The UK and many countries across Europe face major labour shortages in the infrastructure sectors. Blue- and green-collar workers – who play a key role in the transition to a more sustainable economy and national scale infrastructure improvements – need better digital access to training to do their jobs safely and keep up with the latest technological innovation.

This is why we are excited to back Visibly, a tech platform that aims to rebuild regulated training for the infrastructure sector from the ground up. By giving skilled workers the training they deserve, the UK-based company is on a mission to enable blue- and green-collar workers to have a career with impact.

Founded in 2021 by Kane St Quintin, who previously built construction company Pickr, Visibly’s groundbreaking certification-as-a-service platform broadens the range of regulated certifications available to blue- and green-collar workforces, so they can overcome the labour shortages that limit action on the climate crisis and national infrastructure improvements.

Visibly’s user-first technology gives workers on-demand education that adapts to their individual capabilities and translates to the world around them. Furthermore, it provides access to advantages office workers take for granted when undergoing training, like peer-to-peer feedback and expert-led coaching.

Kane St Quintin, Founder and CEO at Visibly emphasises:

“Think of someone digging a hole (excavating). Sounds simple, but hit a high-pressure pipeline and you’ve got fatal consequences. It’s a dangerous task – so how is it taught? In a classroom, with a 20-question written assessment. This is clearly ridiculous. It’s situations like this – and their larger-scale impact – that we’ve set out to change.”

Visibly’s clients include Hitachi, Kier, and SRL. Alison Spooner, SRL’s Service Director comments:

“Giving our users ongoing access to expert-led training and testing their competence through Visibly makes sure they’re doing their jobs safely and effectively. Visibly is a vital tool for us as we look to expand our user base.”

On why we invested, Kate McGinn from our investment team highlights:

“Climate action needs more than just great equipment to transition to net-zero; we need skilled tradespeople to build, install, and upkeep our changing infrastructure. Visibly is the answer to our critical shortage of ‘green-collar’ workers; we’re thrilled to be backing Kane and his team on this mission.”

We are excited to participate in Visibly’s $7.5 million funding round led by our friends at Creandum, alongside Brighteye Ventures, Triple Point, and prominent business angels, including Herbert Sablotny, Celia Francis, and Nick Kingsbury.

Visibly’s team includes Chief Learning Officer Kirsten Campbell-Howes (ex-Busuu, Chegg). The latest round of funding will be used to build the Visibly team and accelerate product development and the breadth of regulated certifications it offers.

For more information visit visiblyhq.com

View open positions at https://apply.workable.com/visiblyhq/ .

Commercial fleets represent approximately 10% of total European emissions. Playing an essential role in the continent’s green transition, there is a significant drive for sustainability and electrification of commercial fleets. However, the switch to EV-native fleet management and operations is complex, costly, and disruptive. The core of the problem lies in the fact that the commercial fleet ecosystem – from vehicle leasing to fleet operations – treats EVs like low-grade ICEs (internal combustion engine vehicles), not capitalizing upon EV’s benefits, such as their high durability and energy efficiency.

This is why we are excited to back Pelikan Mobility, a UK and France-based deeptech platform on a mission to optimize the financing and operations of sustainable commercial fleets.

Founded by David Salfati (Engie, Macquarie) and Vincent Schachter (CEA, TotalEnergies, smart-charging pioneer eMotorWerks sold to Enel) – who have a combined 30 years of experience in the fields of energy, mobility, algorithm development, and real assets finance – Pelikan aims to introduce the next logical step in shifting commercial mobility to electric vehicle (EV): tech-enabled, operations-centric leasing solutions.

Pelikan bridges EV leasing and fleet operations, driving down the cost of electrification by:

How does Pelikan work?

The company is developing a digital twin-enhanced EV-native leasing solution. It reconstructs – from readily available client data – digital twins that precisely capture each fleet’s operations, constraints, and business challenges.

The platform’s AI and combinatorial optimization algorithms enable the efficient integration of EVs and charging solutions into each fleet’s operations over several years.

To build an operations-centric lease plan, Pelikan starts from the fleet’s operational goals and constraints and computes the optimal use of each type of vehicle (ICEs and EVs, at different stages in their lifecycle) and the financing profile that matches that usage value. These usage and financing profiles are translated into a cost-effective and productive EVs lease plan.

Furthermore, the platform tracks and optimizes operations on an ongoing basis, ensuring the fleet leverages the full potential of its assets.

Pelikan Mobility’s solution is being deployed and tested with major utility and logistics players in France.

Vincent Schachter, co-founder, comments:

“Pelikan’s mission is to drive massive electrification of commercial fleets. In order to achieve this, we are convinced that a radically new approach is necessary. We started by developing our technology for usage-driven optimization and fine-tuned its capabilities with our first customers. With this initial round of funding, we will leverage it to lease cost-effective and productive EVs tailored to the context of each fleet“.

David Salfati, co-founder, adds:

“The finance world will need to deploy dozens of billions of euros every year into commercial EV assets, whilst the operations world will need to run them efficiently to power their business. Bridging these two worlds to ensure that capital flows into productive and efficient assets is going to be mission critical, and core to what Pelikan is building.”

On why we invested in Pelikan, Kate McGinn from our investor team, comments:

“The transportation sector accounts for 29% of our annual greenhouse gas emissions. Even though we have the technology to dramatically reduce this number, current leasing options are creating a bottleneck for commercial EVs to be used at-scale. As the commercial green leaser of choice, Pelikan is solving this bottleneck and challenging the way electric vehicles are financed and operated. Pelikan is finally making the green choice a pragmatic one.”

We are excited to participate in Pelikan’s €4 million funding round, alongside Pale Blue Dot, Frst, and other investors.

With the new funds, Pelikan aims to launch the leasing offer.

For more information, visit pelikan-mobility.com.

Cybersecurity has always been a fast changing landscape, but with the rise of widespread-access AI tools such as ChatGPT, we are seeing Artificial intelligence is catalysing a paradigm shift in cybersecurity architecture. Traditional systems, designed to protect against decades of relatively stable known threat types, are increasingly inadequate against AI-augmented attacks, which can analyze vast datasets and exploit vulnerabilities at unprecedented speed and with unprecedented creativity.

Emerging challenges, such as the automated generation of sophisticated phishing attacks, which grew between 500% and 1000% YoY in 2023, or the exploitation of previously unknown software flaws which are being brought to light at volume through AI, require urgent solutions. Massive data management challenges and breaches are surging and impacting public businesses like Hubspot to security darlings like Okta. This isn’t just a risk to survival and security is no longer considered just a cost center. It is also critical infrastructure and 90%+ of businesses with poor security practices missed revenue goals last year. Even the premise behind alerts, alerts analysis and alert management is under stress due to the creative nature of attacks which can be layered and more complex than ever before.

This has prompted a wave of innovation among cybersecurity firms, focusing on adaptive, AI-centric security frameworks. These frameworks are designed to anticipate the evolving tactics of adversaries, ensuring that digital infrastructures can withstand the sophisticated cyber threats of tomorrow. Managing software access for AI agents or integrating security practices in the production and deployment of code, for example, are starting to emerge as crucial lines of defense for any organisation.

_________________________________________________________________________________________

At Seedcamp, we are aware of the above challenges and more, and thus are investing in a new stack of tooling and frameworks to stop attackers in the era of generative AI. Whereas tooling once focused on a certain element like a network, or a device, software is increasingly safeguarding the intersections and understanding the intent of both machines and humans.

To this end, our thesis is underpinned by four distinct categories:

(1) Managing identity more intelligently for humans and machine agents

(2) Shifting left in the software development lifecycle to secure code as it is written

(3) Surfacing complex fraud detection beyond simple pattern recognition

(4) Securing an organisation’s data, regardless of how it is managed in transit, at rest and in use.

In the past, access management was rules-based systems that ensured only the right people access an organization’s data and resources. Role Based Access Management (RBAC), Identity Access Management (IAM) and Privileged Access Management (PAM) were ‘top-down’ and permitted access based on an employee’s rank and function. This was typically a ‘point solution’ in the sense that it solves a single problem in a tightly defined zone of relevance.

This top-down logic is being replaced by tooling that is more context-aware and primed to handle both machine and human users. Attackers have historically snuck past identity systems by understanding the rules and logic and posing as an entity that is permissioned, i.e. by using the email address and password of an employee. Today, machine agents are accessing the same software without passwords or ‘clearance’ in a traditional sense. It is therefore imperative to understand the ‘why’ and ‘how’ behind an access request, in order to decide on what should and should not be accessed. To this end, we have invested in businesses that manage, protect and bring visibility to this evolving environment.

“AI is fundamentally changing the way companies manage their access to software: AI provides context to processes that were merely rule-based in the past. Think of user access reviews, offboarding, or time-based access – AI guides IT and Security teams with recommendations (e.g. “Julia hasn’t used Figma for 9 weeks. You can most likely remove her access.”). This not only frees IT and security teams from manual, mundane tasks but also increases your security and compliance posture.”

Johannes Keienburg, CEO of Cakewalk

Classical cybersecurity largely safeguards the end product – the ‘surface area’ is the zone in which users interact with the software. Detection happens after code has been written and shipped and prevents attacks on the application or infrastructure. Recently, tools are ‘shifting left’ in the software development cycle to automatically check the code base for vulnerabilities.

This developer-first tooling began by effectively scanning static code bases. More recently, it has become ‘real-time’ to operate in parallel with the machine or human actually writing code. To the chagrin of software developers, programming is merging with security and vulnerability scanning will inevitably be instantaneous as code is written. To generalise, these alerts are slightly ‘higher fidelity’ and can help provision resources and even prioritise the haul of alerts that security analysts currently handle.

Catching issues long before code is shipped to the enterprise is exciting and at Seedcamp we are pleased to partner with organisations who make this their mission, including:

“Security should be something developers take responsibility for in the same way they consider how to structure their application, which database to use, and how to approach writing integration tests. It’s often said that developers don’t care about security, when really they just don’t have the right tooling. That needs to change if we want to build software that is secure by design.”

David Mytton, CEO of Arcjet

Impersonation and identity theft represent an enormous threat surface area for the enterprise and for individuals. Global fraud is worth over $1 trillion and onboarding customers, businesses and employees is a huge cost-center. To verify and approve a single identity, enterprises are already deploying several different packages which might independently check KYC, AML, sanctions, political interests and more. For fraudsters, it is essentially very easy to triangulate the personal details of someone from social media and online content. The volume of attempted attacks is only likely to continue growing.

Additionally, fraud tends to be lodged in opaque spaces. Longtail personal details and identities are rarely checked, such as a reference for a job, a merchant on a food delivery platform or a guarantor of a tenancy. Hiding stolen identities or non-compliant information deep in documentation has historically been a simple way to get around checks which tend to focus on the main event – the user or customer.

At Seedcamp, we are excited to partner with businesses securing the entire enterprise workflow against fraudulent individuals and businesses. Some of the solutions we’ve backed include:

“Rising identity-based cyberattacks demand proactive solutions, making automated KYC verification vital for a more secure environment for businesses and their customers. With spektr, continuous client data monitoring, proactive alerts on profile changes, and international data screening ensure fast, secure operations.”

Mikkel Skarnager, CEO of spektr

Finally, it is no secret that organisations are losing an uphill battle to prevent data leakage. As data is plugged into language models, it is almost impossible to tackle the probability that it will escape as an output and be sent outside the organisation. The explosion of free browser based services also means that employees are uploading confidential data on a daily basis to design, content and other automated tools that may be visible to 3rd parties.

“The cybersecurity battleground is shifting. While traditional tools such as perimeter defenses are still important, they don’t work for the large and constantly growing attack surfaces that Generative AI exposes to enterprises. The first line of defense is the application developer. At Bookend we’re building for a future where developers can quickly and simply protect applications from Generative AI-related threat vectors that cause model misbehavior, and focus instead on empowering their organizations to innovate more rapidly.”

Pravin Pillai, CEO of Bookend AI

New tools are emerging to tackle this problem and the process of tracing data and keeping it squarely within an organisation’s four walls is just beginning. Where security was previously one-size-fits-all, it will need to intensify at certain intersections to prevent issues like toxicity and shield employees from a growing wave of fake AI-driven messaging and content.

We are excited about the companies we have partnered with to bring transparency, collaboration and trust to data in the enterprise:

“The old paradigm for data security treated it as atomic pieces of information. With the rise of Large Language Models (LLMs), Natural Language Processing (NLP), and evolving AI/ML techniques, the challenge of data security has now shifted to the level of Knowledge Management which derives meaning from the data we once tried to protect. The paradigms of the old model do not translate well or scale to the new model and we have to find a more effective path than trying to persist the illusion of having our arms around the atomic information.”

Nick Vigier, CISO of Oscar Health*

_____________________________________________________________________________________

The security landscape is evolving rapidly and we are actively trying to solve how best to protect our valuable information infrastructure. If you are a founder of an early-stage security startup, we would love to hear what you’re building!

*Not a Seedcamp portfolio company

Regulatory and technological tailwinds drive investment decisions and as we look ahead, we are excited about emerging catalysts for the software stack and for society. In this article, we touch on just some of the solutions we think might change the world in the next 17 years.

Above all, the demands of our warming planet, chronic disease and disorganised digital environments are in need of software solutions more than ever. Although we can’t wait for a bitcoin ETF to propel decentralised applications and WebTransport and WebGPU to unlock instantaneous, collaborative and high quality entertainment experiences, here we focus specifically on the future of critical infrastructure across security, climate and techbio.

Security

It’s no secret that our digital and physical worlds are changing and we need new software to make them sufficiently secure. So far in Fund VI, we have backed Enzai, Arcjet, Spektr, Bookend, and others still in stealth mode, and look forward to more outstanding opportunities.

The elephant in the room is that generative AI creates immense data risks and we are faced with myriad known unknowns. For example, we haven’t figured out identity control for AI agents that operate software autonomously, access management to company data that can be queried by anyone and open source model safety, whose output is almost untraceable to training data.

In our cybersecurity portfolio deepdive we focus on these emerging challenges and how our portfolio is primed to support enterprises and capture value.

Climate

Elsewhere in sectors like climate and cleantech, we combine a distinctive track record with strong conviction about why the time is right. Seedcamp has supported THIS and Julienne Bruno on their journeys to become two of Europe’s fastest growing plant-food brands, while Papaya, Granular and Sylvera are emerging as early leaders across EV fleet management, energy market solutions and carbon data. We are also especially excited about vertical fintech in clean energy and we look forward to the journeys of Paua and other unannounced commitments driving optionality and flexibility for early adopters.

Over the coming years, we anticipate the emergence of infrastructure that will power a clean and efficient energy system. Be that software that drives a smarter grid and better load-balancing, connected batteries that avoid discharging at times when their operating costs exceed the price of energy or intelligent, local procurement to avoid sending energy hundreds of miles on lossy lines across a continent with thousands of grids and DNOs. At smaller scales, we see the interaction of sensor technology, the Internet of Things and edge-based machine learning dramatically improving industrial energy consumption. Currently, usage is ungovernable and expensive. We anticipate a future where top-line energy consumption doesn’t necessarily need to be pared back, but we can access data and understand usage far more intelligently.

Techbio

Finally in techbio, we look forward to being part of the software-enabled future of drug targeting and discovery. We have already backed businesses like Inovia Bio, Twig Bio and Sable Bio, Lindus Health in clinical trialing, and Faks at the other end of the supply chain in drug delivery. In the coming decade, we see a wealth of opportunities throughout the biomedicine stack; to research and develop treatment for chronic infections like SARS-CoV-2, to anticipate and prevent target failures, and to build the molecules needed for food without meat and plastic without petrochemicals.

Research at the intersection of biology and computing is also primed for a tipping point. Businesses like Apoha are driving sensory intelligence and we anticipate many more use cases of unconventional or neuromorphic computing architectures and even substrates that reflect the brain’s qualities.

For example, rather than the input-output systems of deep learning where training and inference are essentially separate chronological activities, a continuous state machine similar to the human brain’s operating system, would enable a network to evolve around changing parameters, perhaps even paving a route to AGI. Elsewhere we could even see storage based on biology’s principles – a single gram of DNA is worth 200 terabytes – and active inference techniques allowing drones and robots to deploy the sensibilities of a person. We think Retrieval Augmented Generation and NLP applications are exciting but we also can’t wait to see the impact of machine learning on life-saving science, and vice-versa.

_________________________________________________________________________________________

Of course, techbio, security and climate are just a few of the sectors where we think software has enormous potential to disrupt the next decade. Evolving categories like vertical-market software, blockchain infrastructure, database management systems and many more are at the top of our agenda, in addition to more mainstream sectors like fintech, which are yet to fully penetrate society. At Seedcamp our world class in-house experts cover almost every sector and job function, helping entrepreneurs steer the ship, evangelize the product and raise impactful rounds on the way to becoming a category-defining business. As ever, we are always on the lookout for Europe’s strongest founders at the start of their journey–if that’s you, please get in touch on our website or reach out to any member of the team!

If you missed the previous two installments of this series, catch up here and here.

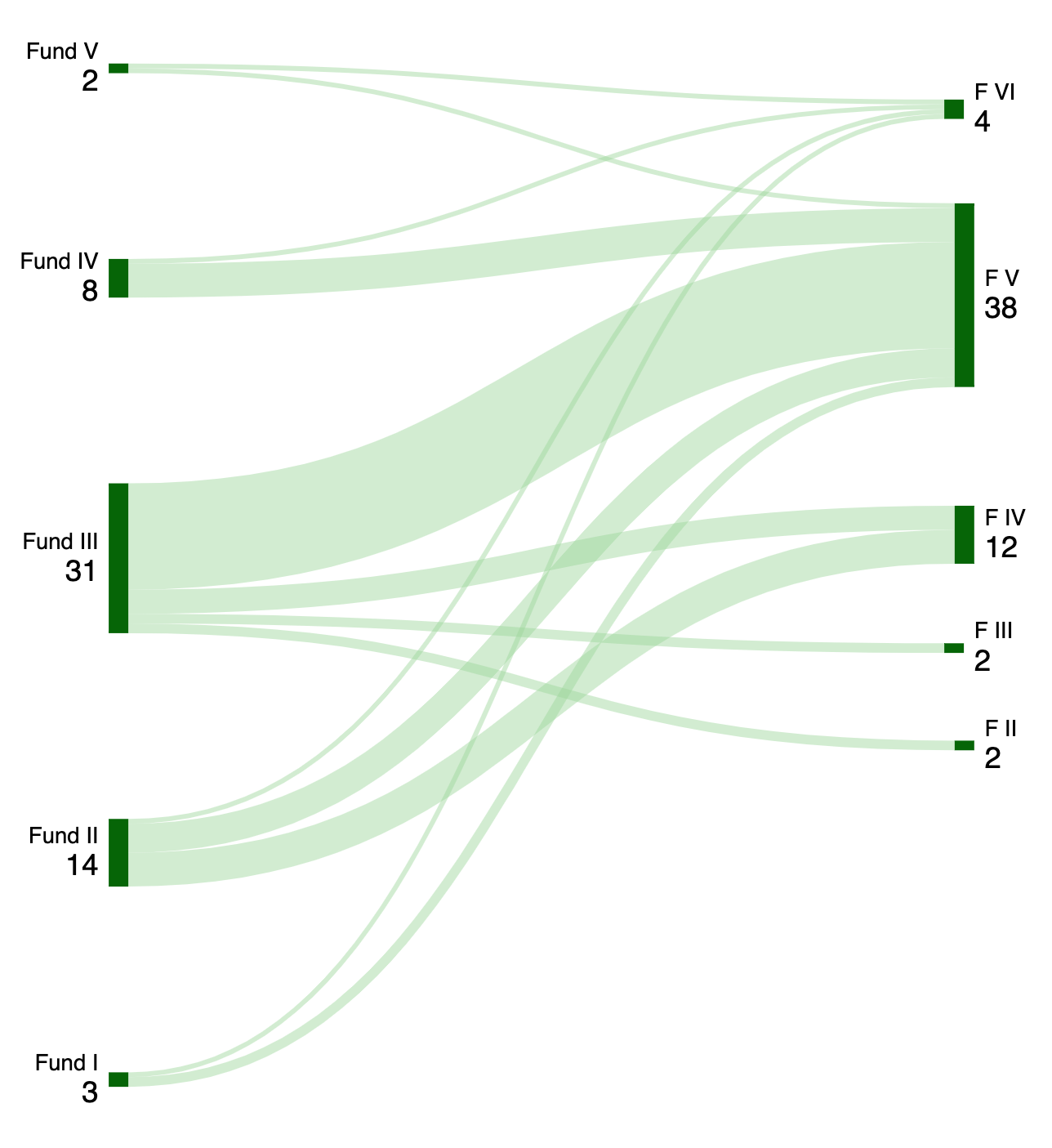

Each Seedcamp vintage tells a unique story about the tailwinds and themes behind our investment decisions. We think that venture is about seeing the present for what it is and committing to founders on missions to solve deeply painful problems. The most exciting solutions are unorthodox and start on the very edge of markets before gravitating to the centre. We invested in Revolut long before mobile banking reached the masses, in Grover when the circular economy was in its infancy and Synthesia when no one had heard of generative AI. In our second installment celebrating the Seedcamp Nation’s milestones, we wanted to share some of the threads that weave together our investments in no-brainer products, inefficient markets and extraordinary entrepreneurs.

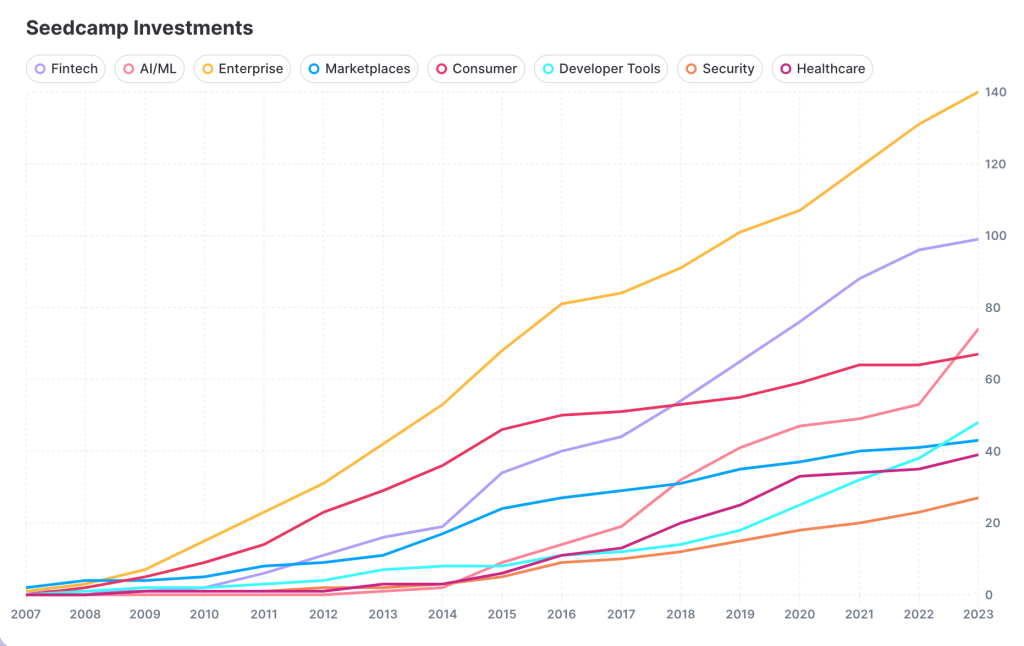

Timing matters and we make it our business to understand fast-moving currents before they reach escape velocity. For example, we lent into fintech in 2015 as open- and neo-banking came to market and our AI commitments accelerated around key breakthroughs– TensorFlow in 2014, Transformers in 2017, and GPT-4 in 2022. As different forces emerge, our theses evolve, resulting in distinctive waves of investment tracing back to 2007.

The total companies invested exceed the number of Seedcamp Investments, as some companies are in more than 1 sector (max 2). Made with Graphy

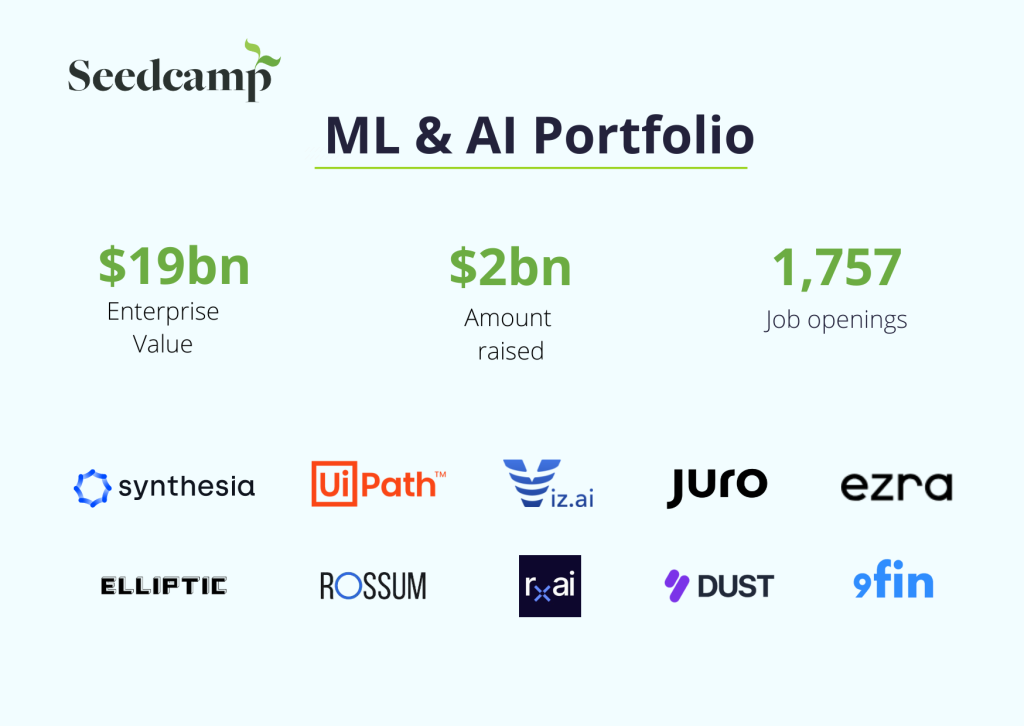

Machine learning first caught our attention in 2012 when we backed Charlie Finance and then Elliptic. Since then, we have invested across the infrastructure and application levels, watched UiPath (NYSE: PATH) go public and recently cheered on Synthesia to unicorn status in one of Europe’s rare growth rounds of 2023. It’s a sector we have studied for over a decade and we can’t wait to see commitments in the enterprise stack like Juro and Rossum continue their upward trajectory, while pattern detection technology like Viz and 9fin drive discoveries across healthcare and finance. Of course, we couldn’t not mention that as GPT-3, -3.5 and -4 have blossomed, we have been thinking about what LLMs will mean and how they will be used in the enterprise. We have made investments like Dust and AskUI to drive business processes, but also can’t wait to see what this technology means for biology, medicine and chemistry. Many components of the machine learning stack like devops, guardrails and security are just getting started and we look forward to supporting the leading minds.

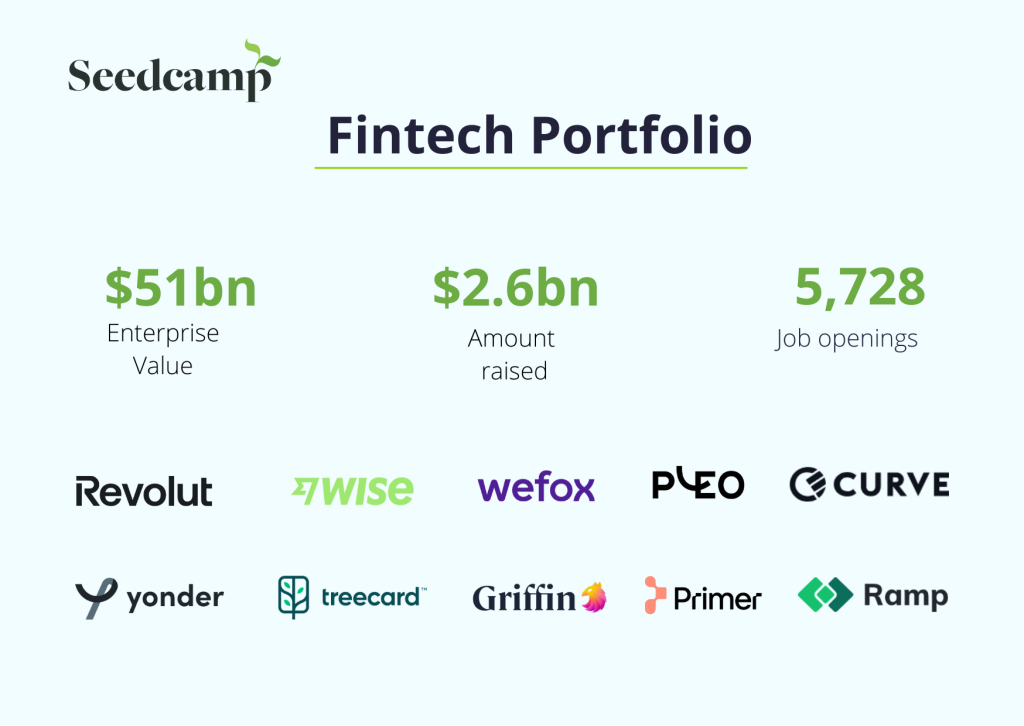

Around the same time as the first wave of machine learning startups emerged in Europe, financial technology began to catch our eye. We came with a prepared mind in 2011, when we invested in Taavet and Kristo’s mission at Wise (LSE: WISE) out of Fund II. In Fund III we were among the earliest supporters of unicorns Pleo, WeFox and Revolut, which recently announced revenue expectations of $2bn for 2023. Meanwhile, other members of the Seedcamp fintech portfolio are in the earlier years of their journey. On the consumer side, Yonder and Treecard are revolutionizing credit and impact at a rate of knots, while Griffin, Weavr and Primer break new ground in the worlds of embedded finance and payments. Financial digitalisation is still in its first innings and while fintech accounts for less than 10% of global transaction volume, we look forward to supporting the next wave of technology that fixes the broken worlds of banking, real-estate, payments, procurement and much more.

In spaces that are a little earlier – like open-source – we think we are where fintech was in 2016

Of course not all themes align neatly to sectors. For example, Adobe’s Flash Player accelerated the development of multimedia applications across all industries and the platform shift to mobile gave rise to innovation from gaming to the Internet of Things. In our emerging portfolio, open-source business models stand out as a fundamental shift in go-to-market philosophy, away from the ultimate buyer in the finance department, and towards the developer. Two rapidly growing businesses that have struck a chord with programmers are Appwrite, which raised its Series A from Tiger Global for its backend in-a-box and Meilisearch, which raised an A round from Felicis for its embedded search engine API. While some open-source commitments look like conventional developer tools for optimizing the process of code writing, deployment and release, others look more like Saas that is simply developer-first. Baserow is a no-code database built in Django and Nust, Rerun is an SDK for visualizing multimodal data, and Medusa is a platform for building rich performant commerce applications. As more and more open-source companies transition their fanbase to paid and supported services, we are excited to see these businesses flourish.

_________________________________________________________________________________________

For any startup looking to build something truly awesome, Seedcamp is the place to start.

Taavet Hinrikus, Co-founder of Wise

Each year, new ideas emerge around fresh ways to build and sell software products. It has been a privilege to partner with businesses on various journeys, from on-prem to the cloud, from desktop to mobile, from centralised to decentralised, and more. Today, new tools are enabling everyone to be a developer, application UX is increasingly voice-first and infrastructure is enabling data to be ingested, transformed, loaded, streamed and analyzed with incredible efficiency. We can’t wait for what’s to come and in episode 3, we look ahead to the next decade.

If you missed Part I, read it here: Seedcamp Turns 17. The Seedcamp Nation and the European Tech Ecosystem, Then and Now (1/3)

Also read Seedcamp Turns 17 | The Next Decade (3/3).

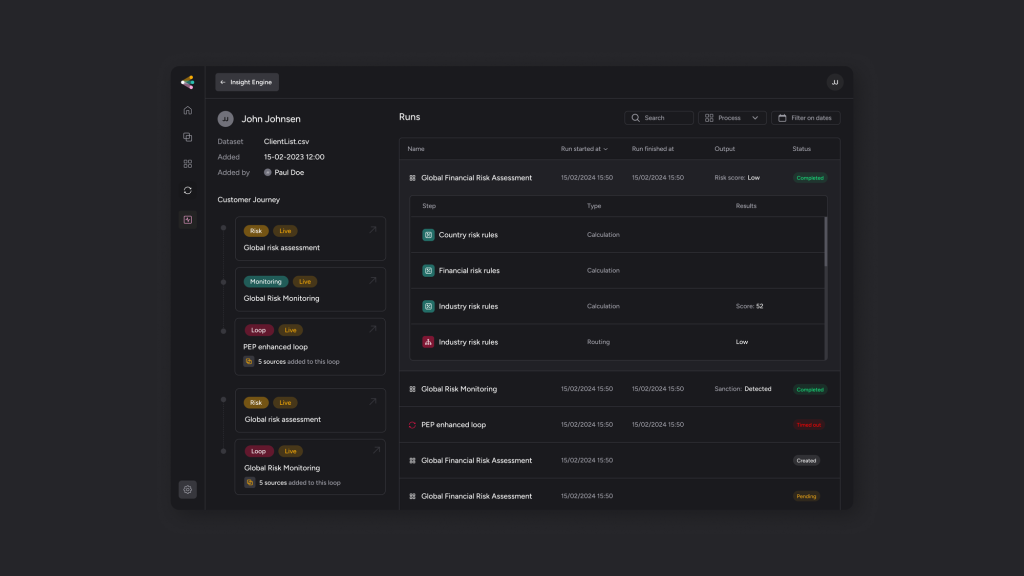

From our own experience investing in many startups building in financial services, we know only too well that ongoing due diligence (ODD) tends to be a manual and inefficient process, even more so for companies that must adhere to rules and laws across different markets. Fortunately, some new approaches and solutions go beyond seeing ongoing due diligence as a mere cost center. They enable compliance professionals to use ODD for regulatory purposes and also to scale their businesses into commercial success.

This is why we are excited to back spektr‘s mission to change ongoing due diligence processes in the financial sector. The Copenhagen-based fintech is founded by a team of experienced serial entrepreneurs, including CEO Mikkel Skarnager, Ciprian Florescu, Jérémy Joly, and Jan-Erik Wagner. We are especially delighted to be working with Mikkel and Cip again, having backed their first startup HelloFlow in 2021 (sold to Canadian company Trulioo in 2022). They’ve assembled a dream team that spent years building simple, easy-to-use, solutions to complex problems at HelloFlow and subsequently Truiloo. We firmly believe they have the ideal combination of skills and experience to build a market-defining company with spektr.

Spektr’s customizable, no-code platform offers financial companies an automated solution for client monitoring and risk control while completely automating all parts of the ongoing due diligence cycle. Recognizing the exponential growth of the compliance field globally, spektr aims to simplify risk-based monitoring with an automation-focused platform that does not require specialised IT skills for the user.

Spektr’s four main solutions provide the ability to:

These solutions help customers:

Co-founder and CEO Mikkel Skarnager highlights:

“With the spektr platform, we can make ongoing due diligence an efficient function with commercial value for companies rather than being a costly expense. When looking at the explosion in the number of employees and expenses, I am convinced that there is great potential in making compliance a better business.

“We’re off to an incredible start, thanks to both the platform and the generous support from our investors. This journey brings back memories of our success with HelloFlow, but this time, we’re aiming for something even bigger and long-lasting.”

On why we invested, our Partner Tom Wilson comments:

“We’re delighted to have the opportunity to back Mikkel and Ciprian as they go again with spektr. The HelloFlow journey gave us a taste of the market-leading products they can build and we’re excited to see where they can take spektr, building on that experience.”

We are excited to participate in spektr’s € 5 million round, alongside our friends at Northzone and PreSeed Ventures.

For more information, visit spektr.com.

Seedcamp has always been about people and the magic that happens when you bring the right people together. 2024 will be our 17th year in the service of Europe’s most exceptional entrepreneurs. We think it’s a perfect time to reflect on how our network, from the Seedcamp Expert Collective to the Talent Network, drives an unfair advantage for Europe’s most impactful software companies.

Many things have changed about technology in Europe since we started out in 2007. European startups now receive over 20% of global funding, up from 8% in 2003, and can stay private for much longer in an ecosystem flush with global capital looking for private opportunities.

At Seedcamp, we are dedicated to keeping the main thing the main thing and doubling down on what we have always done best. As our portfolio enterprise value eclipses $100 billion in enterprise value and our total number of investments reaches 500, we continue to commit to the best founders in Europe and Israel at the earliest stage, drive an unfair advantage through the power of our network and support them to multi-billion dollar outcomes.

Seedcamp works as its own microeconomy, also known as the Seedcamp Nation. Our purpose is to build the best platform in the world for founders to connect with the talent, expertise and capital they need to grow their businesses. Over the years we have seen the depth of this network drive hiring – 59 portfolio alumni now work in C-Suite, VP and ‘Head of’ roles at other portfolio companies – and foster founder-to-founder serendipity as portfolio companies become each others’ design partners and early customers. Some companies get on so well that they join forces. For example, UiPath (NYSE:PATH) acquired Re:Infer in 2022.

Supporting founders is our number one priority, and the team are 24/7 confidantes, cheerleaders and occasionally providers of a friendly boot. But we don’t always know the right answer, and we also act as conduits to world-leading functional and sectoral leaders in our network. The Seedcamp Expert Collective (SxC) is home to highly skilled operators who have taken businesses from $0m to $100m ARR from our own portfolio, like UiPath, Revolut, Pleo and Wise, and other category-defining businesses like Stripe, Cloudflare, Uber, Deliveroo and NextDoor. Founders work with our experts ad-hoc on issues from pricing strategy to product-led-growth to culture building, and in many cases, connect on an ongoing basis as the company evolves. Similarly, our Talent Network of hundreds of vetted candidates across sectors, functions and seniority levels is often a handy shortcut for companies looking for A players at the start of their journey.

From founder meet-ups across Europe, to New York get-togethers for teams who move to the US, events and spending time together in person has been part of Seedcamp’s DNA. While Skeedcamp, Founder Summits and roundtables remain core to our success, other elements have evolved as the needs of founders have changed. In 2007 we were an accelerator, which revolved around Demo Days and Investment Forums. Today, our products are designed not only to support a business at its inception, but to add value around the clock on the journey from early-stage company, to product-market fit, to punchy follow-on fundraises.

We know how to bring together the right mix of people and the conversations that start at our events often result in a partnership sales agreement, LinkedIn marketing collaboration or even a Seedcamp micro-community. For example, Seedcamp founders with an open source go-to-market strategy share a channel for tips on documentation, Discord engagement, remote culture-setting and lots more. Equally, founders from different spheres might share connections in the form of investor references or buyer introductions. While it doesn’t make sense for all businesses to work together, the network effects of the Seedcamp Nation are compounding dramatically as we deploy Fund VI.

The Seedcamp Nation fosters relationships that span companies and decades and when we talk about network, it’s about more than the volume or prestige of people that we know. It’s the depth and quality of those partnerships, highlighted by some of the founding teams we have backed on multiple journeys. To name a few, we are excited to be part of Stan and Gabriel’s new journey with Dust after their first business, Totems, was acquired by Stripe, to invest in Emi and Ezra after Brainient exited to Teads.tv and partner with Gary and Jamie as founders of Fluidstack and subsequently, Treecard. As Europe’s Seed Fund, we have been a central component of the European flywheel – in fintech alone, we have committed to 8 new businesses founded by the growing mafias of Revolut, Wise and WeFox.

Similarly, when founders move onto different pastures after their founding journey, we are always pleased to continue working together as they become our LPs, co-investors and members of the Expert Collective. And when our members of the Seedcamp Nation choose to move on and do brilliant things on both sides of the cap table, we love to continue working with them as Partners at funds like Point Nine, Tiny or Kima and founders of start-ups like Outverse and Ben.

_________________________________________________________________________________________

We believe that 2024 is the most exciting time there has ever been to invest in European technology. Entrepreneurship is top of the list for the brightest minds and startup failure is a chevron worn with pride in a way that hasn’t always been true. Experienced management teams have emerged from the previous decade’s success and are driving scaleups to new levels of ambition. We can’t wait to support the next decade of exceptional founders. In the meantime, stay tuned for episode 2 where we look back at some of the themes that shape our portfolio.

Copyright © 2019 Seedcamp

Website design × Point Studio