From the launch of Fund VI in May to welcoming 39 new companies to the Seedcamp Nation, and introducing new products designed specifically for our founders – 2023 has been the year the Seedcamp Nation reached new heights.

Our networked approach reached new heights in May when we launched Seedcamp VI, our largest and most ambitious fund to date. With $180M in capital commitments and backed by over 200 investors, we are doubling down on our 15+ year track record of investing in Europe’s brightest entrepreneurial talent from Angel to Seed rounds.

To better serve the needs of our founders and their teams, we launched two exciting new products centered around the network and the flywheel effects of the Seedcamp Nation:

(1) The Seedcamp Talent Network – A growing community of pre-vetted entrepreneurial talent looking to join the founding teams of our portfolio that our founders can access at the click of a button. Find out more and join here.

(2) The Seedcamp Expert Collective – A community of 100 top-quality operators who have scaled some of the world’s most successful businesses including the likes of Uber, Stripe, Cloudflare, Revolut, Deliveroo, NextDoor, Skyscanner, and Wise. They provide support to our community of founders and their teams in navigating the critical first steps in building a business.

Over the past 12 months, we welcomed 87 new founders to the Seedcamp Nation, representing 39 new portfolio companies. They are building across a wide array of industries and verticals, ranging from an AI governance platform to techbio.

With a vibrant and expanding Seedcamp Nation, our founder community continues to grow from strength to strength despite a challenging macroenvironment. We are excited to see new collaborations among portfolio companies, such as Thriva and Habitual partnering with Lindus Health to deliver clinical trials, Liveblocks powering the collaborative platforms of Rayon and Fullview, and a number of companies using Outverse as their community solution.

Synthesia officially hit unicorn status with their $90M Series C announced in June. They are the 10th company in our portfolio to achieve this milestone! When we first backed Victor Riparbelli, Steffen Tjerrild, Dr. Lourdes Agapito, and Dr. Matthias Niessner in early 2019 (well ahead of the GenAI hype of today), we sensed they were onto something big with their use of AI for video generation. We’re hugely impressed by the team’s ability to deliver a best-in-class product to a whopping 47% of Fortune 100 companies.

Last but not least, our co-founder and Managing Partner Reshma Sohoni made the Forbes’ The Midas Seed List (#8) and for the second time consecutively The Midas List: Top Tech Investors (#97); and our Managing Partner Carlos Espinal represents our team on Forbes’ The Midas List Europe (#18) for our investment in Synthesia.

Our team is already excited to partner and support Europe’s most promising founders in 2024.

Looking for funding? Our team would love to see what you’re building!

AskUI: a startup that aims to build the next era of process automation by leveraging the power of AI

Cakewalk: a SaaS Identity and Access Management for SMBs solution that helps fast-growing companies to regain control over the software applications they use

Doorfeed: an end-to-end acquisition platform for real estate buyers

Dust: an AI startup aiming to improve team productivity by breaking down internal silos, surfacing important knowledge, and providing tools to build custom internal apps

Enzai: AI governance platform that allows organisations to adopt best-in-class AI governance policies and measure against them

Faks: an all-in-one sales platform connecting labs and pharmacies

Fifth Dimension AI: an AI Co-Pilot for real estate deals, data, and documents

Flagcat: a webtoon studio, producing original series designed for worldwide distribution

Integration.app: an AI-powered integration stack for SaaS products that aims to be the catalyst for deeper connectivity across the SaaS ecosystem

Kern AI: a platform designed for developers who want to implement data-centric NLP solutions

Koios: a voice-driven AI platform set to drastically reduce cost and friction in the personality and management insights market

Kubeark: an enterprise-grade container and application management

Plumery: a digital engagement platform that helps banks implement digital programs

Trezy: a fintech that provides an AI-driven suite of real-time financial forecasting tools for SMEs

Twig: a techbio company that produces sustainable molecules through engineered biology

Verisian: a startup on a mission to increase the rate at which human health improves by redefining clinical trial analysis and drug approvals

26 companies are still in stealth working on solving a range of problems from using AI to detect autism to drug safety and even a Liquid Brain (you read that right!). Keep an eye out for new announcements in 2024!

Synthesia secures $90M for AI that generates custom avatars

Microsoft co-founder’s venture arm contributes to Curve’s £58M funding boost – Series C now at £133M

Sylvera banks $57M to put carbon offsetting on a path to Net Zero

Superscript, a bespoke insurance provider for SMEs, raises $54 million

Peppy secures a $45M Series B to expand its B2B2C health services platform to the US

Lindus Health, a UK clinical trials startup backed by Peter Thiel, raises $18M

It’s official: Griffin is a bank!

Roblox acquires voice moderation startup Speechly

Accel’s Philippe Botteri on His Key Learnings in VC Investment and the Potential of Generative AI [🎙 TMIK]

Pleo’s CTO Meri Williams on Scaling Engineering, Open Source, and Risks and Opportunities of GenAI, featuring Meri Williams, CTO at Pleo [🎙TMIK]

The Impact of AI Innovations and Why We Need to Prioritise Responsible AI, featuring Aaron Rosenberg, Partner at Radical Ventures [🎙️TMIK]

How to Lay the Foundation For Your Startup Brand, featuring Joanna Christie, previously a VP of Brand & Marketing at our portfolio company Gaia Family [🎙️Seedcamp Firsts]

How to Build Your Early Engineering Team: Selecting Engineers & Sourcing Engineering Talent, by David Mytton, Seedcamp Expert in Residence [Seedcamp Firsts]

How to set up a fully remote and distributed team. Lessons from Maze and Gitlab , featuring April Hoffbauer, VP of People at our portfolio company Maze [🎙️Seedcamp Firsts]

How to create and scale an iconic community. Lessons from Sorare, featuring Dan O’Kelly, an early Community Lead at Seedcamp-backed fantasy sports unicorn Sorare [🎙Seedcamp Firsts]

Risk / Reward Framework for AI, by our Managing Partner Carlos Espinal and our Associate Will Bennett

Diving into Culture Across Remote and In-Office Environments, featuring Bretton Putter, CEO of CultureGene

AI, ML, and Seedcamp’s commitments to date, by our Associate Will Bennett

Hiring benchmarks pre-Series A: Data from across the Seedcamp portfolio, by our Associate Will Bennett and our Talent Manager James Wright

Talent is top of mind for founders, especially at the earliest stages of company building. For many years, Talent has been a core pillar of our support to founders and we permanently fine-tune our offering around this.

Our new Talent Manager James Wright joined us in March. Since then he has directly supported 51 companies across the portfolio.

This year, Engineering and Sales talent remains the main topic of conversation and the priority for our founders across the portfolio. Whilst overall demand for hiring has slowed this year, Engineering hiring remains the most challenging to attract the top 1%. If you’re an Engineer or Sales Superstar looking to join a Pre-Seed or Seed stage startup, make sure to apply to our Talent Network to be the first profiles our founders meet with!

We haven’t quite reached the end of the year yet, but thus far our job board has generated an impressive 12,293 candidate applications across our portfolio. For many of our earlier stage companies, gaining visibility with these candidates makes the difference in bringing the best talent to the table. There are over 700 jobs across the portfolio right now and you can take a look here.

Hiring the right people is one of the most important components of company-building, especially at the earliest stages. However, deciding who to hire and which roles to prioritise is easier said than done.

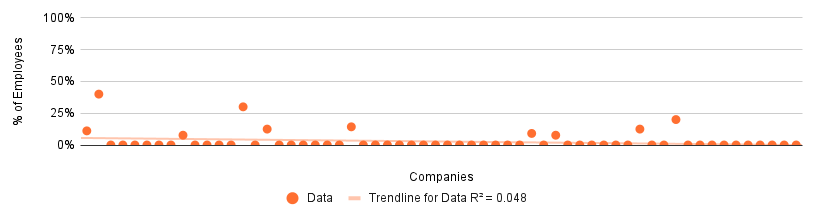

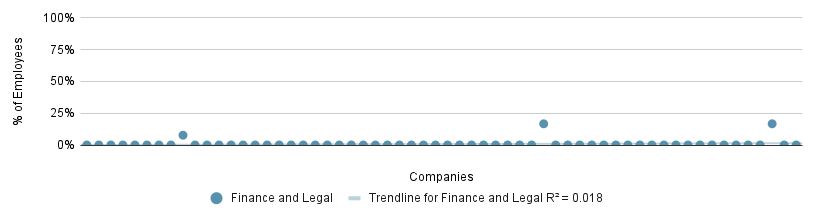

In this piece, we have mapped out the hiring decisions made by 60 Seedcamp-backed companies with less than 20 employees. These companies are all pre-Series A and although the dataset doesn’t spit out any ‘right answers’ about who to hire, it surfaces lots of interesting correlations.

Inspired by Lenny Rachitsky’s article about the order of early hires at breakout B2B companies, we tackle hiring from a different angle, focusing on the hiring patterns driven by sector and distribution channel.

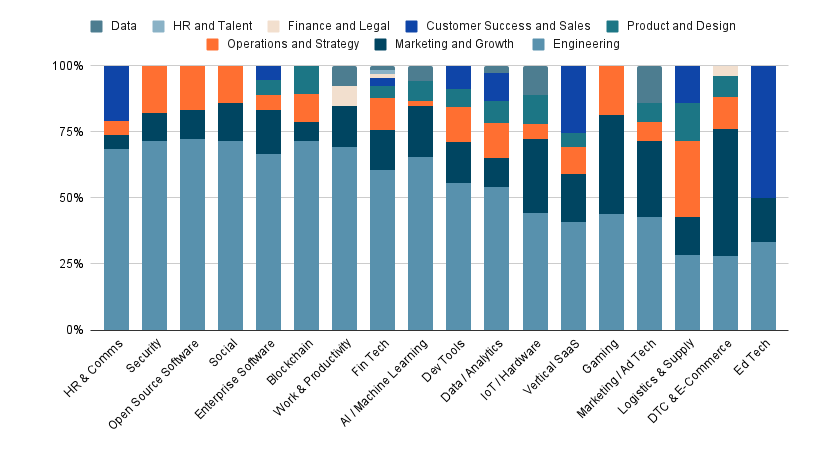

Engineering is the most important role among the first 20 hires by a significant distance. Across most sectors, engineers comprise over 50% of the first 20 hires and in several sectors, engineers comprise closer to 75%. In categories with a lower engineering contingent, such as Gaming, E-Commerce and Ed Tech, design and marketing functions tend to eat into engineering as a result of the intense competition for eyeballs on the end-user experience.

Data hires are most obviously critical for cases where the core product involves interaction with company or user data (e.g. ad tech, ML, AI). Data engineers also tend to be more important for companies where product-market-fit can be an exercise in fine margins (e.g. enterprise, productivity). Understanding user interactions with the product and making minute adjustments to UX choices can unlock big retention gains.

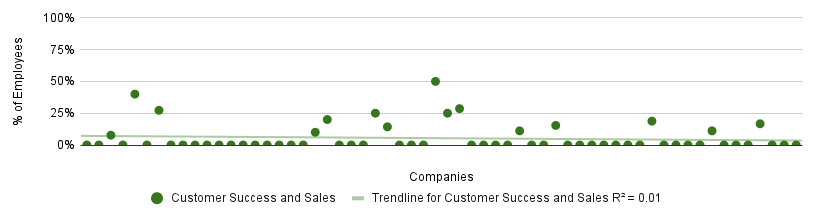

Customer Success and Sales hiring seems to depend more on the typical sales cycle for the product. Highly complex deals with large enterprise customers require a sales-led motion and strong post-sales support. Whereas security and OSS (open source software) tools don’t necessarily have ‘end users’ within the enterprise and require limited non-engineering customer support, vertical or HR software is likely to have several features for different users working in different parts of a business. For example, an HR suite could be used by different teams for performance management, onboarding and hiring.

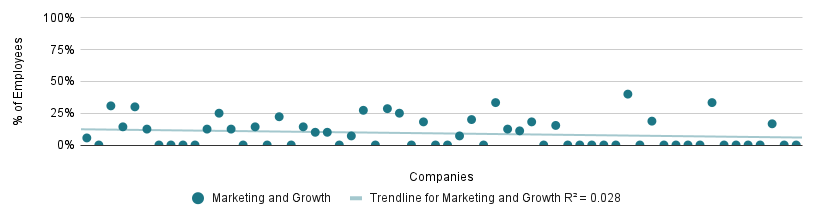

Marketing. Most companies seem to need an early marketing hire in one way or another. The data emphasises sectors that are hotly competed by lots of adjacent companies (e.g. enterprise software) are competing for eyeballs (e.g. gaming), or might have a more extended user education curve (e.g. IoT).

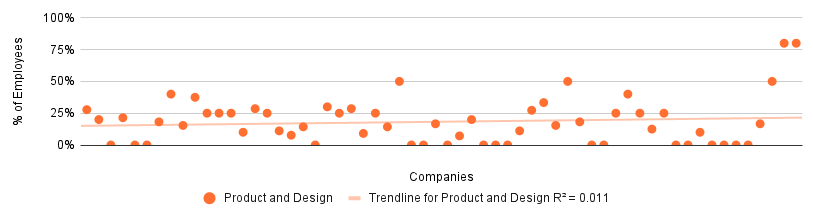

Product hiring trends are harder to derive from the data. Often one of the founders will be the business’ de facto product leader through the early stages of growth. As a result, until the engineering team reaches a critical mass, a PM is typically less vital to the team. This is especially the case while there is minimal data with which product decisions can be made. That said, the crossroads of scaling product is very founder-specific .If the founding team are required in other areas of the business, the first PM is a critical hire.

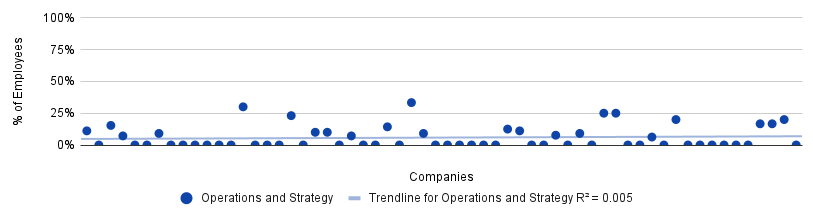

Operations are not totally dissimilar and depend largely on the specific components of the business. For many software companies, there simply aren’t many operational considerations early on. Whereas some businesses have operational complexity in the physical world embedded at their core, such as a food delivery marketplace or a solar financing business, the majority do not.

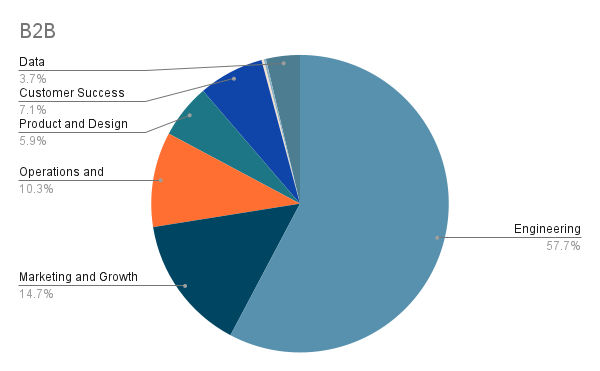

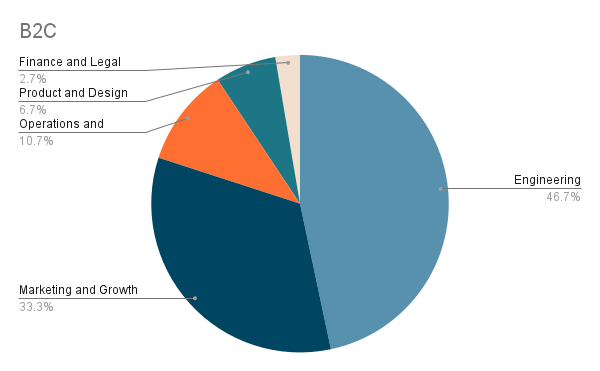

B2B vs. B2C Companies

For B2B companies, engineering contributes the lion’s share of employees. Start-ups are increasingly being born into a world where MVPs need to look and feel like the finished product, before considering hiring a flock of sales people. This requires a lot of engineering up front as ‘building in public’ continues to become less popular.

You will notice that for B2C companies, the allocation of hiring to Marketing and Growth is much larger, at the expense of Engineering.

It used to be a consensus that a consumer needed to be reached by marketing 7 times before making a purchase. That number is probably now far higher with the saturation and competition of ‘sexy’ consumer brands on social media.

According to Chamath Palihapitiya in a now-deleted Social Capital shareholder letter from 2018, “Startups spend almost 40 cents of every VC dollar on Google, Facebook, and Amazon”. Although this may well be overstated, marketing spend is clearly key to many B2C winners. Duolingo for example continues to outspend competitors on performance marketing by 5x.

B2C companies have a very similar portion of operations and strategy employees to B2B companies and do not require customer success and sales execs that guide through heavy duty contracts.

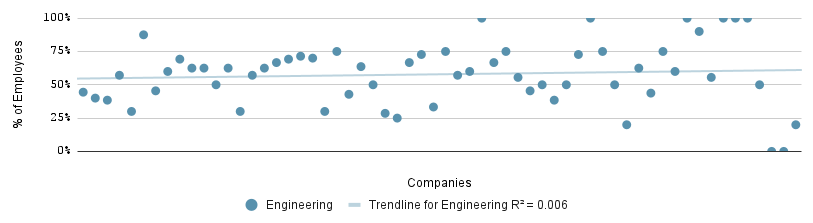

Variety and Deviation

This data is all well and good but doesn’t necessarily show the strength of correlation within each of these hiring categories, which varies considerably.

If you have thoughts and opinions on hiring in early-stage tech companies, we’d love to hear them! Alternatively, if you are interested in a role, join the newly-launched Seedcamp Talent Network.

Notes on the data

This post was written by Will Bennett, Associate and James Wright, Head of Talent at Seedcamp.

Our Talent Manager James Wright spoke with Brett Putter, CEO of CultureGene about the role culture plays in today’s work environment, especially when it comes to hybrid and fully remote teams.

At CultureGene, Brett and his team help companies develop effective hybrid, remote-first, or remote companies. They have developed different tools and different programs to help companies depending on the size and scale of the business. Typically, they work with companies that are growing rapidly and need to stabilise their DNA and the foundation so that growth is built on solid foundations.

Watch the video or read the Q&A below!

James: There is no clear consensus on whether fully-remote, hybrid, or office-based cultures are best. What are the major benefits or drawbacks of these options from your perspective?

Brett: There are a number of elements to consider here. If you’re intentional about building the remote capability inside your company you can see how well it can go. Take companies like remote.com who scaled from a startup to over 1000 employees in four years in 60 countries. They are doing it well. Gitlab also went from 100 people in 2016 to 1800 now. So you can see remote first businesses can do it very well. But like anything, there are benefits and drawbacks. The benefits are that you have access to a wider talent pool, you can hire and find the best employees from anywhere. Some companies are saving money on office space and scaling quicker because of that. Studies have also shown that remote and hybrid employees are happier and they’re also more productive.

On the other hand, if you are not intentional about building a remote working capability, you can see many issues arise. Communication and collaboration challenges are common challenges. Cultural challenges can grow and the leadership often struggle to maintain high performance as a result. It can also be hard to track employee performance for remote or hybrid teams.

With an office environment, leaders know how to lead in this environment. We’ve done it before and we are designed as humans for synchronous communication, so it is naturally easier to collaborate. It’s easier to develop a company’s culture and it often happens by default. You also typically find it is easier to manage performance too. But the drawbacks are limited access to talent, often higher costs, and a general decrease in employee flexibility. This last one is the biggest threat to companies as employees want flexibility and autonomy.

So there is no easy answer and no silver bullet.

James: Frequently founders of remote companies realise they have performance problems, but struggle to identify where they originate from. How do you go about identifying the bottlenecks in a business that is fully remote? And then, how do you fix them?

Brett: Bottlenecks are happening ultimately because of remote work friction. And this happens because most remote companies operate like they would in an office environment. They aren’t being intentional about building a remote work capability.

The bottlenecks usually originate from collaboration and people management. When it comes to collaboration, if you aren’t defining your key processes then new employees have to work it out themselves. If you aren’t being deliberate about developing and documenting processes a lot of time is wasted either by the employee asking others in the business for help or taking more time figuring it out themselves.

If you aren’t balancing synchronous and asynchronous communication and working out what you should do when, and building rules and structure around this, then that is where the friction happens. If you aren’t being deliberate about building social capital and social connection as your business scales, then people lose connection, contact, and trust over time.

Remote work companies manage and lead differently, they are outcomes-based rather than input-based. To your point around performance, they have a way of ensuring that you know who’s performing even at a micro level. So it’s on the manager to be on top of performance so this can then be fed up to the leadership.

James: A lot comes down to the people you hire in a business, and different work environments need different people. Have you seen a typical leadership persona that works well in a remote-first business?

Brett: There is some research on this, Georgia Southern University did a study before the pandemic. They had 220 teams of 4 people. 110 worked remotely and 110 worked in an office. All the teams had to choose their leaders at the end of the project.

Those who had been in an office environment had leaders with the following characteristics: charisma, hierarchical, verbal, and delegators. Whereas those that had been remote had leaders with the following characteristics: coach, mentors, facilitators, project managers.

This is the crux of some of the leadership challenges that are happening right now, leaders who are strong in an office environment aren’t necessarily strong in a remote environment.

Ultimately, a lot of companies quickly pivoted from in-office to remote first during Covid, without changing the leadership team and it’s something we help our clients with, in changing the style of management in the organisation which is needed for high performance.

James: To monitor and track performance in a remote business, many default to micromanagement, which is never liked by employees. How can you avoid micromanagement in a high-performance, remote-first environment?

Brett: Micromanagement is very destructive. It’s bad in an office environment but even worse in a remote operation. They are either going to waste a lot of time showing you proof of work, or they will lie.

What I’ve seen is remote work companies use is an idea by Andy Grove who came up with a concept called task-relevant maturity. It’s the idea of how capable the individual is of doing the set of tasks they have to complete. As a remote manager, you can evaluate if a team member has completed those tasks before and what they might need support with. Essentially this is a powerful tool that allows you as a manager to get ahead of the bottlenecks before they happen. It’s a slightly different way of leading but I’ve seen it used extensively in remote companies.

James: It’s certainly easier to introduce these processes when you incorporate your company as a remote-first business from day 1, but when you’ve transitioned from in-office to remote, how do you go about transitioning your style of working without suffering major brain-drain from resignations and poor performance?

Brett: Typically if you were in the office before the pandemic and then you’ve decided to go hybrid or remote, the thing that we don’t fully grasp or appreciate is the extent to which the office helped us with our culture development. The office gives us physical proximity and learning by observation. When you’re in an office space you almost don’t need to be that intentional about your culture. You can catch up when it’s 50 or 100 people and start being more deliberate. If you leave that environment it can often feel that your culture has been obliterated.

Even in a hybrid environment, the office is not as effective as it was. So as a leader, you need to understand what you’ve lost and how to make up for it. So one example is losing the ease of collaboration in the office. That might mean being more intentional about key processes, making sure everyone is aware, and keeping those processes up to date.

James: Flipping the direction of the conversation a little, we’re seeing more and more of our portfolio head back into an office environment, or at least having more days in the office. How would you recommend managing that process?

Brett: When you say ‘some of the team’ want to be in the office, usually this is the leadership team that wants to be in the office and they are ultimately the ones driving this initiative. If they are, that is fine. However, you have to accept that some people are going to disengage as a result. There are some people who are now no longer willing to spend an hour travelling to the office every day. Ian Goodfellow was the Chief of ML at Apple. In 2022 Apple went from Remote to Office again and he resigned as a result. If a company like Apple can’t keep their best people in that transition nobody can. Ian went to DeepMind who had a more flexible work arrangement for him.

James: Different teams typically have different openness to office working. For example, engineering teams typically favour working from home and sales teams generally prefer office-based environments. Can companies create different rules for different functions in their businesses?

Brett: I’ve seen companies do this. It’s viable if you manage it properly. I believe that if you have a hybrid or remote first mindset then you can have people in the office and people at home without issue. It just requires a lot of thought around how you ensure information isn’t lost when some are in the office and others are at home. As long as everyone understands those processes to mitigate this then it can work.

This conversation has been edited for length and clarity.

The average enterprise uses hundreds of SaaS applications. When a company is considering purchasing new software, ease of integration with the existing stack is top of mind. Building integrations is also a priority for both developer teams and sales teams at every SaaS vendor.

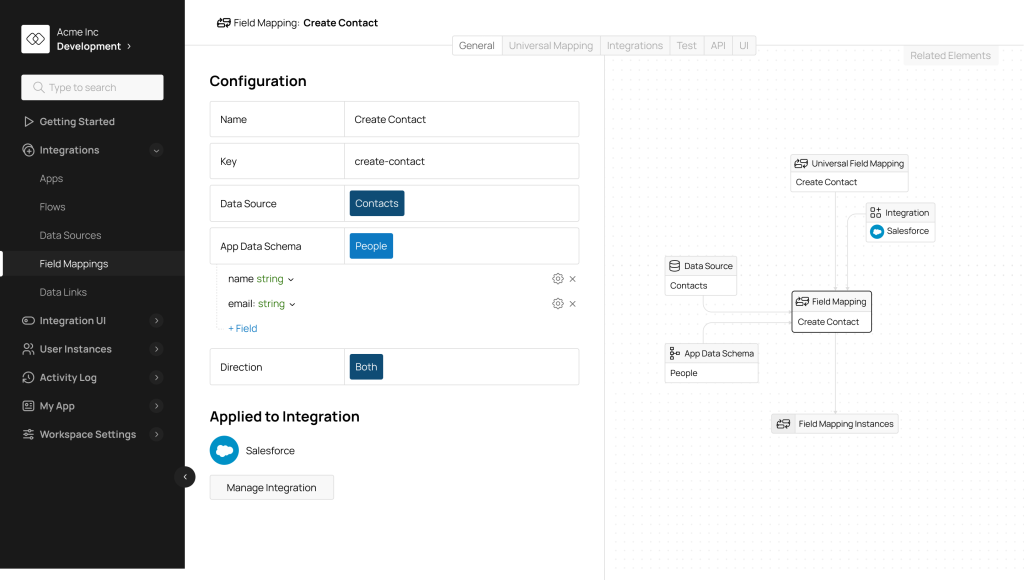

This is why we are excited to back Integration.app, an AI-powered integration stack for SaaS products that aims to be the catalyst for deeper connectivity across the SaaS ecosystem. The platform provides a single flow to integrate with every external application, thus freeing developers from having to build the same integration scenario over and over again.

Founder and CEO Daniil Bratchenko, previously an early engineering leader at DataRobot, a leading AI automation platform, has experienced first-hand the challenges of software integrations, while he helped grow the company from 20 people to over 1,000.

“At DataRobot, I saw first-hand how much customers value well-integrated software, and how important integrations are in purchasing decisions. At the same time, I have seen how challenging it can be for developers to build strong integrations at scale. It is my mission, and Integration.app’s mission, to solve this problem for developers once and for all”.

Integration.app’s Universal Integrations architecture aims to revolutionise the integrations category by removing the trade-off between time-to-implementation and customizability. Product and engineering teams in software companies can use Integration.app’s suite of APIs, SDKs, and UI components to build customer-facing integrations with multiple apps in one go, while maintaining the look and feel of their application.

The company’s platform leverages emerging capabilities of Large Language Models to create a “one-to-many” paradigm, whereby developers can configure one integration scenario (e.g. import customer data from any app). Integration.app will intelligently map APIs and UIs across multiple applications to generate dozens of integrations at once, speeding time to production by up to 3-6 months. This empowers developers to focus on building core features, rather than spending hours reading API documentation and building repetitive integrations.

The platform is already being used by a wide range of B2B SaaS companies, from early-stage startups to large businesses such as Airmeet. Airmeet, a leading virtual events platform, saved budget and engineering time by using Integration.app to scale their portfolio of integrations with Sales and Marketing Automation tools.

“As we were looking to build out our next batch of CRM integrations, we discovered that Integration.app had a unique solution compared to unified API platforms or embedded iPaaS offerings. They are an API-first and developer-first solution, with a flexible and customizable framework that features the right amount of abstractions to build on top of. We managed to build out integrations with Salesforce Pardot, Pipedrive, ActiveCampaign, and Keap in a matter of weeks, which gave us time back to focus on our core features” said Raghav Takkar, Principal Product Manager at Airmeet.

SaaS vendors that use Integration.app save time and money on building integrations while shortening sales cycles from prospective customers who request specific integrations to the applications they need.

CEO Bratchenko emphasizes:

“5 years from now, integrations will become a commodity. AI will make it simple and free for a developer of a business application to connect with every other application their customers use. Think of how easily it is for smartphone apps to consume and send data across each other. This should be the same for business apps. Integration.app will provide this deep connectivity layer and pave the way to this future for the next generation of SaaS companies.”

On why we invested, our Principal Felix Martinez comments:

“Integration.app is harnessing AI to create a new type of platform for integrations, harmonising the balance between being customisable and user-friendly – a choice that has traditionally challenged developers in creating native integrations. In a world in which deep integrations become table stakes for all SaaS companies, Integration.app can become the connective tissue which binds business applications into a cohesive ecosystem. ”

We are excited to participate in Integration.app’s $3.5 million Seed funding round led by our friends at Crew Capital, alongside Cortical Ventures, Accel Starters, DataRobot founders (Jeremy Achin, Tom de Godoy), and UiPath executives.

The new capital will be used to accelerate the company’s mission of enabling SaaS apps to work seamlessly with each other. Integration.app will continue to expand upon its existing portfolio of hundreds of connectors with a breakthrough new product that leverages AI to enable developers to build their own custom connector for any application with a documented API.

You can learn about Integration.app and sign up through the website. Feel free to send a message to hello@integration.app if you’re interested to learn more.

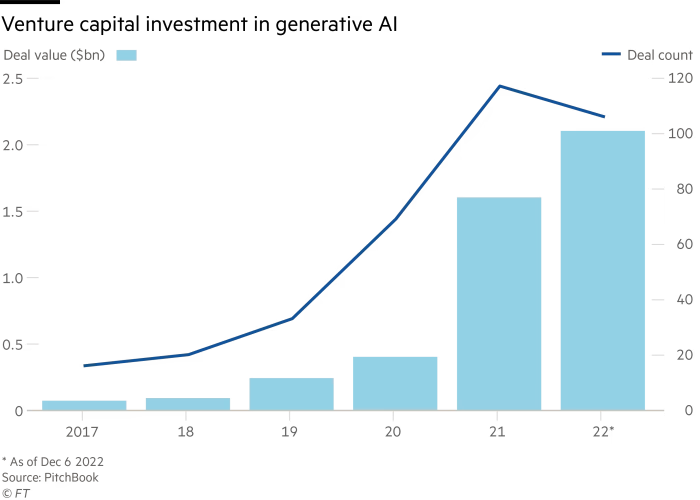

At Seedcamp we first invested in machine learning as part of Fund II in 2012, when artificial intelligence was mostly confined to academia. Our earliest investments were James Finance and Elliptic, which recently raised a Series C to continue powering financial crime detection. AI fundraising activity gathered momentum in the lifetime of Fund III. We are deploying Fund VI, which we launched in May this year,

We are now deploying Fund VI, which we launched in May this year, and are particularly excited about startups building AI-driven solutions across industries and verticals. Our most recent commitments include the AI governance platform EnzAI and AI-powered automation software AskUI.

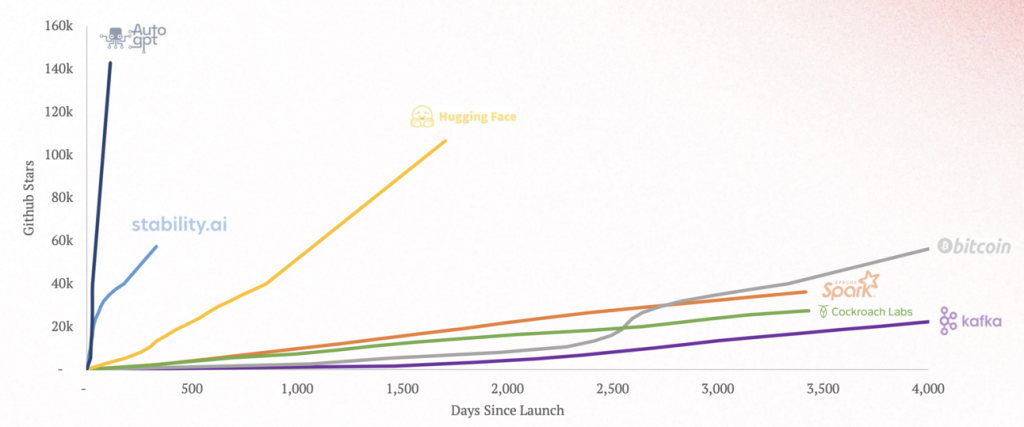

Accelerated by rapid innovations in Generative AI, the AI space has reached blistering speeds and represents 18% of all investment in the venture industry.

This article walks through some of the micro-themes that bind the 70 commitments Seedcamp has made to date in AI and ML.

Large language model are the first AI tools capable of doing work that would otherwise have been done by humans. Sarah Tavel of Benchmark has written a great article about this point of inflection. Where software could only previously enhance the efficiency of work, it can now literally do or generate it.

Seedcamp has invested in Metaview which writes interview notes, Flowrite which can write emails and messages across Google Chrome, and Synthesia which automates video production and recently achieved unicorn status.

Users can enter text to Synthesia, choose an avatar trained on actors, and generate videos

Users can enter text to Synthesia, choose an avatar trained on actors, and generate videos

The concept of software that does work is already catalysing a wave of startups and new business models and philosophies for the enterprise.

How should we re-calibrate ‘productivity’, if it is a function of infinitely re-produceable software?

Where ‘time’ was the denominator of the traditional productivity equation, [productivity = rate of output/rate of input], is the correct denominator now GPU?

If in the future humans are just responsible for validating model accuracy and precision, then the real opportunity is to find the ‘fast moving water’ (as coined by NfX), where AI is capable of the biggest volume of work.

Within this early wave of LLM applications that do work, a pattern is emerging of companies focused on automating time-consuming, high-complexity activities that are conducted in written natural language. Procurement RFPs, compliance questionnaires, legal documents, and code generation are all obvious early use cases. Companies that can translate the description of a problem in these areas to sound and reliable output are likely to capture value.

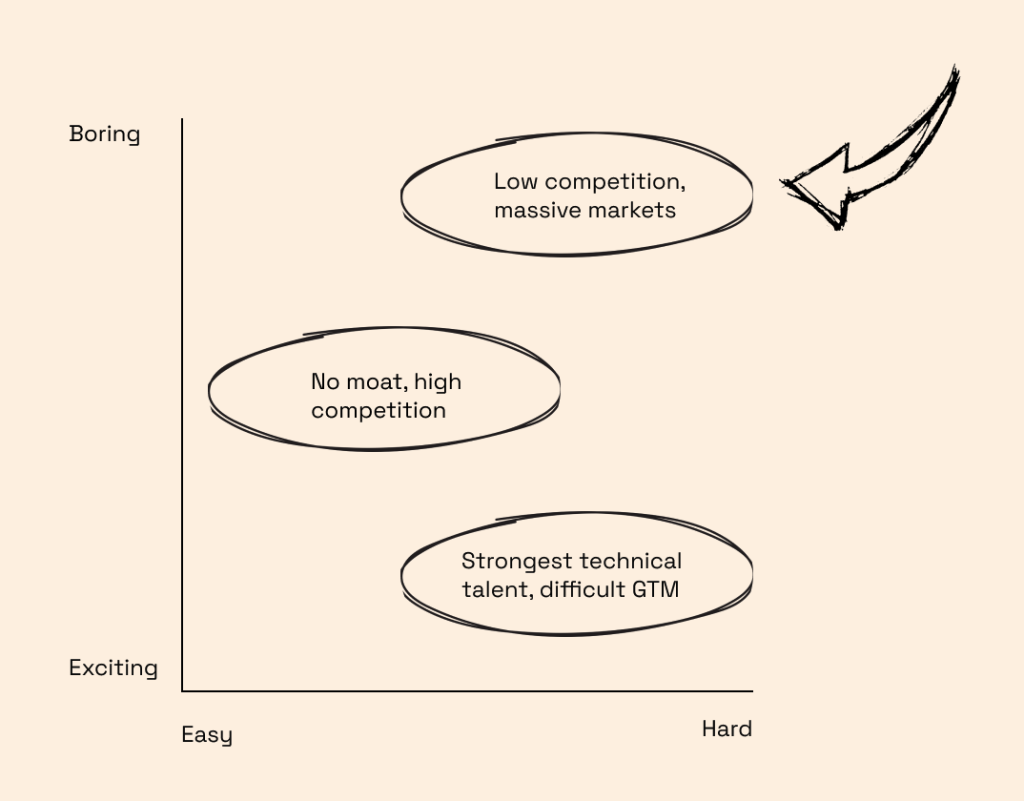

The lion’s share of enterprise AI applications in the last decade have focused on employee efficiency. The most remarkable innovations have been horizontal software that tackle ‘hard and boring’ problems such as process mining, application automation, and project management to give employees more time to do more work.

UiPath (NYSE: PATH) is a category leader in the enterprise work stack after going public in 2021. The company helps businesses automate and improve high volume and low complexity tasks within the enterprise and recently acquired communications automation platform, re:infer, also Seedcamp-backed. We have also invested in AI businesses automating other corners of the enterprise such as Rossum, a document gateway for business communication, Juro, a contract collaboration platform, and tl;dv, which records meetings and helps you tag important moments on the fly.

Newer robotic process automation products and features increasingly include ‘self-compounding’ elements that use previous activities to prioritise future activities based on ROI and other key metrics.

In the longer-run, there may be a significant difference between apps that ‘do work’ and more general efficiency-enhancing enterprise software. AI businesses in the former category may use models trained on sector specific data, which are necessarily vertical software (a co-pilot for every industry). In the latter category, the market opportunity includes all business with processes, for which broader approaches may be more relevant. Vertical or sector-specific winners can of course still be massive businesses, and may capture 60%+ market share whereas horizontal winners rarely get more than 15%.

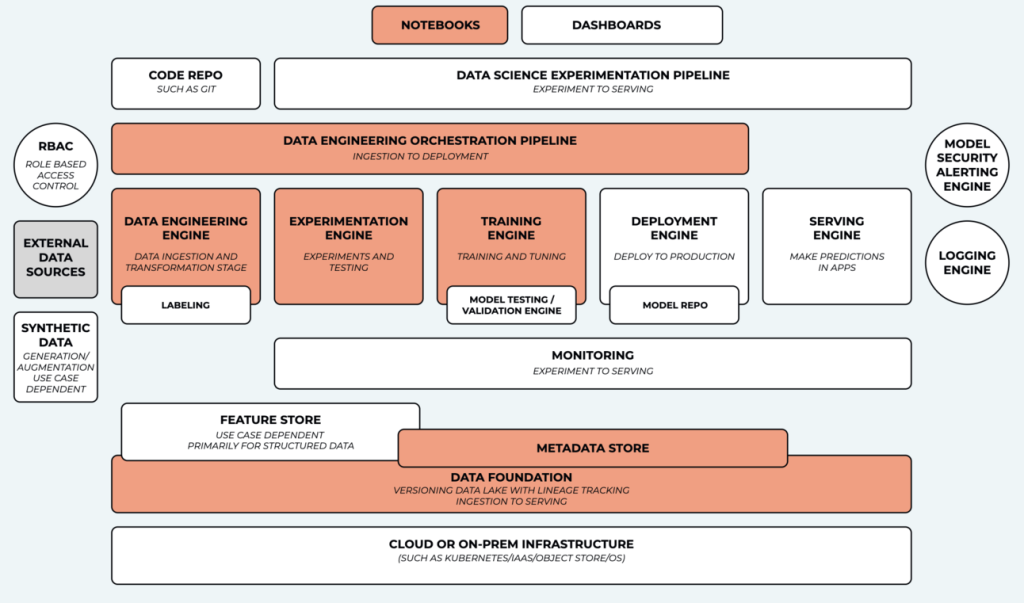

‘MLOps’ has become a nebulous branch of the AI taxonomy but remains the best way to describe companies that enable the running, maintaining, analysing and fine-tuning of AI models.

MLOps has several layers that are each prerequisites for model development; the GPU layer, the data layer, the observability layer, etc. Companies typically have an insertion point that tackles one of these and move on to add features that target several at once where there are obvious adjacencies. MLOps companies are the ‘picks and shovels’ of artificial intelligence.

Pachyderm’s products serve customers across several uses case within model production

In our portfolio, Embedd.it parses data from ML datasheets to generate drivers for semiconductors and Fluidstack aggregates spare capacity in datacenters to rent out to customers.

The speed of developer adoption of MLOps tools highlights that demand may be outstripping supply in this category. For example, at the data layer, there is still plenty of white space for AI-native tooling for observability, integration and transformation, and the race to build tools to debug and increase performance of models is red hot.

Redpoint Infrared Report (2023)

Propping up the MLOps ecosystem is a cluster of software trying to prevent the general misuse of AI. If generative AI is an open-road race, the guardrails are the police, the red lines, the car bumpers, the rolling barrier and the orange cones. The guardrails entail a broad set of companies spanning from cybersecurity – Resistant.ai protects AI-native systems from complex fraud and sophisticated machine learning attacks through to governance; Enz.ai helps organisations adopt policies to build and deploy AI and track their practices against them.

DALLE’s best impression of AI guardrails

Guardrails are plausible at many insertion points within a model pipeline. Software that ensures only the right company data is sucked into in an open-source model, software that sits on top of a model to ensure brand alignment and software that generally ‘troubleshoots’ the software supply chain in complex cloud environments, such as RunWhen.

Tools of this nature are increasingly integrated into infrastructure rather than at the application level. They have ‘shifted left’ chronologically. This enables companies to ensure compliance and security across the entire model production sequence. Although this approach often has a higher rate of false-positives, since checks occur prior to project completion, there is scope for reinforcement learning layers to drive a smoother workflow and categorise issues as they are flagged.

The hardest category to succinctly compartmentalise is the tooling layer that helps developers integrate models. These aren’t a feature of model ‘building’ but rather how developers within enterprises can best select and use these models.

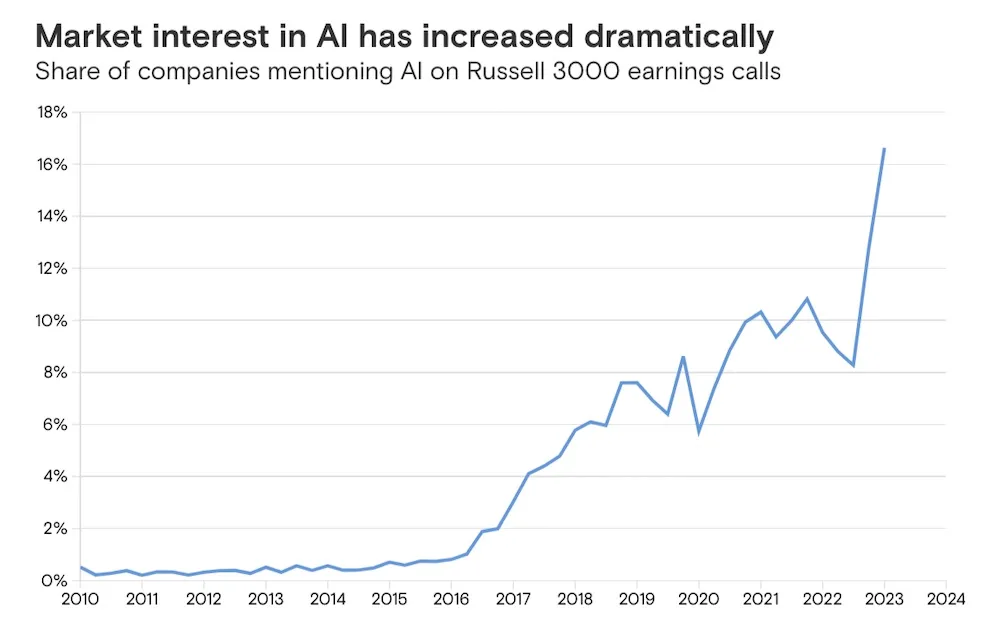

These tools are often modular and focus on how models interface with the enterprise and with the end-user. Deployment channels will be especially relevant for industries with fewer software developers to conduct bespoke model integrations. Companies in the Russell 3000 might well be thinking about how to do this effectively.

Goldman Sachs (2023)

This is one of the spaces that is moving incredibly quickly in the current LLM wave as the answers to many questions are yet to emerge.

At Seedcamp, we have invested in several early-stage businesses in this space. Dust is a platform for creating sophisticated processes based on large language models and semantic search. AskUi is a prompt-to-automation platform that understands applications and helps users build UI workflows that run on every platform. Kern.ai helps companies connect external models to a internal data in a secure fashion.

Finally, there are the predictive applications of ‘old-school’ AI; much less a la mode. This type of business typically detects unknown unknowns, such as suspicious trading patterns, but can also detect known unknowns earlier in a workflow, which is often the case in a medical setting.

Despite the heady excitement around generative AI, predictive AI still has a lot of room to improve its own value proposition. For example, intelligent AML, KYC, and transaction monitoring technologies are still trying to crack financial crime and scams. The amount of risky and illicit crypto flowing into financial platforms is still in the hundreds of billions despite trending downwards YoY and represents 2-3% of all inflows.

At Seedcamp, we have focused on healthcare and fintech in this space to-date. In healthcare, we are investors in Ezra, an early cancer detection technology that combines advanced medical imaging technology with AI, and viz.ai, which alerts care teams to coordinate care, connect professionals to specialists and facilitate communication. In fintech, we are investors in 9fin, a platform for financial institutions to leverage analytics and intelligence and Elliptic.

Other interesting areas in this space might include agriculture, manufacturing and logistics. There has been compelling innovation but it has largely been confined to incumbents like Siemens and John Deere. John Deere spent $1.9bn on R&D in 2022, or 4% of revenue. That wouldn’t be much for a pharmaceutical company but its a hell of a lot for a heavy machinery business.

One reason that AI is so exciting is that it continuously forces investors to reconsider what they believe. Seedcamp’s first AI/ML commitment in 2012, James Finance, built fintech infrastructure to determine customer eligibility. In Europe, Lendable and Funding Circle became breakout companies in this space, but AI advancements didn’t propel a large group of winners in the intervening period and investor theses about the space decayed.

With each evolution of AI technology, the category has changed and in 2021 and 2022, predictive fintechs like Marshmallow reached significant scale with technology that determines customer eligibility. Investor sentiment pivoted again✝.

At Seedcamp, we are optimistic about the way AI upends sectors and we are always interested in new solutions at every interval of the software value chain.

We are especially excited about entrepreneurs with a differentiated perspective on the future. That might be that every company will operate myriad small open-source models via a routing layer, that the entire data pipeline needs to be rebuilt or that federated learning between farms will unlock a new wave of agricultural prosperity. It might even be that language models are a flash in the pan until they are in the hands of humanoid robot butlers, doctors, and waiters.

Whatever it is, we would love to hear it, so please get in touch!

✝Funding Circle, Lendable, and Marshmallow are not Seedcamp companies.

With a multi-trillion dollar valuation, the global Real Estate industry has been slow in embracing digital transformation. It remains one of the most document-heavy and data-filled industries, with enormous potential for automation and talent upskilling.

This is why we are excited to back Fifth Dimension AI, a London-based startup on a mission to amplify the exceptional in real estate professionals. Coming out of a pilot phase, the company launched its flagship product Ellie, a first of its kind AI co-partner developed to improve productivity and amplify exceptional teams in industries that deal with a lot of documents and data. It automates time-consuming tasks such as data analysis and industry research, thus freeing people up to focus on bringing value to their business and fully using their expertise and insights.

Founded in January 2023 by Johnny Morris and Dr. Kate Jarvis, Fifth Dimension AI leverages their wealth of expertise across real estate, finance, and technology. Dr. Kate Jarvis, a large language model wizard with a PhD in Linguistics from Stanford University, has spent over a decade designing Machine Learning-powered products and bringing them to market. Johnny Morris brings more than a decade of real estate experience, in roles such as Chief Operating Officer at Wayhome and Analytics Director at Countrywide. The founders believe that Large Language Models (LLMs) can unlock the exceptional in people, taking away the time-consuming and often boring task of reviewing large quantities of information locked away in disparate documents, and instead producing outputs in a fraction of the time.

Dr. Kate Jarvis, Co-Founder & CEO of Fifth Dimension AI, comments, “This investment is a testament to the recognition of Ellie’s ability to redefine the world of work beginning with the real estate industry. We solve the issue of lifting employees out of time-consuming, repetitive and boring work, working with natural language that is designed to ensure people from all backgrounds can use it in the way that is most productive for them. Ellie empowers knowledge workers to do their best work and lead happier, purposeful, and more fulfilled lives.”

Johnny Morris, Co-Founder & CPO, Fifth Dimension AI, adds, “We designed Ellie to provide real estate professionals with a competitive advantage by providing a partner to help them get done in minutes what usually takes hours. Across our clients, we’ve been amazed by the impact that Ellie has on the newest generation of real estate professionals. These young and ambitious individuals are able to increase their output and amplify their expertise in the industry – in a fraction of the time. With Ellie as their partner, we believe the next generation will have the power to truly move the industry forward.”

Following the completion of an initial pilot scheme running since April, Fifth Dimension AI already boasts nearly 10 major real estate firms as clients, including big names such as Hamptons.

On why we invested in Fifth Dimension AI, our Managing Partner Carlos Espinal comments:

“With their wealth of expertise across AI, Real Estate, and Finance, Johnny Morris and Dr. Kate Jarvis are a world-class founding team taking on a massive opportunity to innovate the real estate industry. We love their emphasis on the human element, i.e. enabling real estate professionals to fully leverage their talent and knowledge, and thus focus on high-impact activities that create more business value.“

We are excited to co-lead Fifth Dimension AI’s £2.3 Million pre-seed alongside Anthemis’ Female Innovators Lab Fund, with support from Ascension Ventures Ltd, Concrete VC, Love Ventures, Twin Path Ventures, and Sie Ventures. With the new funds the company aims to scale the business’ sales and marketing functions and focus on product development to enhance the tool’s capabilities for an expanding audience across the real estate industry

For more information visit fifthdimensionai.com.

While automation has become ubiquitous all across business sectors, the innovation and customisation potential is massive. The new wave of AI technologies unlocks new opportunities for more user-friendly, powerful, and flexible solutions to cater to specific customer needs.

This is why we are excited to partner up with Jonas Menesklou (CEO) and Dominik Klotz (CTO), founders of AskUI, as they set out to build the next era of process automation by leveraging the power of AI. The Germany-based company merges the power and flexibility of advanced AI models with the beauty of Large Language Models and user-friendly experiences of a combined no-code and code approach.

On a mission to democratise and redefine process automation, AskUI aims to introduce a new era of automated digital solutions that are not just intuitive and visually appealing but also robust, adaptable, and user-friendly.

AskUI’s founders emphasise:

“By leveraging the power of words to automate any process, we intend to create a digital world where automation is for everyone, everywhere.

Creating an automation engine that serves all industries is an enormous undertaking. We have been working intensively on developing the cornerstone features that form the basis of process automation. But we’re not just checking boxes; we’re dissecting every aspect of automation and reimagining it into an exceptional experience. From system controls and UI comprehension to data scraping, we’re creating world-class, frictionless experiences.”

On why we backed AskUI, our Partner Sia Houchangnia comments:

“The opportunity around enterprise workflow automation is massive, and it’s a theme we’ve been actively investing in at Seedcamp. The technology that AskUI has developed over the past 2 years has the potential to change the game in this space. By combining the latest advancements in computer vision and LLM, they’ve developed features that truly reimagine the entire automation experience. We are delighted to back Jonas, Dominik, and the whole AskUI team alongside a great group of co-investors.”

We are excited to participate in AskUI’s €4.3 million seed funding round, led by Eurazeo, alongside 468 Capital, LEA Partners, APX, and existing angels Carsten Thoma and Christian Stiebner. With the new funding, the company plans to advance product development, release their first prompt-to-automation model, and amplify their go-to-market activities.

AskUI is also planning to grow the team and is currently looking for talented engineers and AI researchers.

For more information, visit askui.com.

Copyright © 2019 Seedcamp

Website design × Point Studio