marketing platform that uses generative personalisation and LLM workflows to rebuild email marketing for B2B companies.

Co-founded by Dave Schools (CEO), Nicolas Klein (COO), and John O’Gara (CTO) whom we had the pleasure of hosting in our old London office during their time as early employees of Hopin, the UK startup aims to launch the next era of email marketing using generative AI and LLMs to unlock far easier segmentation and better personalisation in large-scale communication, beginning with email marketing.

Dave Schools, co-founder and CEO of Singualte highlights:

“We’re solving the biggest problem we saw in events and marketing at Hopin. We had data on our attendees and customers from our events, product, and CRM — but we didn’t know how to easily segment and meaningfully personalize our marketing messages to speak to the individual at scale, so we sent email blasts — leaving millions on the table.”

Singulate’s product lets marketers use LLMs to easily create limitless audience segments to branch every component of a campaign on the fly. Singulate introduces powerful new ways for writers to use generative AI to make content deeply relevant for individuals at scale.

“Personalization is an exhausted word,” adds Schools. “And AI is making it worse. What we’re building is more long term and focused on quality and versatility. We want to give marketers tools that fundamentally change how they write at scale for their customer personas.”

On why we backed Singulate, our Partner Tom Wilson, comments:

“We are delighted to back a strong founding team that we know so well from previous years, now bringing their track record to a market they know well. This team is very familiar with solving difficult customer problems at hyperspeed.”

Our Director Natasha Lytton adds:

“We’ve all been on the receiving end of a hi [first name] email or asked for feedback on an event we never attended. Email marketing is such a huge opportunity that’s being missed due to generic messaging that falls flat and fails to deliver a truly personalised message. That’s why we’re so excited about Singulate’s proposition and the ability to build stronger, lasting relationships through meaningful, targeted communication.“

We are excited to participate in Singulate’s $2.3 million pre-seed round led by Bowery Capital, with additional support from angel investors, including Johnny Boufarhat, Paul Forster, founder of Indeed, Alex Theuma founder of SaaStock, via Backfuture, Draper Startup House, Allen Gannett, Alen Cvisic, Liz Willits, Dillon Scanlan, Johnathan Kol Bar, and more.

The company has launched in private beta and is looking for design partners. If you’re a B2B marketer, agency, or growth PM, drop your email on Singulate’s landing page to get started.

For more information, visit singulate.com.

Parents worldwide strive to prioritise their children’s early education and better prepare them for an uncertain future dominated by fast-paced technological change. However, they are torn between limiting children’s exposure to noisy media and entertainment environments, and enabling them to learn to use technology from an early age. We believe there must be a viable, in-between solution that also complements what kids are taught in school.

This is why we are excited to partner with Nurture, a startup creating a new way for children aged 4 – 7 to learn foundational skills through immersive play. Father of two young boys, Nurture Co-founder & CEO Roger Egan had an important realization in early 2020 after selling his last startup to Alibaba: for the first time in history, no one knows what skills or jobs will be relevant in 20 years.

In the midst of the pandemic and remote learning, Roger was struck by the major disconnect between how and what children are taught in school and their preparedness for the future, particularly one powered by AI. For him and many other parents, foundational skills such as critical thinking, digital literacy, mindfulness, empathy [and resilience] are key to thriving in today’s rapidly changing world, yet they are missing from traditional education.

He named the problem “the life preparedness gap” and immediately knew his next venture would be focused on closing this gap. Together with co-founders Danny Limanseta, Scott and Julie Stewart, and Sally Doherty, Nurture is bridging the disconnect between how and what their kids are taught in school and their preparedness for the future.

Nurture’s Immersive Learning Media (ILM) platform combines the best aspects of children’s television and gaming to create immersive story-based adventures. Learning themes are introduced in the story and kids apply the skills they learn in interactive games and creative projects.

Roger Egan III, Co-Founder & CEO of Nurture highlights:

“I witnessed first hand how traditional education focuses on teaching kids what to learn, not how to learn. I knew I had to find ways to supplement my boys’ education to help them adapt to a rapidly changing world. With what, though? None of the existing alternatives fully addressed the problem. Homeschooling is too time-consuming, and there are too few alternative schools and they’re unaffordable for most families. Educational TV is heavy on entertainment, light on education, and learning apps don’t hold kids’ attention; plus they focus on academic skills, not critical life skills.”

Nurture’s solution, developed with leading experts in children’s education and entertainment is designed following three major guiding principles:

Manuel Bronstein, Chief Product Officer Roblox and Nurture Advisor, emphasises: “I believe that Nurture’s unique combination of engaging story and fun interactivity is the right approach for preschoolers. The opportunity is huge.”

Besides single device experiences, adventures are enhanced with Nurture’s pioneering dual-screen format (TV + mobile / tablet) – a new form of interactive TV. Interaction between screens creates a magical, immersive experience, where kids help their favorite characters and become the heroes of the story.

Unlike most streaming media channels and children’s games, the Nurture app contains exclusively learning-focused, age-appropriate, interactive adventures – truly guilt-free screen time.

On why we partnered with Nurture, our Co-founder and Managing Partner Reshma Sohoni comments:

“After trying the Nurture app with my 5-year-old, I was convinced that children will find Nurture’s magical experience much more engaging than traditional media. Nurture transforms mindless screen time into an interactive learning adventure.”

We are excited to co-lead Nurture’s $2.8 million pre-seed round alongside Golden Gate Ventures, and Reach Capital. With the new funds, the company will develop its Immersive Learning Media (ILM) platform and establish it as a new category of media called Immersive Learning Media that prepares children for the uncertainty of an AI-driven future.

Nurture has just released their invitation-only Beta, currently available on iOS in the US, Canada, UK, and Singapore. Parents, you can sign up to join Nurture’s community and help them close the Life Preparedness Gap by equipping your children with the skills they need to thrive in the future.

For more information, visit nurture.is.

The United States is considered one of the most entrepreneurial countries in the world. However, SMBs – the backbone of a healthy economy – must handle significant bureaucratic burdens that stall their growth.

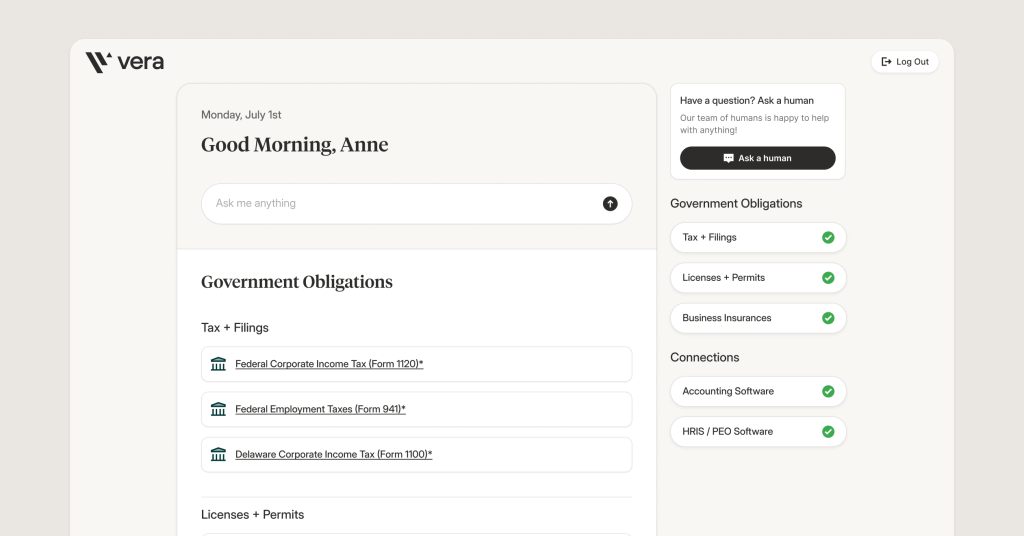

This is why we are excited to partner with Vera (formerly Vance), an AI back-office service for startups and SMBs, that handles business obligations like a top-tier admin and ops manager. Founded by serial entrepreneur Simon Holland, the New York City company’s mission is to eliminate the admin burden for America’s 33 million small and medium businesses (SMBs).

By leveraging advanced artificial intelligence and machine learning technologies, Vera aims to automate 95% of tedious, time-consuming back-office tasks, enabling Admin and Ops Managers to effectively put the back office on autopilot so they can focus on growing their core business, specifically more differentiated tasks or customer-focused priorities.

The team that includes Richard Davies, CTO; Clementine Clough, Head of Partnerships and Community; and James Devlin, Head of Growth will tackle the most challenging part of back-office business administration first: managing government obligations.

Simon Holland, Founder and CEO of Vera highlights:

“It should be so much simpler to run a business. We want to liberate startups and SMBs from admin burdens so they can focus on achieving their true potential.

“It’s hard to succeed as a small business. As a multi-time founder, I know firsthand how painful administrative and government obligations can be. They’re a constant distraction, and neglecting them can be costly.”

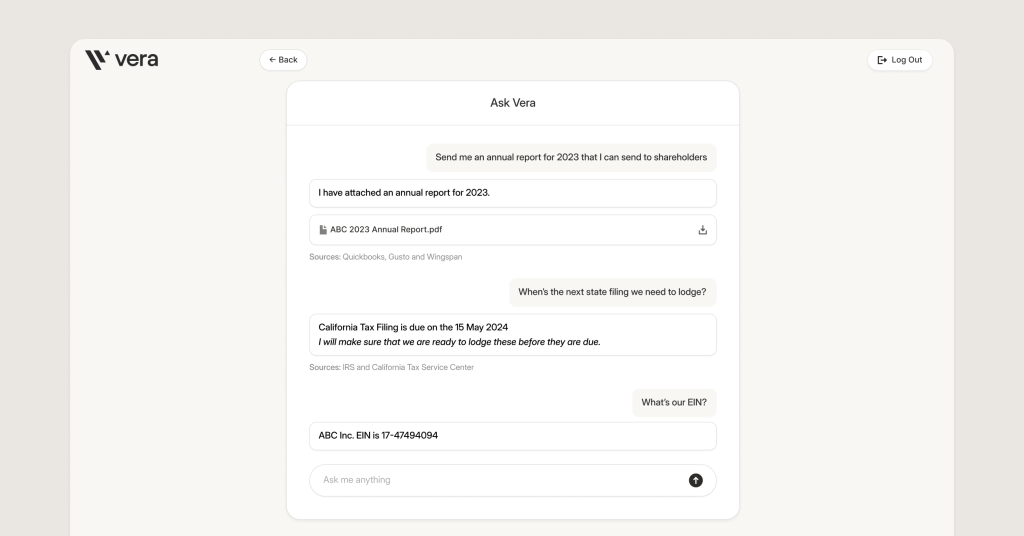

Vera connects a company’s existing back-office tools—PEO, HRIS, and Accounting—and compares up-to-date business data with over 200 fragmented government sources to inform them about their mandatory government obligations. Additionally, two core features, “Ask Vera” and “Quick Actions,” enable companies to get support with queries about requirements, retrieve key data from company documents, and proactively keep them on track with government deadlines, thus avoiding fines.

On why we backed Vera, our Managing Partner Carlos Espinal comments:

“We are delighted to partner up with Vera and support their mission of empowering SMBs across the US to focus on their core business rather than tedious admin work. Simon’s experience as a multi-time founder, paired with a strong vision and proprietary technology are the kind of bold, innovative play we get excited about.”

We are excited to participate in Vance’s $1.5 million oversubscribed pre-seed funding round led by ViIlage Global, alongside Anamcara, Foreword, Visionary Ventures, and angel investors.

The new funds will be used to onboard small businesses across the United States and develop a proprietary recommendation engine that informs them of their obligations, while AI agents perform administrative tasks.

Sign up for early access here.

For more information, visit hirevera.com.

Machinery downtime in the heavy machinery industry leads to significant financial and opportunity costs, factoring in late penalties, idle labor, equipment rentals, and administrative expenses. Furthermore, Right to Repair laws require manufacturers and dealerships to provide technical support and parts for machines for up to 10 years.

This is why we are excited to back, Digital Iron, a copilot for dealerships that leverages AI models trained on CAD schematics, machine manuals, and telematics data. The platform offers intelligent diagnostics and parts sourcing to respond faster to breakdowns.

Co-founded by Ciaran Gillen (CEO), a second-time founder, with 18 years of experience in the material processing and equipment sales industry, and Salina Brown (CPO), previously Director of User Experience at HP, Digital Iron automates order processing and summarization, thus helping reduce errors and improving operational efficiency. The integration of enriched dealership, customer, and machine data speeds up diagnostics and increases parts sales, boosting revenue at dealerships.

Ciaran Gillen, Co-founder and CEO of Digital Iron comments:

“Machines break down on average 600 hours every year and there’s an extremely manual process involved in trying to get them back in action. This is because each machine can have anywhere between 50 to 200 documents attached to it and as dealerships could be selling up to 1,000 machines a year they can find it difficult to answer questions to find out what has gone wrong.

“Down time for machines obviously means lost revenue but our platform addresses this by ingesting all the manuals so that when questions come in we know exactly what documents to access to get answers to problems in seconds rather than in days.

On why we backed Digital Iron, Kate McGinn from our investment team comments:

“Digital Iron is tapping an immense opportunity to disrupt a large, underserved, and undigitised market. We’re thrilled to back two heavy machinery wizards, Salina and Ciaran, as they help dealerships offer 10x better diagnostics and parts sourcing.”

We are excited to lead Digital Iron’s $2 million pre-seed round alongside our friends at Concept Ventures, RTP Global, and FJ Labs.

For more information, visit digitaliron.com

Cash flow management is the primary reason why SMBs go out of business. Business owners and financial professionals still rely on a burdensome system of financial tools to manage money transferred in and out. For SMBs outside the SaaS and e-commerce payment systems, the challenges are particularly significant.

This is why we are excited to back Mimo – which stands for ‘Money In, Money Out’ – a platform simplifying global payments, cash flow, and financial management for SMBs and finance professionals.

Founded in 2023 by CEO Henrik Grim (former General Manager of Europe at Capchase and Investment Manager at Northzone), Alexander Gernandt Segerby (CPO), and Andreas Meisingseth (CTO), the London and Stockholm-based company provides a suite of financial tools that bundles the features needed for SMBs to better understand and control their cash flow.

Mimo gives businesses, accountants, and bookkeepers a single tool for easier administration and better financial decisions. The platform’s credit offering helps minimise risk and optimise working capital, enabling businesses to send and receive payments on their own terms. Trading SMBs and finance professionals can pay suppliers with a click, access working capital, and get paid faster by customers, in any currency.

For businesses that hold inventory or trade internationally (e.g. those in consumer goods, retail, hospitality, or wholesale) and require a substantial number of invoices and multi-currency management, Mimo’s financial management solution solves the painstaking, time-consuming issues that are synonymous with these sectors.

Mimo already works with 50+ SMBs and finance professionals and processes several million GBP every month via its early access offering.

Henrik Grim, co-founder and CEO of Mimo, comments:

“I’ve seen first-hand the time-consuming and fragmented processes SMBs must deal with when managing money. SMBs and financial professionals have to jump between apps and spreadsheets to pay invoices or make and chase international payments, all while trying to keep track of and manage cash flow. Mimo bundles this into a single tool so that businesses can easily manage the movement of their money and receive payments in any currency, faster. We’re delighted to be backed by our investors to help give SMBs full control of their finances.”

On why we invested, our Partner Sia Houchangnia comments:

“We’re seeing a step-change in how SMBs are equipping themselves with technology to become more astute and proactively-minded businesses. From their work at iZettle, Hedvig, and Capchase, Henrik, Alex, and Andreas are deeply entrenched into the financial management needs of SMBs which they are now solving for with Mimo. We are thrilled to partner with them on this journey.”

We are excited to participate in Mimo’s £15.5M (€18M) funding round led by our friends at Northzone and joined by Cocoa Ventures, Upfin VC. The round also includes an asset-backed facility arranged by Fost and participation from angel investors including founders and early operators from Stripe, GoCardless, Wayflyer, and Anyfin.

Mimo aims to continue to build out its B2B payments solution for SMBs and expand its headcount which now includes 14 employees, of five nationalities, across the company’s two locations.

For more information, visit mimohq.com.

From our own experience investing in many startups building in financial services, we know only too well that ongoing due diligence (ODD) tends to be a manual and inefficient process, even more so for companies that must adhere to rules and laws across different markets. Fortunately, some new approaches and solutions go beyond seeing ongoing due diligence as a mere cost center. They enable compliance professionals to use ODD for regulatory purposes and also to scale their businesses into commercial success.

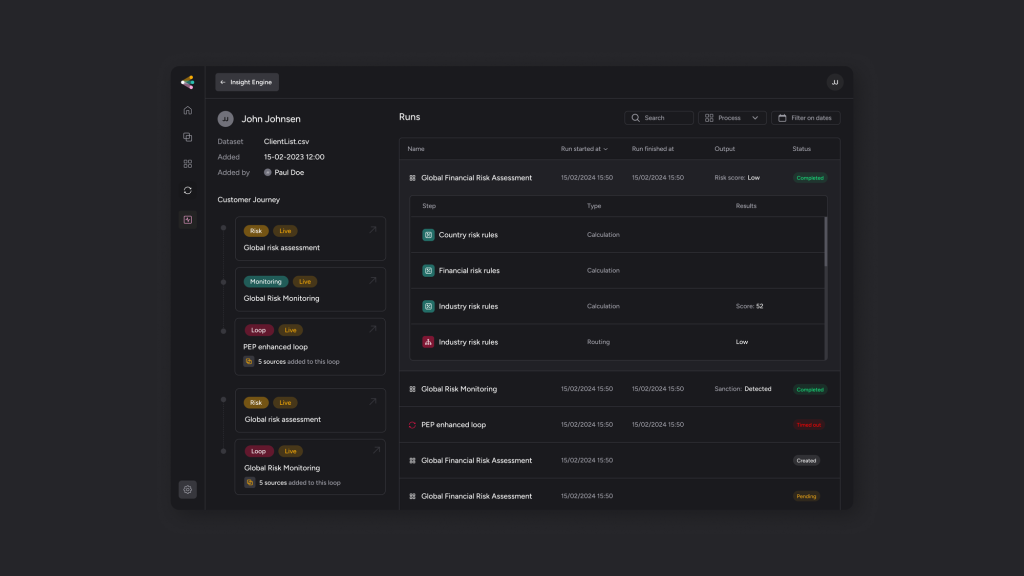

This is why we are excited to back spektr‘s mission to change ongoing due diligence processes in the financial sector. The Copenhagen-based fintech is founded by a team of experienced serial entrepreneurs, including CEO Mikkel Skarnager, Ciprian Florescu, Jérémy Joly, and Jan-Erik Wagner. We are especially delighted to be working with Mikkel and Cip again, having backed their first startup HelloFlow in 2021 (sold to Canadian company Trulioo in 2022). They’ve assembled a dream team that spent years building simple, easy-to-use, solutions to complex problems at HelloFlow and subsequently Truiloo. We firmly believe they have the ideal combination of skills and experience to build a market-defining company with spektr.

Spektr’s customizable, no-code platform offers financial companies an automated solution for client monitoring and risk control while completely automating all parts of the ongoing due diligence cycle. Recognizing the exponential growth of the compliance field globally, spektr aims to simplify risk-based monitoring with an automation-focused platform that does not require specialised IT skills for the user.

Spektr’s four main solutions provide the ability to:

These solutions help customers:

Co-founder and CEO Mikkel Skarnager highlights:

“With the spektr platform, we can make ongoing due diligence an efficient function with commercial value for companies rather than being a costly expense. When looking at the explosion in the number of employees and expenses, I am convinced that there is great potential in making compliance a better business.

“We’re off to an incredible start, thanks to both the platform and the generous support from our investors. This journey brings back memories of our success with HelloFlow, but this time, we’re aiming for something even bigger and long-lasting.”

On why we invested, our Partner Tom Wilson comments:

“We’re delighted to have the opportunity to back Mikkel and Ciprian as they go again with spektr. The HelloFlow journey gave us a taste of the market-leading products they can build and we’re excited to see where they can take spektr, building on that experience.”

We are excited to participate in spektr’s € 5 million round, alongside our friends at Northzone and PreSeed Ventures.

For more information, visit spektr.com.

With a multi-trillion dollar valuation, the global Real Estate industry has been slow in embracing digital transformation. It remains one of the most document-heavy and data-filled industries, with enormous potential for automation and talent upskilling.

This is why we are excited to back Fifth Dimension AI, a London-based startup on a mission to amplify the exceptional in real estate professionals. Coming out of a pilot phase, the company launched its flagship product Ellie, a first of its kind AI co-partner developed to improve productivity and amplify exceptional teams in industries that deal with a lot of documents and data. It automates time-consuming tasks such as data analysis and industry research, thus freeing people up to focus on bringing value to their business and fully using their expertise and insights.

Founded in January 2023 by Johnny Morris and Dr. Kate Jarvis, Fifth Dimension AI leverages their wealth of expertise across real estate, finance, and technology. Dr. Kate Jarvis, a large language model wizard with a PhD in Linguistics from Stanford University, has spent over a decade designing Machine Learning-powered products and bringing them to market. Johnny Morris brings more than a decade of real estate experience, in roles such as Chief Operating Officer at Wayhome and Analytics Director at Countrywide. The founders believe that Large Language Models (LLMs) can unlock the exceptional in people, taking away the time-consuming and often boring task of reviewing large quantities of information locked away in disparate documents, and instead producing outputs in a fraction of the time.

Dr. Kate Jarvis, Co-Founder & CEO of Fifth Dimension AI, comments, “This investment is a testament to the recognition of Ellie’s ability to redefine the world of work beginning with the real estate industry. We solve the issue of lifting employees out of time-consuming, repetitive and boring work, working with natural language that is designed to ensure people from all backgrounds can use it in the way that is most productive for them. Ellie empowers knowledge workers to do their best work and lead happier, purposeful, and more fulfilled lives.”

Johnny Morris, Co-Founder & CPO, Fifth Dimension AI, adds, “We designed Ellie to provide real estate professionals with a competitive advantage by providing a partner to help them get done in minutes what usually takes hours. Across our clients, we’ve been amazed by the impact that Ellie has on the newest generation of real estate professionals. These young and ambitious individuals are able to increase their output and amplify their expertise in the industry – in a fraction of the time. With Ellie as their partner, we believe the next generation will have the power to truly move the industry forward.”

Following the completion of an initial pilot scheme running since April, Fifth Dimension AI already boasts nearly 10 major real estate firms as clients, including big names such as Hamptons.

On why we invested in Fifth Dimension AI, our Managing Partner Carlos Espinal comments:

“With their wealth of expertise across AI, Real Estate, and Finance, Johnny Morris and Dr. Kate Jarvis are a world-class founding team taking on a massive opportunity to innovate the real estate industry. We love their emphasis on the human element, i.e. enabling real estate professionals to fully leverage their talent and knowledge, and thus focus on high-impact activities that create more business value.“

We are excited to co-lead Fifth Dimension AI’s £2.3 Million pre-seed alongside Anthemis’ Female Innovators Lab Fund, with support from Ascension Ventures Ltd, Concrete VC, Love Ventures, Twin Path Ventures, and Sie Ventures. With the new funds the company aims to scale the business’ sales and marketing functions and focus on product development to enhance the tool’s capabilities for an expanding audience across the real estate industry

For more information visit fifthdimensionai.com.

Copyright © 2019 Seedcamp

Website design × Point Studio