Earlier this year, our EiR David Mytton, wrote about the first step in hiring – how to source candidates. Once you have applications, then you need to evaluate them to decide who you might want to hire.

In this follow-up piece, David shares more about how to think about the interview process. Regardless of how urgent the need is to fill the position, finding the right people, not just for the role today but for how your business will change in the future, is crucial to success. This post will take you through how to create a robust selection process for hiring engineers.

You have to remember that you are still in a sales process. You are not just trying to match applications against your person spec but you are also trying to convince them to accept the offer you might make at the end. This means there are several goals to consider:

The basic foundation for running a good engineering interview process is valuing the time of the candidates. They likely have full time jobs and/or consulting gigs, so you cannot ask candidates to spend many hours on the phone, doing coding tasks or building projects. Of course they will need to give up some time to dedicate to the process but you should work hard to minimise it.

The usual application is a simple form which asks the candidate to submit their basic details, a CV/resume and a short cover letter explaining why they are interested in the job. The cover letter is the most important aspect and the only element that is actually examined at this stage.

In the job and I include an instruction which asks the applicant to mention a keyword in their cover letter. If the keyword isn’t present then the application is instantly rejected. This is specifically to filter out mass, shotgun-type applications and to test for attention to detail.

The best people will usually only ever apply to a small number of positions. You want to find people who take the time to consider the company and role well in advance of ever applying, which means reading the full job ad and description.

Where possible, this step should be automated. Only collecting the minimum amount of information e.g. email, cover letter means you can systematically ignore any other details of the application, such as the CV, name, which might introduce bias. Be aware of protected characteristics and things you cannot ask.

Just like college degrees being mostly irrelevant for engineering positions (unless you have some very specific scientific knowledge you require), some companies are now excluding CV submission entirely. This is worth considering as another way to remove potential for bias. The only thing I find CVs useful for is to research interview questions in advance, but everything you need to know you can simply ask the candidate when you speak to them later.

I have found there is a good correlation between ability to write well and coding ability. Programming is all about clear and accurate communication, whether that is directly in code itself or communication about the project with real people!

I test this by requiring candidates to do a short writing exercise whereby they have an hour to research the answer to a particular question, and write up the response. The question should be relatively easy because the focus is on their written answer. You are simply looking for accurate spelling and grammar. Any mistakes should mean an instant rejection – if they are unable to write such a short piece without mistakes or proper proofreading then that indicates a lack of care and attention.

The task should take no more than an hour and you are not looking for technical accuracy of the response. This is purely an assessment of clear and accurate communication.

Designing a good coding exercise is tricky. It needs to be representative of the kind of skills you need for the role. It should allow the candidate to demonstrate a wide range of skills, from writing clear code to tests and documentation. And it should be straightforward to build in a short period of time – a couple of hours is ideal.

One of the more successful exercises I have used in the past is to ask the candidate to build a simple client for a public API. This tests many things such as working with real world systems, understanding credential management and dealing with network issues and error handling.

Whatever you pick, you want the candidate to be able to create a self contained package or repository, with some basic installation and setup documentation so that you can evaluate both whether it works, and the implementation itself.

Before starting this, as an engineering team you need to create a list of objective criteria that you can score the exercise against. These can include things like checking the documentation is accurate, test coverage, code linting, etc. You can determine your own criteria but they should be as objective as possible so that each evaluator can compare their conclusions.

Once the candidate sends you their completed exercise, the code should be given to several of your engineers to evaluate. This should be done blind so the evaluators only see the code, and they do not discuss the details with each other. This gives you several independent evaluations and avoids any bias. Be sure to instruct the candidate not to include any identifying information in the package e.g. a Github URL or their name in an auto-generated copyright code comment.

At this point you have done most of the evaluation and believe the candidate has the skills you’re looking for. The final stage is to evaluate actually working alongside you in a more realistic situation. For this, I prefer to meet candidates in person and have them work alongside their potential colleagues.

I have done this stage remotely in the past but have found that it is more effective to meet someone in person. You can then evaluate what they are like as a person. However, this is also the stage where there is most risk of bias. You can mitigate this by involving multiple people from your team so that one person doesn’t have a veto.

In the interests of speed and efficiency, I try and schedule all final interviews within the same week. This may not always be possible but I try to batch them as closely as possible. This makes the best use of your team’s time and means that candidates can get a response quickly.

You should cover all travel costs for the candidates, booking tickets for them rather than making them pay with reimbursement – they shouldn’t have to loan your company their own money! If they have to travel a long distance, offer overnight accommodation, transfers and food. Also ensure they have a direct contact who is available 24/7 in an emergency. You want candidates focused on the interview, not worrying about logistics.

Again, you need to determine what the best approach to evaluating their capabilities is. I have found that getting them to actually work on your codebase is a good way to see how they deal with an unfamiliar environment and start to learn a new system. You can ask them to fix a known bug, or introduce a simple bug into the code and work with them to fix it. You are not testing them on their knowledge, but on how they approach the problem. Whether or not they fix the problem isn’t important.

Remember that this continues to be a sales process. Take the time to introduce them to key members of team, show them around the office and, if they’re not local, the area where they’ll be working. Be sure to show off and explain why you want them to join. This is the job of everyone on the team – multiple people telling them about the company is a lot better than just the hiring manager or CEO!

Anyone who gets past step 1 should receive a response to their application whether they are successful or not. One of the worst things about applying for a job is not knowing what the decision was.

The challenge with giving a negative result is that candidates will often ask for feedback and may argue with it. It is up to you whether you want to do this at all, but I usually offer detailed feedback only if a candidate reaches step 3 or 4. Failing step 2 is only for poor spelling/grammar, which you can build into an auto-generated response.

If you are going to make an offer, do it as quickly as possible. Include the key information about the compensation package, start date and anything else you need from the candidate. Be sure to review the legal requirements for a formal job offer first.

Don’t use exploding offers and don’t pressure the candidate. During the step 4 interview, you may want to ask them what their evaluation criteria are and whether they are looking elsewhere. Asking them when they think they will be able to reply to you is probably fine, but don’t ask about salary expectations.

You may notice that certain things are not present in the above process.

Cathy White , Communications and Marketing Manager at Seedcamp, has written this piece on PR hacks that early-stage companies can use to get attention while bootstrapping.

, Communications and Marketing Manager at Seedcamp, has written this piece on PR hacks that early-stage companies can use to get attention while bootstrapping.

I’ve always been a firm believer in not using a PR agency as an early-stage company. Great agencies are expensive and when you’re at the beginning of your startup journey every penny should be used on your product and in attracting the best team possible.

Agencies want to be working with startups because they’re sexy. Working directly with a Founder is an exciting prospect and being able to play a part in their growth is hugely attractive to PRs.

However, it is rarely a healthy relationship. In my own experience, agencies will cut corners where possible to shrink a budget down to a size that a startup can afford, whilst still working the hours usually given to much larger, long-standing accounts. I’ve had my fair share of bending over backwards to line up great coverage, but in the end, it’s not up to the expectation of the startup and what counts as a small budget for an agency (often leaving them out of pocket) is a huge chunk of change for the Founder. The result is an agency that is exhausted and frustrated and a startup that has a negative experience of PR – not great for any potential partner in the future.

Agencies typically make sense when you’ve had a large seed round or your Series A. Of course, there are exceptions to the rule, but generally speaking, my advice is to build out your own basic PR strategy in the beginning.

PR isn’t just about getting your company name in an exciting title. It’s anything public facing.

It connects with your social strategy, how you speak about yourself, how you communicate to your community, as well as your customer. It isn’t something fluffy that you think about last minute. Unfortunately, it also doesn’t come with a guarantee. With all the best strategic planning in the world, sometimes it just doesn’t work. But, like building your company, you can pivot. You can change your strategy and there are little ways of measuring its success. It must drive results, and as a startup, you can afford to experiment.

I’ve often spoken about why you don’t need an agency, and in doing so, provide a few hacks learnt from my own background that enable you to build and execute a basic PR plan.

Where do you want to be? Set your objective for PR. Do you want to attract 10,000 new customers? Do you want attention from prospective investors? Do you want to be the first to market? What you want to achieve determines where you need to be seen. If you start at the end, you can breakdown the research you need to do.

If you want 10,000 new customers, who are they? What do they read? Setting a goal will enable you to address these key questions before researching further. For instance, getting covered in The Telegraph might look good from the outset – great title, huge reach – but if your target customer is a millennial, it’s not really relevant! You want to ensure that the PR you do is likely to drive a return on the investment of your time.

Starting from the end helps determine how to measure the success of your PR campaign. If it’s customers, simple app downloads that peak when coverage is out are a strong indication. Awareness can be measured by keeping an eye on your Google analytics and mentions online, and for getting investment, a simple invitation to a meeting will do the trick.

Once you’ve determined who your audience is, you need to start reading what they read. Most publications will provide a breakdown of their audiences in an advertising section. Spend 15-20 minutes a day skimming through the publications you recognise as being connected with your audience. Any stories that relate to what you’re doing, should be collected in a spreadsheet. Note down which publication, who the journalist was, the date it was published, a quick summary of the article – 140-character Twitter style being ideal – and a link. If you’re not sure what your customer reads, ask them – a simple survey is all it takes.

Over time, you’ll know who your go-to journalists and publications are, what stories work, which profile opportunities fit you, and how often they write. Emails and Twitter handles are easily found online, and when you come to pitch them, you’ll be able to add context and open up a real conversation, rather than an email that blends in with the rest of their inbox.

Another great tool is to set up Google Alerts for all your key competitors. Have a look at where they are being covered and why. Pitch the journalists they talk to, and show them why you’re different. Or use Flipboard to stay in the know on the go, and use those minutes of downtime on your commute to scan the news.

Research will play a key part in learning what a story really is. You are rarely the story. You need a news hook and to remain factual at all times. Hooks could be fundraising, product launches (very tricky to announce unless you’re Apple), insightful data that you’ve gathered through your service, a campaign you’re starting or international expansion. Regardless of the hook, you need to be able to talk big picture. Why is it important? What does this tell us about the market in five year’s time? What are you “disrupting”? Think big, and think bold. As a startup you don’t have to watch every word you say like a huge public company – so have a bit of fun!

Mike Butcher, Editor-at-Large of Techcrunch Europe, wrote this article last year on how to pitch him. Mike believes the press release is dead – I disagree, (I’m a flack) but this article does provide a long list of questions that you should definitely be able to answer. It’s a great exercise to go through this list and fill out your responses. It will help you shape your story and pull out key angles to use for each publication you pitch.

A press release should give a journalist all the information they need to write your basic story. But you must be able to offer more. Provide them with interviews, customer case studies, images, off-record information etc. whatever it takes for them to get the one angle that works well for their audience.

If you can pitch to investors, you can pitch to journalists. Just change the way you do it. For tips on storytelling check out this article by Seedcamp’s Reshma.

It’s best to contact journalists over email, through Twitter, a direct introduction (talk to your fellow Founders) and, if you’re feeling brave, over the phone. A journalist is bombarded with information and pitches daily and only has the capacity to write a few stories. So make sure your subject line stands out, that you keep your email pitch brief and engaging, and provide the right context. If you do your research, you can reference previous articles they have written and how your company ties in. Once you’ve pitched once, give them some breathing space. It’s ok to follow up a few times, but not within five minutes, and after a few days of quiet, even with some nudging, move on. They’re just not that into you.

Once you know your story is going to land, and the coverage is expected, think seriously about how you can make the most of it. Shout about it on your social channels, email your network, pull out quotes to use on your website, even put a link to the articles in your email signature.

We are all constantly surrounded by information, and that one stand-out piece of news will have a short life span, so think about how you can pro-long its life and get more for your time investment. You may see a peak of interest over a 12-hour period, which then dies. You have to build out a sustainability plan to make sure you achieve that end goal.

Then think even longer-term. At this stage, you should know a few journalists and have a list of publications that still haven’t covered you. Keep them updated on what you’re up to. Take them for a beer. Build that relationship and help them in anyway possible, it will pay off for you in the future – think of this as press karma.

The last and most crucial piece of advice for hacking your PR strategy together is to be nice, be helpful and be authentic. It sounds so simple, but treat others how you’d like to be treated. The job of a journalist can be tough and demanding, so help them out by being that one contact that can bring a smile to their face and you’ll be remembered for all the right reasons.

To stay updated on the latest Seedcamp news and resources, subscribe to our Newsletter, and follow us on Twitter, Facebook and LinkedIn. To apply for pre-seed investment, go here.

Seedcamp Partner, Carlos Espinal, has written this piece focusing on how to show growth and traction for early-stage startups looking for investment, with key contributions from our Experts in Residence Scott Sage and Keith Wallington, and Jeff Lynn, CEO of Seedrs.

As an early-stage startup trying to fundraise, you’ll likely have to tell a version of your company’s story that demonstrates high likelihood of growth to attract an investor. Which are the stories that are most commonly used during the early stages of a business, and which ones later on?

In this post, we’ll cover the various forms of ‘validation & traction’ that you can potentially leverage in conversations with potential future investors as well as to create internal benchmarks for you and your team.

If we look back at this topic as a form of storytelling, below are the ’stories’ I hear the most (alone or multiple at once):

In previous blog posts, I’ve covered what makes an amazing team and how investors evaluate a team, what Tier an investor is in and how other investors might judge who is in your round. In this one, I want to focus on 4 and 5 of the list above. Basically, understanding when you have any kind of traction and what constitutes ‘impressive’ for the average investor.

One way of trying to benchmark what is ‘impressive’ is by looking at some companies that are generally considered to have done extremely well. In this Quora post, we can see a few of the companies often referred to as ‘impressive’:

Weekly Revenue Growth

However, as impressive as they are, these numbers don’t show the entire story. They hide various operational and industry dynamics that are only possible in the sectors in which those companies operate. For example, the cost of acquisition and the sales cycle for each of these businesses might be drastically different than yours. Looking at these figures as a 1:1 to what you have to achieve might create an insecurity complex and frustrating unit economics. Effectively, you can’t compare oranges with apples. They’re impressive for sure, but are they applicable to your company and is it realistic for you to sustain those kinds of numbers in the long term?

Whilst the above point might seem self-evident for extreme cases, I’m always surprised by what I hear some founders receive as feedback from investors when being compared to idealized growth cases.

Let’s kick things off with the easiest form of growth to talk about, user-growth in any kind of network effect business where monetization is not the immediate short-term goal. The most typical example will be social networks.

These kinds of companies are the ones that are the most referenced to when looking for ridiculous growth rates. Facebook and Twitter in their early days are good examples. However, before we get into what kind of week-on-week growth is impressive, let’s tackle one very big point that makes any growth meaningful.

If the business’s successful growth allows it to have lock-in effect, then a non-monetized growth strategy early-on makes sense as a way to monopolize the customer-base and once locked-in, monetization strategies can be considered without fearing user-growth-rate loss and churn to competitors and/or substitutes.

Not all businesses that embark on a non-monetized high user-growth rate strategy truly have lock-in capabilities so it is not unusual to have these be the ones most investors are less interested in. If there is any risk that you might fall into this category, start thinking about what could make your user-growth rate create a lock-in that no competitor could make you lose.

For these kinds of businesses where user growth rates are what is being used as a proxy for future revenue, a 6-10% week-on-week growth rate will be considered as impressive. Above 10% week-on-week would be considered as boss-level growth, as can be seen from Facebook or other companies mentioned in the Quora post above. Only a few companies frequently achieve these levels. Other impressive growth rates from companies falling into this category can be seen here.

Once a company decides it needs to be charging early-on because its product doesn’t have a network effect built-in (or where there are plenty of substitutes in their market), one can expect the company to be measured by a different set of growth rate standards. Although there are always exceptions, once money is involved, things get more complicated.

There are several factors that can generate a different set of growth rates, with the main ones being:

Sales cycles can vary greatly from business-to-business and can serve as a proxy for sales growth until you actually materialize sales. If you want a quick brief on sales cycles, this link will walk you through the basics.

Comparing growth rates of monetized companies becomes complicated because not all of them have the same sales cycles. We’re back to our orange to apple comparison dilemma. Some might have a heftier cost of customer acquisition but can sell immediately (such as software download), while others might require a subscription once someone deems the relationship with the service worthwhile (such as dating sites) but might be able to leverage virality effects intrinsic to their sector or customers’ needs/desires to lower their cost of acquisition. Life isn’t fair, but let’s try and see how we can compare businesses in these categories.

Let’s first start by looking at companies that have a long sales cycle. These companies might have interactions with their customers via newsletters, social media, click-throughs etc. but can have frustratingly low month-on-month growth rates on conversion. For those, a good starting point as a proxy for growth is to have engaging discussions really early on about the value you bring to your customers so you can use it as a proxy to the actual (and hopefully, eventual) conversion point. Try and find correlations between behavior and interactions with your product as a precursor to conversion between marketing initiatives (content marketing reads, etc.). This isn’t easy or pretty, but having nothing to speak about on why your early customer might care is likely unacceptable. This also helps to think about what kind of ‘features’ you can build into your product that can signal the intent of conversion in the future. For example, does adding things into a wish list you’ve created for customers increase conversion once key dates in the year come around (holidays or birthday).

As a software company, you should not get caught in the sales funnel trap. Too many startups equate growth to how many deal leads are being added to the sales funnel every week. Adding X% new business to your pipeline every week is great, but if the output — closed deals — is close to nil and not growing, you have a serious problem. If you and your team are able to convert your top of the funnel demand into an efficient sales process and close deals, well done. But if you’re like most startups, you will have inexperienced people adding every possible deal lead in the world into the sales pipeline without knowing 1) how to qualify those deals or 2) whether they even fit what a typical buyer looks like.

So, how should we think about traction from the standpoint of a software startup and their sales cycle? One important note to make is that the range of pricing varies greatly. A startup selling $100k enterprise deals will have a longer and more complicated sales cycle than a startup selling a $5k deal that may not require the board’s or your CFO’s sign-off. Investors want to see consistency in your sales execution. If you were able to close nine deals in the first quarter of focusing on sales, then they will want to see at least nine deals in the next quarter. The more deals your team closes, the better they get at qualifying opportunities, pushing the sale through, and understanding where various customers receive the most value from your product. Once you have a good idea of what your sales cycle looks like, then you should be able to shorten the cycle and in theory, close more deals faster with the same team.

At a high level for SaaS businesses, investors want to see an absolute minimum of 100% growth year-over-year. Assuming your sales and marketing team and costs stay the same from one year to the next, investors will expect you to retain a very high proportion of customers from the first year (let’s assume for simplicity you’re able to keep 100% of the revenue from year one’s customers by retaining 90% and up-sell another 10%). Then with the same team, you should be able to acquire the same number of customers with roughly the same size of contracts. So Y1’s recurring bookings + Y2’s new bookings = 2x Y1’s first year’s bookings.

Aside from Sales Cycles, there are other limitations that can create an artificial restriction on growth rates in early-stage companies, which make it unfair to compare companies like for like. Two examples include marketplace supply and demand balance, and operational limitations, which when optimized, lead to increased demand.

Various successful marketplaces have used a number of strategies to capture a market and grow, but all share a common pattern, which was to start from the supply.

Shutterstock, Founded 2003

Airbnb, Founded 2008

Etsy, Founded 2005

Quibb, Founded 2013

Key Lessons:

KPIs:

What investors look for in online marketplace businesses: growth metrics

Supply

Demand

Summary Table for how to think of where your company’s economic opportunities are

So, we’ve covered quite a bit of ground on user growth rates, sales cycles, marketplaces and the like, but how about for businesses where there might need to be some stockpiling of inventory first before going out to the market, or perhaps R&D and progress therein, before being able to announce/launch a product, or how about ones that are just getting better and better in their internal processes and waiting for the next inflection point in demand to really scale up after a fund raise?

For now, let’s focus on the optimization of production costs that are already existing in order to better demonstrate your company’s growth in preparation for a fundraising.

Optimizing production costs leads to unlocking the ability to service more customers and, therefore, to grow faster. Until fully optimized, you will be limited not by user interest, but rather by operational limitations. Week-on-week or month-on-month growth could, therefore, be pegged to operational improvements.

A number of operational blockades will need to be overcome throughout the customer journey:

Can start manually going through a human collection of leads such as contact details etc. and is appropriate for early-stage customer validation. The process must be automated or other lead sources secured to ensure marketing can deliver a growing volume of appropriate leads into the customer acquisition funnel.

Might be limited by the number of meetings each sales person can schedule and attend in a week/month- solution: study the sales funnel and automate where you can, improve use of CRM, evolve marketing lead qualifications and nurturing processes to deliver better-qualified leads to sales such that the customer is more progressed towards a purchase by the time they are handed to sales. Adding more sales people without optimizing these other pieces will likely see CAC not improving as the business grows

Manually onboarding and supporting customers is ok in early customer validation phase but must be automated to the maximum appropriate degree without destroying customer experience to avoid a bottleneck. Often an automated onboarding and support experience (with good monitoring, alerting and access to help) can improve customer experience as they can work at their own pace and not need to fit into a schedule

Process innovation by reducing issues internally and unlocking a new rate of growth. Marketplace growth requires balanced growth and should result in week-on-week growth.

In conclusion, there are many variables that can be used to determine a company’s growth and traction ‘by proxy’. In a recent chat with Jeff Lynn, founder of Seedrs, he said “the appropriate unit of time to measure a business’s growth varies from company to company. One of the things we’ve found with Seedrs is that month-on-month growth rates aren’t particularly helpful because we’re too spiky in terms of monthly transaction levels. When we look at month-on-month, one month we’re over the moon because we’ve grown 200% over the previous month, and then the next month we’re in despair because we’ve shrunk by 50%. We’ve now moved to measuring everything on a quarter-by-quarter basis — even that isn’t perfect, and our real cadence is more like six months, but we’ve had to balance that against the need to iterate and adapt quickly enough (although in our Series A fundraising materials, we should everything on a six-monthly basis, and it worked just fine).”

Hopefully, this post has given you a new way of looking at some potential ways for you to start tracking growth in your company to create a more compelling case for future investors.

To stay updated on the latest Seedcamp news and resources, subscribe to our Newsletter, and follow us on Twitter, Facebook and LinkedIn.

This article was written by Taylor Wescoatt, one of Seedcamp’s Experts-in-Residence. Follow Taylor on Twitter @twescoatt.

This article was written by Taylor Wescoatt, one of Seedcamp’s Experts-in-Residence. Follow Taylor on Twitter @twescoatt.

This title isn’t entirely accurate I have to admit. It should be ‘Validate or Die Slowly!’. If you’re reading this, you’ve read The Lean Startup and other best practice, and you know that validating your ideas is critical to success. It is also the quickest way to figure out if you’re off track, so you can re-evaluate your options.

At Seedcamp, we work with lots of startups at a very early stage, so validation is super important and we do it a lot. It’s hard though, for a good reason. Customer Validation research is about systematically challenging your own beliefs. As a founder, our sense of self-worth is often woven in with our startup idea, so forcing ourselves to question that is painful. Until you get used to it, then it’s fun!

There is a huge amount of best practice and industry built up around validation techniques, and you can spend many thousands of pounds hiring people to help, but how do you do it yourself on the cheap? Before we dive in, let me make a few suggestions;

Here are the techniques I recommend;

Needs Analysis

Product Analysis

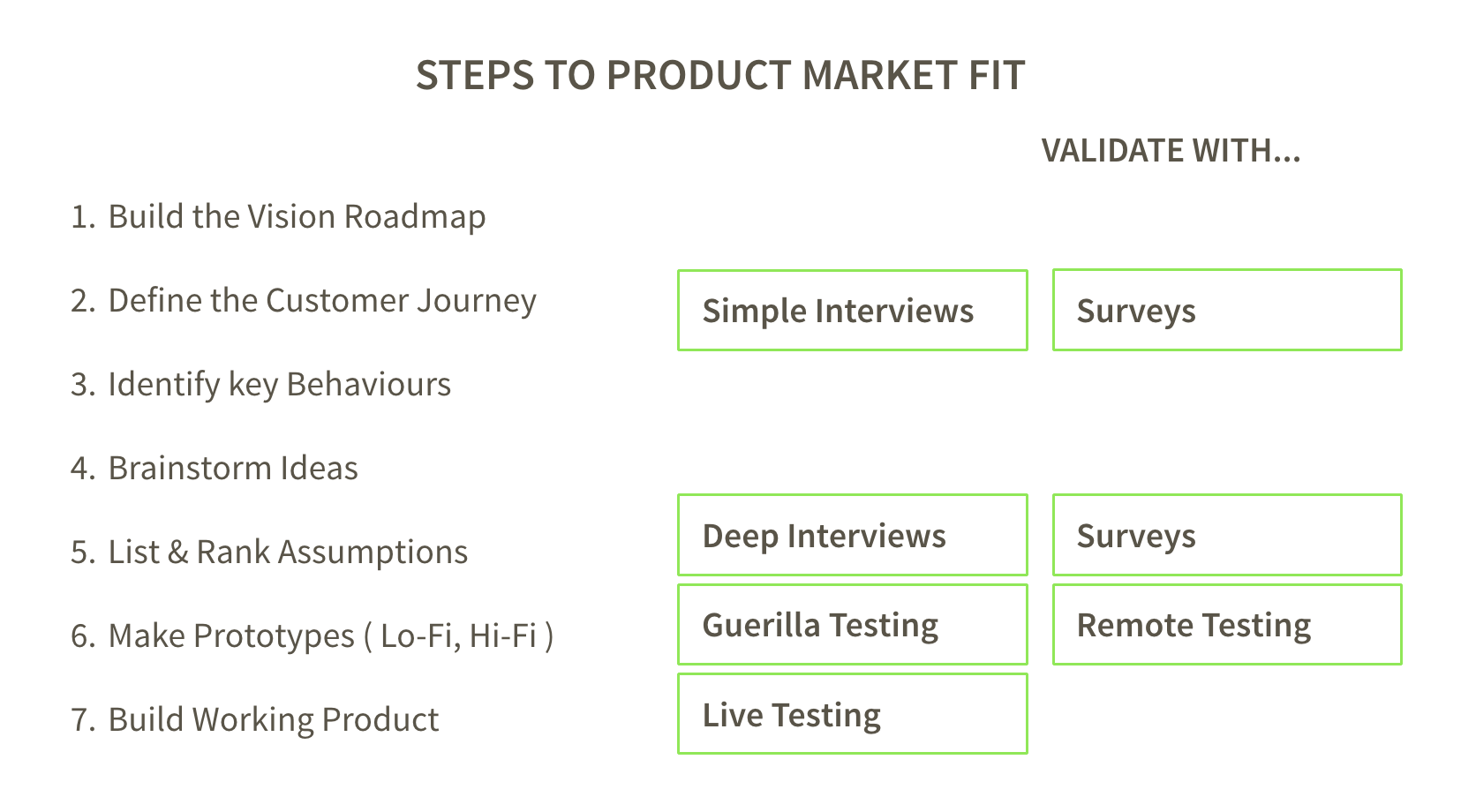

Putting it all together, here are some places where each type of testing can be helpful in the drive towards Product Market Fit;

A couple of extra things to consider;

Building validation into your process is the way to go. At first, it may seem laborious, but you’ll be thankful that what you learn will have saved you a lot of time, you’ll be happier that what you build will get used, and you’ll have a stronger culture of caring about the customer within your team.

For a list of all my articles: https://seedcamp.com/eir-product-articles/

This article was written by Taylor Wescoatt, one of Seedcamp’s Experts-in-Residence. Follow Taylor on Twitter @twescoatt.

Startups are bets. “Housemates would like to have an app that helps them track expenses in a shared household.” (Splittable is a great new Seedcamp startup) The realisation of your vision is actually a whole series of these bets or hypotheses. You test them, learn, and move forward. What users like, don’t like, how much, and what they will respond to. These are beliefs that investors buy into, and it’s your job as a Founder to ultimately prove them to be true, or if not, try something else!

But when you dig into your Vision, there are a lot of underlying assumptions. What are they? Which ones do you address first? The risk of not thinking about this methodically is that you spend a long time operating under an assumption that ultimately turns out not to be true.

Here’s a helpful tool I’ve come across a few times, the Assumptions Matrix. It asks you to graph your assumptions based on how ‘Fundamental’ they are to your business and by how ‘Unknown’ they are. Imagine using a scale of 1-10 for each axis. The result, as you can see, suggests a priority of what you should be addressing first.

Naturally, you want to focus FIRST on the ones in the upper-right, this is called the Pivot Zone.

For things that are highly ‘unknown’ – how can you learn more? Talk to an expert? Get a research report? Reference competitors? Test with users? Of course, the most important things you just can’t know beforehand, that’s what makes startups ‘bets’.

For things that are ‘fundamental’ – if they turn out not to be true – what alternative approaches could you take? Imagine my CarSparkle example. If people don’t want a better way to get their car washed, I am kind of hosed. If, however, they simply don’t care about a 30-minute response time, I can change the timing model of the business, which probably alters staffing requirements.

This is a good exercise to make sure you’ve got the 30,000 feet view, at least, and can also be helpful in your day-to-day debates. It’s also a good platform to make sure people don’t get too locked into their own functional way of thinking and understand what each other are up to. Go Team!

For more Product articles, see my index at https://seedcamp.com/eir-product-articles/

This article was written by Taylor Wescoatt, one of Seedcamp’s Experts-in-Residence. Follow Taylor on Twitter @twescoatt.

Probably the most powerful tool for early-stage Product thinking is the Customer Journey. Literally, every step your individual Customer must go through in order to create value for your business. By capturing, developing, and working with this framework, you will;

A good Customer Journey is an ordered list of actions that your Customer largely must follow in order to achieve a state of real value (for the Customer). If you’ve already read about the Vision Roadmap, you’ll be familiar with this as “The Proposition”. The list starts often with a need (felt some pain, frustration) which leads to awareness, trial, experience, and then finally your customer’s real value state, habitual use, re-purchase, or referral, for example. Here are a few examples;

The first surprise most startups have in doing this is that they find out there really are a lot of steps involved in getting a user to the real value state. Great things just building this list calls out are a) the things that happen outside your product (e.g. meetings) and b) other players in the decision process (e.g. boss, CFO, partner). You should think of it as a superset of your conversion funnel, and put numbers against the steps that you can. Now, which steps (I like to choose two to three) are your main issues to focus on for the next 90 days?

Some of the questions that come up in this exercise

Each of these steps, actions, will also have an associated motivation (why they took that action) and expected reward (what they ideally hope to achieve by taking that step). Action + motivation + expected reward is, essentially, a behaviour. Understanding complete behaviours will give you a rich set of options of how to encourage users to perform the desired action. For example, you can appeal to emotional rewards, or confirm motivations by comparing the step you want them to take with something they do already. I like to point out the Transferwise example here, where at one stage of the journey the customer needs to go off-site (to their bank) to initiate the transfer. Completely lacking in visibility here, Transferwise instead appealed to the emotional reward with a “One more step and you will have avoided massive fees!” type statement.

I’ve written a bit on how to then turn these into actionable initiatives in my Backlog article.

Your now-better-aligned team should come up with lots of ideas here, and many of them will not be product solutions, which is great! Several times, for example, the teams I work with have come up with sending gifts, like chocolates, to the person they wanted to use the product “one more time”, but it could equally be helpful to simply reposition the step by promoting the respect your user would achieve from colleagues by using a new exciting product.

By now you’ve built your Customer Journey, you are thinking from the Customer’s point of view, you have identified key behaviours that you need to focus on, and brainstormed different ways to encourage your customer to perform these key actions that make your business work. There is a ton more you can do with your Customer Journey (thus my opening statement), but for now I’ll leave you with just a few extra-credit ideas;

This is an update to a previous post entitled Behavioural Roadmap which is no longer live.

For a list of all my articles: https://seedcamp.com/eir-product-articles/

This article was written by Taylor Wescoatt, one of Seedcamp’s Experts-in-Residence. Follow Taylor on Twitter @twescoatt.

“I have the vision in my head, but I don’t know how to get it into the heads of my growing team so they can execute what and how I want them to” — Startup Founder

I have heard this a lot (spoken or unspoken) in startups. It stresses out the Founder, it frustrates the new marketing or UX person who wants to show they can make a difference, but aren’t quite sure how to.

Rallying around a five-year Vision Statement is fine, but what exactly should your team be doing TODAY to make that come true? I like to use a breakdown of the Five Year Vision I call “The Vision Roadmap” that I started developing at eBay and found well received later at Time Out and Emoov. By expressing your Vision in progressive steps, by customer segment, in the customer’s own language, you can;

Make the Vision Actionable

“Who Are We?” – good question, but you need to answer it on many levels. Answer this for each of your customer segments (e.g. early adopters, followers, and service providers or suppliers), and identify how this changes over time. Collectively, and cumulatively, these eventually lead to the full realisation of your Five Year Vision.

The goal of this format is to allow you to render the roadmap between now and fully realising your vision. You recognise that your business will transform in stages over time, and this helps you focus on achieving those stages.

“This works nicely in an agile world where the lighthouse stays the same, but the tactics evolve as we build, test, and iterate toward the vision” — Bill Watt, Product Director, GoDaddy

The CarSparkle Vision Roadmap

So, for example, let’s say you’re building a mobile app for at-home car-washes & services, “CarSparkle”, and your Vision is “Car washing, servicing, and overall management all from your phone”

Each entry is called a User Proposition, that is, what you mean to them. How does this help?

“I liked the proposition approach to (1) diverge vision from product development, and an evolving sales strategy, and (2) a way to manage customers’ expectations” — Didier Vermeiren, Founder, Rial.to

This doesn’t take long to do. You and your Co-Founder can rip it out in an hour or so. If it takes longer than that, all the better because you’ve identified what must be a serious hurdle in realising your Vision. Your team will thank you as they dive back into work re-energised with a clearer sense of purpose and strong connection to the Vision. Follow it up by asking them to give you a revised execution plan. Drop it into your deck, it will be a nice touch to drive that next investor meeting in the right direction.

Once you have this sorted out – you may want to move on to the Customer Journey.

This is an updated version of an older post which is no longer live.

For a list of all my articles: https://seedcamp.com/eir-product-articles/

Copyright © 2019 Seedcamp

Website design × Point Studio